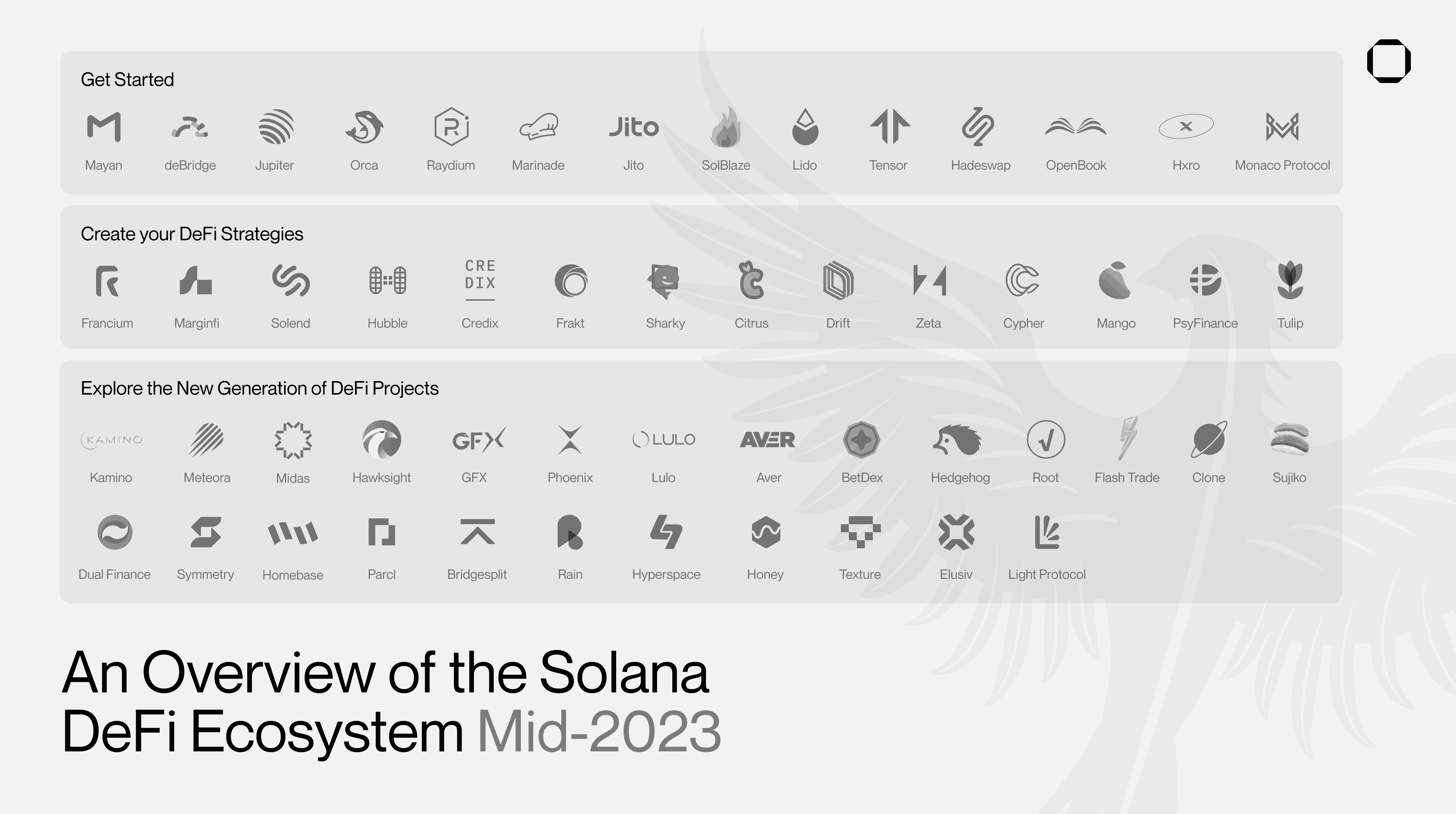

Over the past year, the Solana DeFi ecosystem has endured many trials, ranging from hacks, network outages, the collapse of FTX, protocols sunsetting, and liquidity drying up. Still, rather than dying under these pressures, it has grown stronger, with committed teams and builders ready to tackle ongoing challenges and make DeFi thrive on Solana.

