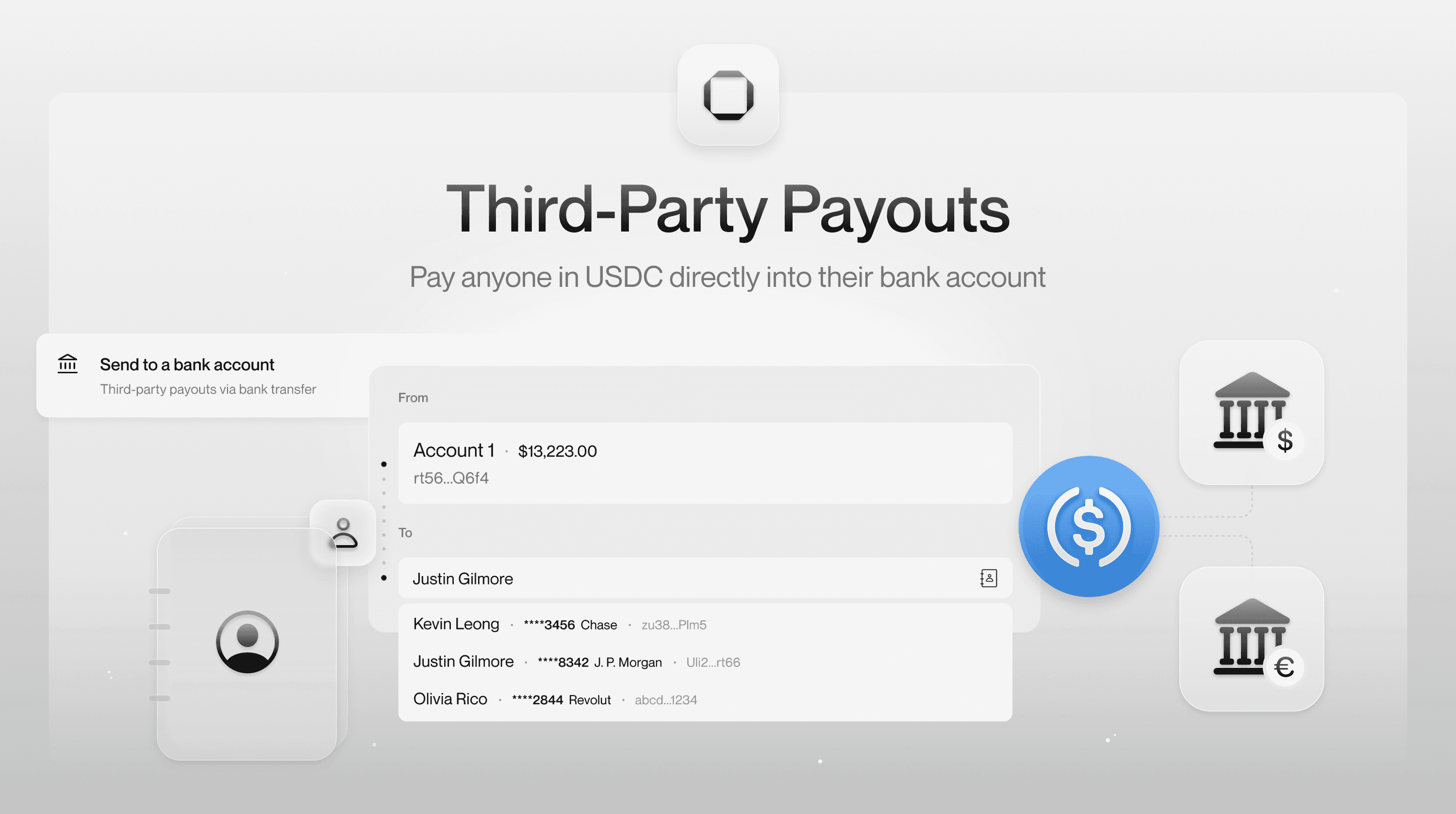

Today, we're introducing third-party payouts—powered by Bridge.

This new feature enables Squads users to make USDC payouts to bank accounts of both businesses and individuals, with funds arriving in either USD or EUR.

Eligibility

Third-party payouts are currently available for most businesses in Canada, Europe, Asia, and other regions outside the OFAC sanctions list. While U.S. businesses are not yet eligible, non-U.S. businesses can use the feature to pay their U.S. counterparts.

To access third-party payouts, you must complete the Bridge KYB verification process outlined in the section below.

How to get started

Log in to your Squad and navigate to the “Contacts” section in the left-hand menu.

Here, you’ll find two available options:

Option A: Add bank details to an existing contact

Option B: Create a new contact incl. a wallet address and/or USD/EUR bank details

Regardless of whether you choose Option A or B, you’ll first need to complete the Bridge KYB verification process, which will be conveniently prompted if you haven’t done so already.

Go to your Squad dashboard and click “Send”. In the “External” section, choose “To bank account”. Select your payment account and the payout recipient from your contacts—click “Next”. Alternatively, you can click the “Send” button directly from the contact overview to initiate a faster third-party payout workflow.

Next, enter the USDC amount you'd like to pay out and choose a transaction method—click “Next” to proceed.

Review the payout details and initiate the transaction. The USDC payout will be converted to USD or EUR based on the recipient’s bank details.

Options & fees

Multiple transaction methods are available for third-party payouts.

Wire Transfer

Fee: $20 + 0.5%

Settlement: Within 1 business day (fastest option)

ACH Same Day

Fee: $1 + 0.5%

Settlement: Within 1 business day

Standard ACH

Fee: $0.50 + 0.5%

Settlement: 2-3 business days

SEPA Transfer

Fee: $1.00 + 0.5%

Settlement: 1-5 business days

Accelerate

Take your business fully onchain with the power of third-party payments and virtual US bank accounts—no need for legacy banks or intermediaries.

Onramp USDC through a virtual US bank account and manage payroll, invoices, and more using third-party payments. Leveraging this setup, you can avoid issues such as banking delays and excessive fees, while enjoying self custody and faster transactions.