The United States has long been a beacon for entrepreneurs around the world. Yet even in America's relatively advanced and accessible financial system, legacy processes collide with innovation: non-citizen founders must wait six weeks for an Employer Identification Number before even applying for a business bank account—a delay that, while frustrating, offers merely a glimpse of the hurdles entrepreneurs face across global markets.

In the modern economy, speed isn’t optional—it’s essential.

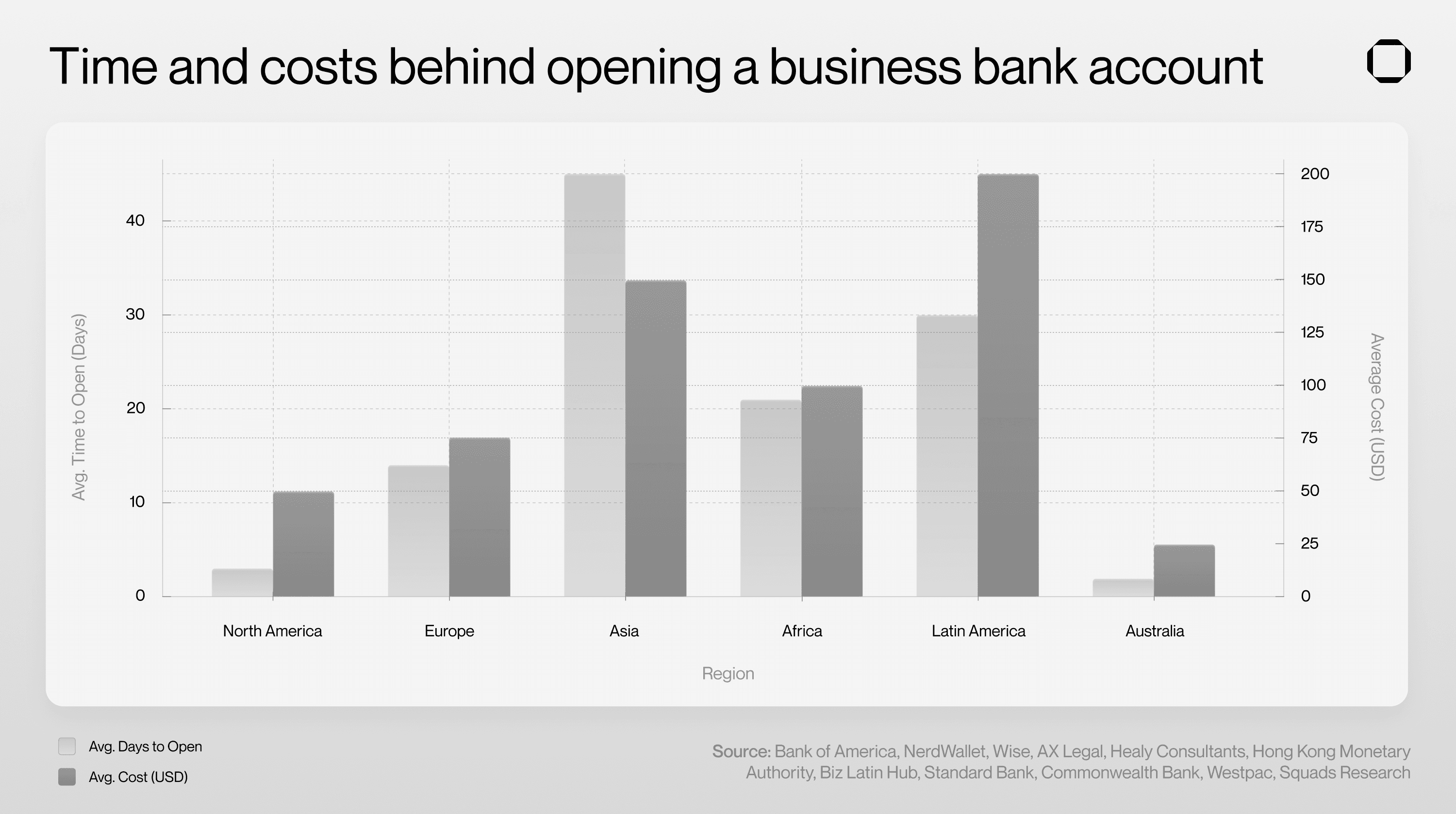

The above graph represents the average time and cost of establishing business banking. In some instances, the costs are far greater (~$5,000 in Brazil, ~$1,900 in Luxembourg), or the processing time far longer (~203 days in Guatemala). The problems associated with business banking go beyond time and money for establishing accounts; further costs arise when operating businesses.

Payments & payroll: Business banking’s Achilles’ heel

It's not just that it's difficult for businesses to get banking—it can also be difficult for international companies to receive or send payments on time.

38% of companies experience delays of 5 days or more when sending or receiving international payments. International payroll via traditional banking channels is expensive and time-consuming, with cross-border transfers frequently taking up to ten business days. Businesses managing global teams must initiate payrolls across multiple jurisdictions, incurring substantial fees and unfavorable FX conversion rates, increasing operational expenses, and hampering employee satisfaction.

While fintech solutions, such as Revolut, Mercury, Brex, Rho, Zeller, and Allicia Bank, speed up business banking, they are subject to the fees and delays of traditional banks, are limited geographically, and remain inaccessible to many entrepreneurs worldwide.

Establishing business banking, however, should move at the speed of the Internet. Stablecoins and smart accounts offer precisely that, allowing businesses to get off the ground instantly and begin receiving money and paying employees.

Squads business accounts: A better solution

Squads directly addresses the chronic inefficiencies of business banking through innovative stablecoin-powered features designed explicitly for modern businesses:

Setting up a Squad for stablecoins: Businesses can open Squads accounts within minutes to leverage stablecoins, circumventing weeks of traditional bank bureaucracy. Squads accounts are accessible to anyone with an internet connection, ensuring immediate usability without geographic restrictions.

Benefits of stablecoins: Unlike sluggish international wire transfers, businesses using Squads can accept and pay with stablecoins for instant settlement.

Virtual EU/US bank accounts: Businesses can easily create US and EUR virtual bank accounts, eliminating the cumbersome process of obtaining local accounts to accept USD and EUR payments.

Third-party payouts: Squads facilitates third-party payouts using stablecoin payments that arrive in the recipient’s bank account as USD/EUR, reducing the fees and operational complexity of many traditional payment platforms.

Easy on/off-ramps: Squads users can seamlessly off-ramp to traditional bank accounts when needed.

Conclusion

Stablecoin-powered platforms like Squads represent not just technological innovation but an economic necessity. Squads offers compelling banking alternatives that remove bureaucracy, accelerate cash flow, reduce operational costs, and ensure businesses remain agile in an increasingly competitive global economy.