If you were looking for an overview of the current Solana DeFi ecosystem, this is the article for you. We will explore the protocols building on Solana, as well as innovative and emerging projects that are creating financial products "only possible on Solana," and take a look at the Solana summer season and its potential upcoming airdrops.

Note that NFT protocols will also be covered in this article, as we believe that NFTs are gradually evolving into a new asset class in crypto, especially on Solana, beyond being simple “jpegs”.

Getting Started on Solana DeFi in 2023

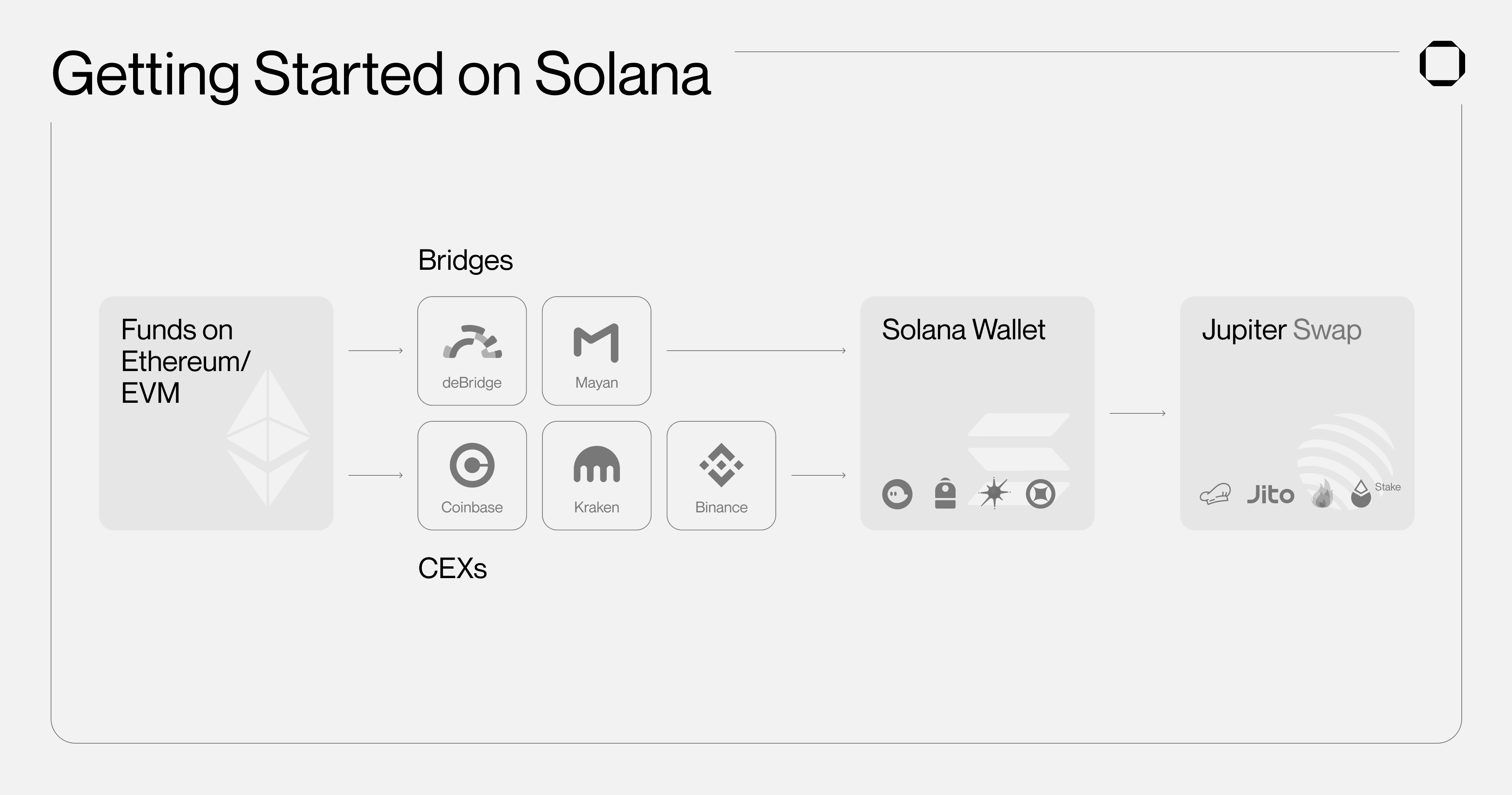

For those with funds on another blockchain such as Ethereum/EVM, the easiest way to transfer them to Solana is through centralized exchanges like Coinbase or Kraken, or by using decentralized cross-chain solutions like Mayan Finance (powered by Wormhole) or deBridge which allow receiving native tokens (rather than wrapped assets).

Buying tokens on Solana

Once your funds are on-chain, you need to swap them for SOL, USDC, or any other token you're interested in. Unlike on Ethereum, most people on Solana don't directly trade with an AMM. Instead, they use Jupiter, the leading DEX aggregator that sources liquidity from AMMs like Orca and Raydium, or order books such as OpenBook and Phoenix. Not only does Jupiter provide the best rates for swaps, but it also allows users to create on-chain limit orders for any token. Moreover, an on-chain DCA feature is coming soon.

Staking opportunities

With some SOL and SPL tokens in your wallet, you're ready to explore the various yield opportunities available on Solana. One simple option is to earn rewards from staking SOL. Fortunately, there are excellent liquid staking providers like Marinade, Jito, SolBlaze, or Lido. JitoSOL (Jito), an innovative liquid staking SOL, rewards stakers not only with emissions but also with MEV rewards generated by Jito validators, offering a higher yield than traditional staking solutions. Marinade is currently the largest staking solution, with over $150 million in stake. It offers an interesting feature, "Directed Stake", that allows users to select the validators they want to delegate their SOL to. Another newcomer is SolBlaze. Like Marinade, it automatically stakes your SOL across many validators according to their delegation strategy to help further decentralize Solana. SolBlaze has also recently begun to publicize its upcoming $BLAZE token airdrop.

