There’s a feedback loop that drives software development. A market need gives rise to innovative software solutions that, in turn, shape that market in a continuous cycle. This loop exists because great software accelerates and expands a market by providing teams leverage on their time, assets and money.

Stripe, Figma, and Ramp are prime examples of software companies that have built products that shape their markets. In this article, we explore these companies and how they have influenced our work at Squads Labs to accelerate the onchain economy.

Stripe: Growing The GDP Of The Internet

Stripe builds financial infrastructure for online businesses to manage revenue operations and launch new business models.

PayPal introduced the world to secure online payments, and Stripe made online payments elegant and scalable. Stripe introduced an API-first payments solution that made it simple for businesses to launch and scale their online operations. All it takes is a few minutes, and your site can accept local and international payments. This simplicity and Stripe’s focus on developers led to a viral product that shaped the trajectory of online commerce. Their platform facilitated the rise of new business models, such as subscription services and on-demand platforms, which have become integral parts of the digital economy. In 2023 alone, Stripe processed over $1 trillion, equivalent to 1% of global GDP.

After establishing its core payment processing product, Stripe built out a fully integrated suite of financial and payment products for launching an online business:

Stripe Atlas: A service that streamlines company incorporation in Delaware—in minutes.

Stripe Issuing: A banking-as-a-service infrastructure provider for innovative startups.

Stripe Capital: A loan service offering flexible payments without lengthy applications.

By streamlining the process of starting an online company, these solutions contribute to the internet's growing GDP, which in turn fuels an increase in transactions processed by Stripe.

Figma: The Operating System For Design

In the 2010s, an explosion in apps led to a growing market for product design and development. Adobe dominated all aspects of this market with its feature-rich products, used by almost every design team. Despite this lead, Figma launched in 2014 and has become the operating system for design by building the most widely used collaborative design tool. Figma’s adoption and success can be attributed to the following three key factors.

First, Figma introduced seamless collaboration and version control by leveraging the latest technology to be browser-first. At the time, web applications were often clunky and lacked the power of traditional desktop software. Figma had to prove it could offer a professional design experience entirely within a web browser. As stated by Ben Thompson, “it was the epitome of leveraging new technologies to compete on a new vector, which in this case was collaboration.”

Second, Figma provided a user-friendly interface and a comprehensive design ecosystem, integrating various design tools into a single platform. These intuitive tools enabled “every” employee at a software company to be a part-time designer or product manager. This grew the design market and made Figma the perfect solution for the rapidly growing application space.

Third, Figma focused on its core offering and onboarded third-party developers to build plugins that added editing capabilities to its platform. This extends Figma’s capabilities to include a larger percentage of the design process. Designers still use Adobe for tools such as Photoshop and Illustrator, but Figma sits in the middle of the design process because of its superior collaboration tools. This positioning provides Figma with a unique opportunity to vertically integrate within the design supply chain to further improve the user experience. From its inception, Figma was driven by the need for design collaboration. Today, it not only meets this demand but also accelerates it.

Ramp: Software That Saves Companies Time And Money

Ramp is the fastest-growing SaaS company in history—hitting a $100M revenue run rate in two years. Founded in 2019, Ramp is a fintech company that is reshaping the corporate spending market, which accounts for over $100 trillion annually worldwide, with $15 trillion spent on corporate cards alone.

Ramp launched a corporate card as its primary offering to position itself at the heart of payment transactions. Unlike traditional cards that encourage you to spend via points, Ramp's mission is to help you spend less. That's because the card was just the Trojan horse. By owning the card, Ramp has direct access to live transaction data that they leverage to build a host of related products—such as Ramp Flex, expense management, and vendor management—that automatically save companies time and money.

An example of this is Ramp leveraging its network data to automatically identify instances where companies are overpaying for products and services, enabling the platform to automatically negotiate more favorable rates with vendors. Ramp also launched integrations with Gmail, Amazon, Lyft, and others to automatically verify employees’ receipts and repayments for out-of-policy spend.

Apart from that, Ramp's transaction data enables the platform to leverage AI as well. Just recently, Ramp launched Copilot, a virtual CFO, that uses AI to answer your questions, build approval workflows, and suggest ways to reduce costs and free up time.

In an economic climate where companies are prioritizing profitability and cost-cutting, Ramp has found product-market fit by helping businesses save time and money, allowing them to redirect resources towards growth.