Liquidity provisioning

In Solana, concentrated liquidity has become the norm for AMMs, with leading decentralized exchanges like Raydium and Orca primarily offering concentrated liquidity market making (CLMM) pools. These are more capital efficient, offering greater liquidity for users and more fees for traders. For example, if you've staked your SOL into mSOL or JitoSOL, you can support users wanting to swap these tokens by providing liquidity on these exchanges for pairs like SOL or USDC. This not only allows you to earn yield from trading fees, but you may also benefit from additional rewards through liquidity mining programs, like Marinade does with MNDE for mSOL pools.

Major NFT protocols on Solana also incorporate an AMM for improved NFT trading. Hadeswap has led the way in democratizing this for major collections, followed by Tensor and Magic Eden. Just as you would provide liquidity for a SOL-USDC pair, you can do the same for NFT collections, earning fees on these marketplaces from people trading the liquidity you've provided.

More advanced users can explore additional protocols on Solana to provide liquidity and earn trading fees. OpenBook, which was forked from Serum by the Solana community after FTX's collapse, is an on-chain order book frequently used by traders for on-chain limit orders and integrated by protocols like Raydium and perpetual exchanges. Users can also access products built on top of Hxro, a liquidity layer for derivatives trading and betting applications. In the same field, Monaco Protocol is powering many betting applications on Solana, such as BetDex.

Expanding Your Exposure to Solana DeFi

One of the best ways to create strategies in DeFi is through lending/borrowing protocols. On Solana, the main lending protocols are Marginfi and Solend, both of which accept various SPL assets, including liquid staked tokens (LSTs). Marginfi launched their borrowing/lending product earlier this year and recently started to gain major traction. Solend, on the other hand, recently unveiled its v2, introducing new features such as borrow weights, TWAP oracles, and outflow rate limits.

In addition to these, other types of lending solutions are available on Solana. Francium offers lending for traders to leverage their LP positions by borrowing one or both pairs of a liquidity position from Orca/Raydium. Hubble, a great solution for fixed rate borrowing, is a Collateralized Debt Protocol (CDP) stablecoin, with mechanisms similar to MakerDAO (DAI) to maintain the peg of its stablecoin. Users can deposit SOL and various SPL assets to mint USDH, which can then be used to leverage their exposure (e.g. by swapping USDH for SOL). For more "exotic" lending opportunities, Credix is an interesting Real-World Asset (RWA) protocol that facilitates private credit loans on-chain, offering lending rates for USDC that aren't correlated to the crypto market.

While NFT AMMs are well implemented on Solana, NFT traders also have the option of leveraging other types of financial activities with their NFTs through protocols like Frakt, Sharky, or Citrus. Here, users can lend their SOL to others who borrow it against NFTs. If the borrower fails to repay the loan, the lender keeps the NFT. This is a very lucrative type of DeFi product on Solana, with borrowers willing to pay APYs as high as 240% for some collections.

On-chain Futures with Solana Perpetual Exchanges

Perpetual exchanges provide another avenue for lending or borrowing, and the Solana scene is quite active in this respect. Drift is currently the leading perpetual exchange by TVL and enables traders to leverage several types of cryptos such as SOL, BTC, ETH, ARB, RNDR, MATIC, to name a few. Users can lend SOL, USDC, or mSOL to provide additional liquidity for Drift traders. Recently, Drift introduced an insurance fund staking program, offering another lending opportunity for users willing to backstop for the perpetual exchange in case of an adverse event. Beyond Drift, many other perpetual exchanges are available on Solana, such as:

Zeta, that recently started the Mad Wars trading competition to onboard NFT users onto Solana DeFi;

Cypher, which recently launched its Liquidity Incentive Program;

or Mango Markets, built on top of OpenBook.

The New Generation of Solana DeFi Protocols

While most of the protocols mentioned above are already well-developed, there are many new teams that either recently went live or are preparing for their upcoming launch.

We began this article speaking of liquidity provision on Solana, and two projects are emerging to solve liquidity issues or simplify them. The first one is Kamino, a protocol that manages LP positions from Orca and Raydium on behalf of the user. CLMMs have become complex, even for protocols that need to provide liquidity for their native token, and Kamino alleviates these pain points by automatically setting ranges, rebalancing positions, and auto-compounding fees.

The second protocol is Meteroa, a project incubated by Jupiter that offers two main products working closely together: lending aggregation vaults and dynamic liquidity pools. Instead of sifting through every lending/perpetual protocol to lend their assets, traders can deposit their tokens into Meteora. It not only finds the best rates but also looks for healthy risk factors to avoid being stuck in a lending pool if a borrower poses risk on the position. Midas, incubated by Hadeswap, is also a novel stablecoin protocol similar to Hubble but for NFTs. NFT owners can collateralize their NFTs to mint $MIDAS and sell or use it across DeFi. For users who don't have time to create complex strategies, Hawksight offers one-click DeFi strategies on top of many DeFi protocols like Kamino, Orca, Raydium, and more. Additionally, GFX is working on single-sided liquidity pools to simplify liquidity provision for anyone.

Order books are also starting to take off on Solana, mostly due to the unique nature of the Solana blockchain. While we've already seen some successful use cases like OpenBook for limit orders on SPL assets or Sharky for customized NFT loans, new teams are working to further improve this field on Solana. Phoenix (Ellipsis) recently went live and is already among the top pool providers by volume on Jupiter. It's a new central limit order book (CLOB) that is completely decentralized and aims to bring the same experience as a centralized CLOB but on-chain. It will soon launch an interface to facilitate the use of order books for anyone, bringing the familiarity of a CEX with the benefits of a DEX.