Squads: Accelerating The Onchain Economy

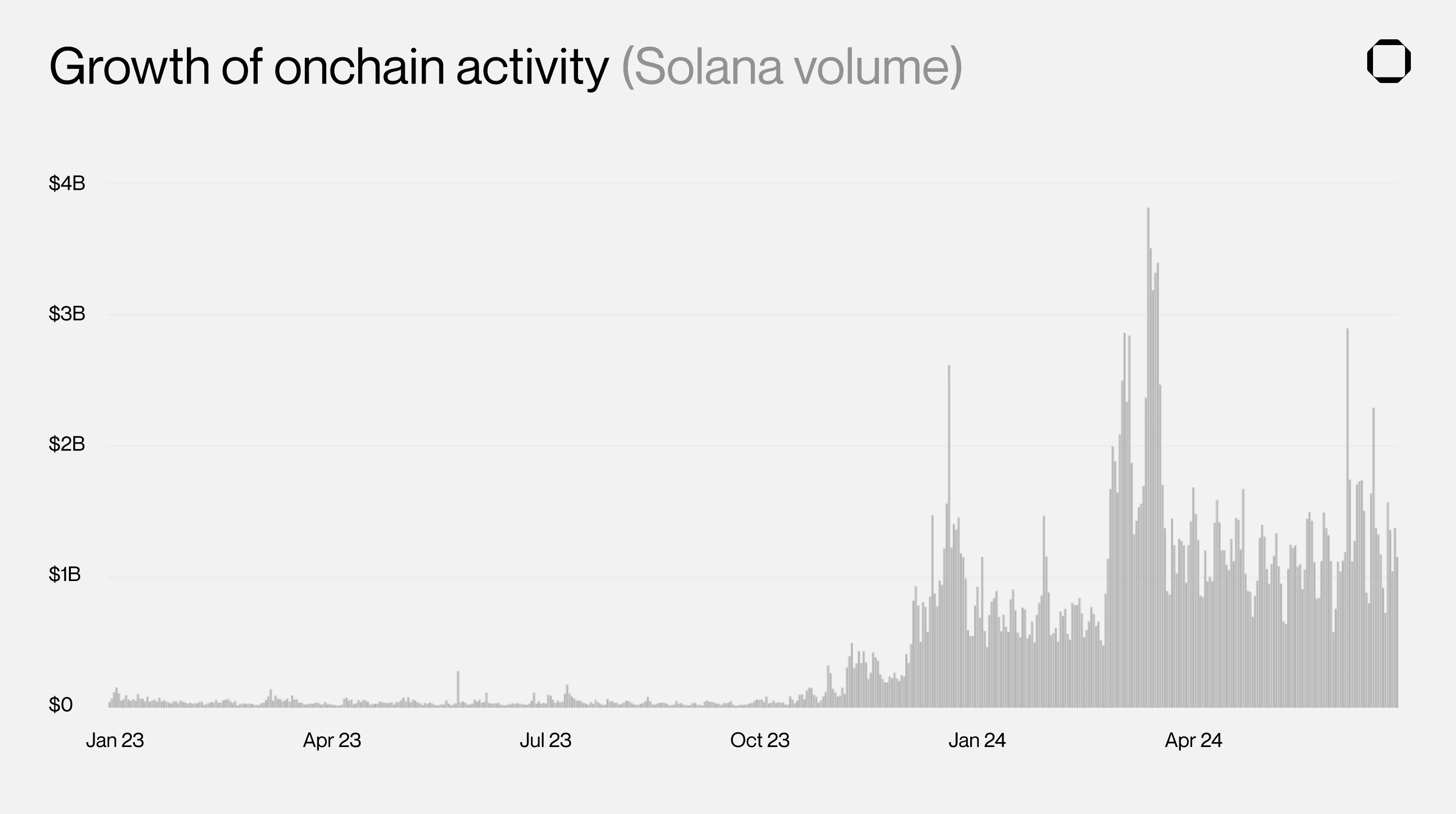

Solana’s early success proved projects and teams will move onchain if given low fees, high speeds and increased distribution. As Solana’s economy grew, these teams needed a secure solution to manage their digital assets and onchain operations.

In 2021, we launched Squads Protocol to provide teams with the core infrastructure (smart accounts) to collectively manage their onchain funds. We then built Squads on top of Squads Protocol as an enterprise platform that enables businesses to run their operations onchain. Squads started as a simple app allowing teams to create a multisig wallet, but it has developed into an advanced workflow management platform that teams use to secure their funds, launch tokens, run payroll, upgrade programs, manage investor tokens, make payments, stake with validators and more. Squads has evolved to provide a traditional SaaS-like product experience that feels familiar and intuitive to both traditional and crypto-native businesses.

Blockchains enable efficient asset management with instant, cheap global transfers, no intermediaries, increased automation, and granular permissions. Businesses are already being built on blockchain rails today, and that trend will only accelerate over time.