Lulo is another order book, but instead built for lending and borrowing. Currently, most lending/borrowing protocols for fungible assets on Solana are pooled, and traders cannot set their own parameters (e.g. APY, duration). Lulo will allow anyone to create lending or borrowing orders with specific terms on their order book until it is matched with the other side. Moreover, order books can enable much more than trading crypto assets. Protocols like Aver, BetDex, or Hedgehog are building prediction markets and betting on sports events on-chain. Root is also an interesting protocol that combines both AMM and order book mechanisms for market makers on Solana, allowing them to provide liquidity in a very custom way and without restrictions.

Perpetual exchanges are also growing on Solana, and Flash Trade is working on bringing more liquidity to BTC and ETH on Solana with similar mechanisms to GMX. This will also bring new yield opportunities for BTC and ETH traders. Still in the derivatives field, Clone is working on synthetic assets, allowing anyone to trade any kind of assets on Solana, such as currencies, gold, stocks, and more. While the NFT landscape is already growing fast, there's still a missing piece: NFT perpetuals. Sujiko is working on this, with similar mechanisms to Drift v2 and Mango Markets but tailored for NFT collections. It will work not only for Solana collections but will also allow traders to trade ETH and BTC collections with the low fees and speed of Solana. Dual Finance, on the other hand, offers decentralized vault options. Last but not least, Symmetry allows anyone to create a decentralized index fund (similar to an ETF) on-chain and be their own asset manager with rules for rebalancing the fund.

Finally, the Solana DeFi ecosystem is diversifying with tokenization projects like Homebase, which tokenizes individual houses, and Parcl, which expands this to entire cities. Bridgesplit is bringing financial innovation by tokenizing loans on Solana. Alongside, the NFT landscape is still evolving with Rain, Hyperspace, and Honey developing novel financial uses for NFTs, while Texture aggregates the best prices for NFT borrowers. Privacy is also quickly becoming a thing on Solana with Elusiv offering private SPL token transfers and Light Protocol working on enabling DeFi protocols to anonymize parts of their applications for better use case.

Did You Say Airdrop?

Airdrops have played a considerable role in the success of protocols on Ethereum, with even L2s using them to bootstrap their communities and bring liquidity to their ecosystems. Earlier this year, BONK demonstrated that successful airdrops on Solana were possible. Many projects on Solana haven't launched a token yet, but several have recently hinted the potential for an airdrop for their users.

Cypher led the way by launching its Liquidity Incentive Program, which offers a fixed yield to those providing liquidity for Cypher traders. Tokens are locked for 6 months, and depositors are compensated in $CYPHER tokens. Some forms of gamification have been observed as well, with Marginfi introducing points to bootstrap liquidity and engage traders with the platform. These points will eventually be used for rewards or perks, like eligibility for a token airdrop. LSTs are also trending on Solana, and as said above SolBlaze publicly announced that they are working on an airdrop for bSOL holders.

Whether or not Solana projects launch a token, their products are still worth exploring. In the world of startups, many projects will emerge, and not all will succeed. However, given the energy of the builders in the Solana ecosystem and solutions like Cubik that facilitate funding for early projects, it's clear that this is just the beginning of the new era of Solana DeFi.

Squads is proud to support teams building their vision on Solana. Whether for programs or treasuries, most DeFi protocols mentioned in this article rely on Squads to split control over their on-chain assets with their team members and securely manage their operations with multisig security.

About Squads

Squads is a crypto company operations platform that simplifies management of developer, creator, and treasury assets for teams building on Solana and SVM. Open source, formally verified, immutable, Squads enables teams to secure their on-chain assets in a multisig and jointly manage them.

Learn more

Squads: https://squads.so/blog/what-is-squads

Squads Protocol: https://squads.so/blog/solana-svm-smart-contract-wallet-infrastructure

Code: https://github.com/Squads-Protocol/squads-mpl