We are building Squads to both a) meet the demand of the teams and startups that are choosing to run their operations onchain today; as well as b) to help more businesses make the same choice in the future by providing reliable, secure infrastructure for asset custody and an intuitive product experience for managing onchain assets. As blockchain adoption continues to rise, enterprises that have the tools to adeptly manage digital assets will be better positioned to capitalize on new opportunities, mitigate risks and become more efficient in their operations.

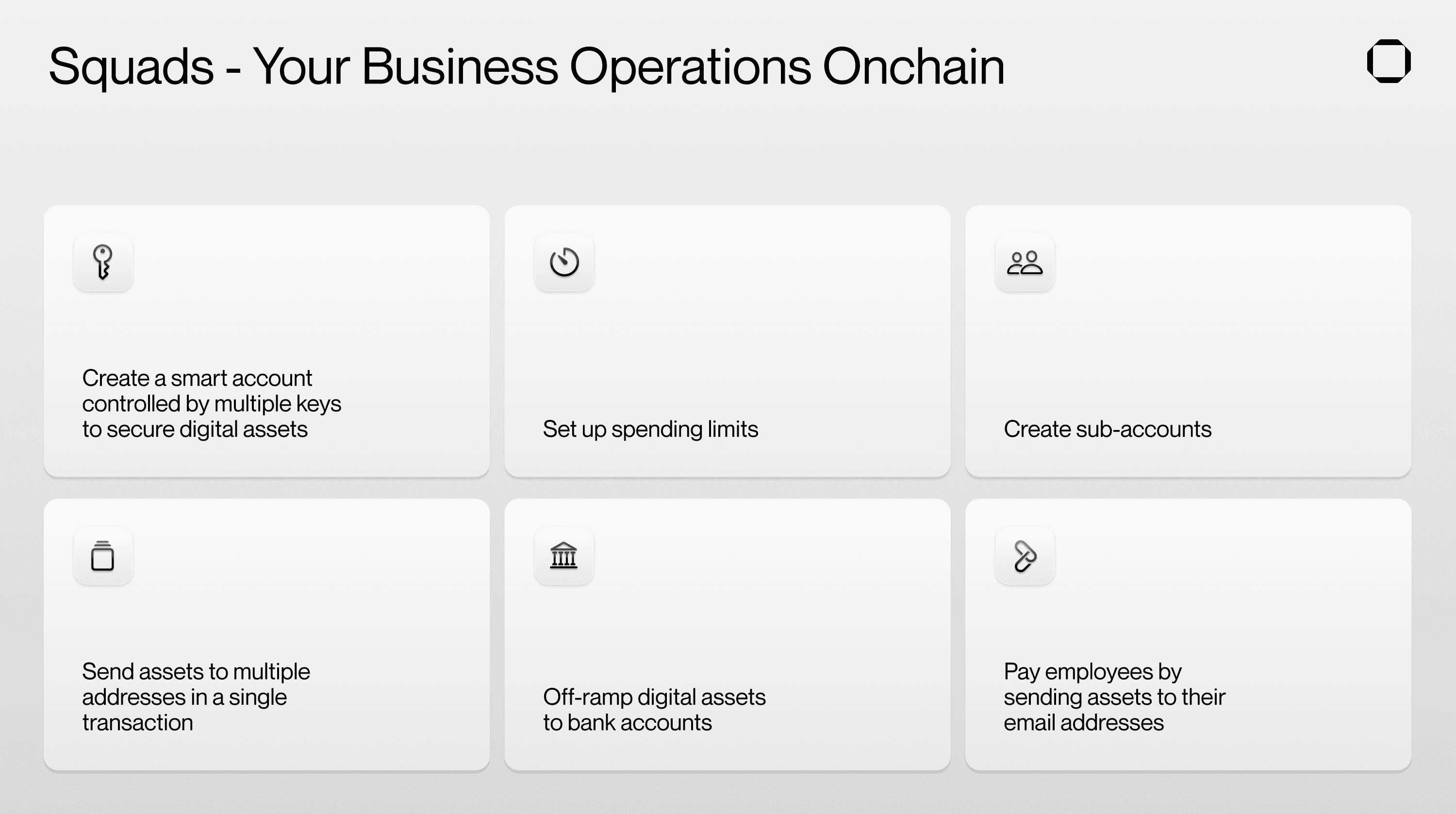

Today, enterprises use Squads to:

create a smart account controlled by multiple keys to secure their assets

set up spending limits

create sub-accounts

send assets to multiple addresses in a single transaction

off-ramp digital assets to their bank account

pay employees by sending assets to their email addresses.

In the upcoming months, we will introduce:

CSV exports and accounting software integrations

refined experience for invoicing and recurring payments

a new trading experience for diversifying treasury assets

onchain and offchain yield opportunities

more on/off-ramp options

granular policies

email and Telegram notifications

corporate credit cards

and more.

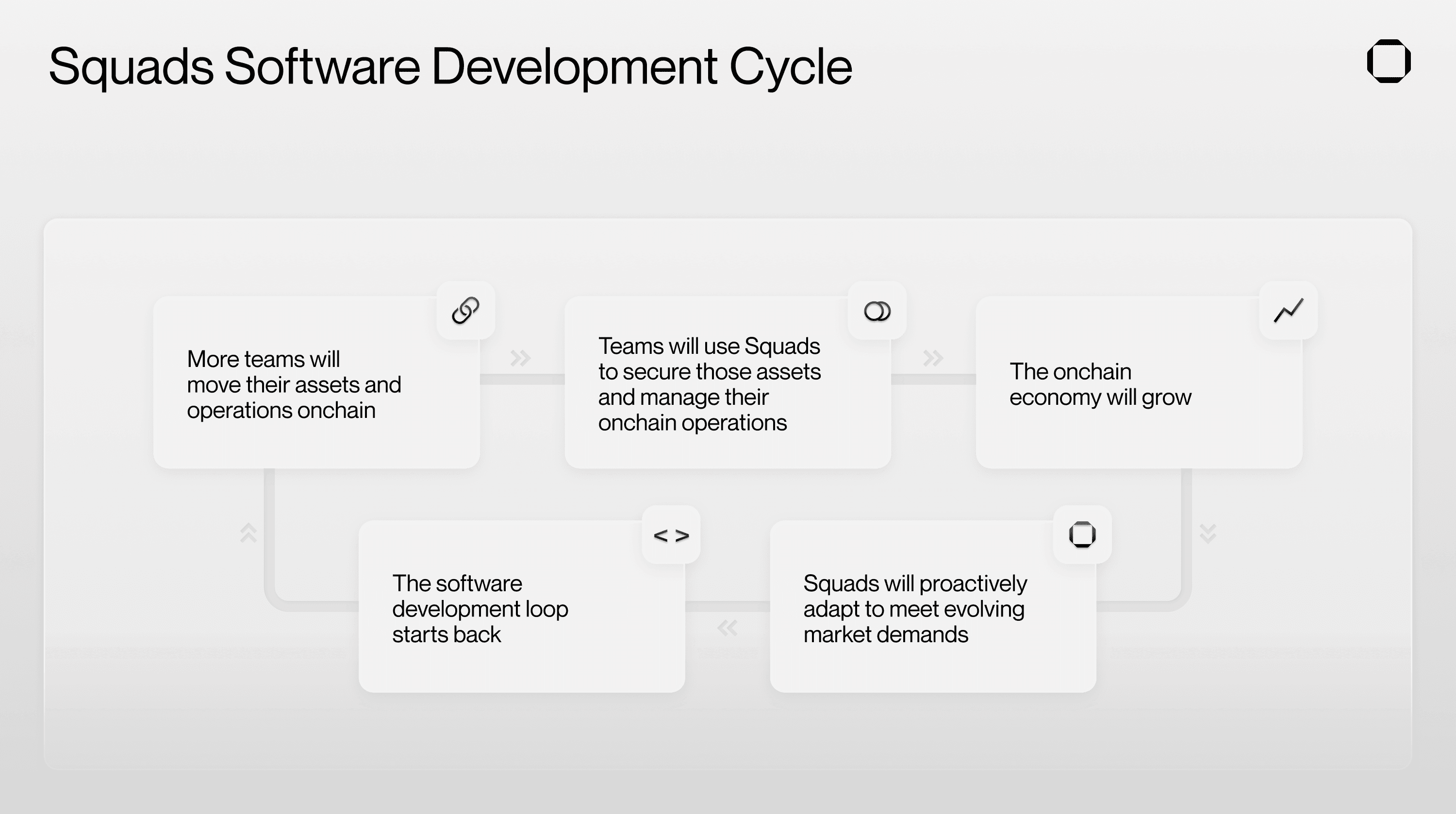

Squads is following the software development cycle described in the opening paragraph:

More teams will move their assets and operations onchain

Teams will use Squads to secure those assets and manage their onchain operations

The onchain economy will grow

Squads will proactively adapt to meet evolving market demands

The software development loop starts back at step 1.

We are betting on a future where an ever-increasing amount of productive economic activity happens onchain. Our goal with Squads is to accelerate that future. Secure asset management and an intuitive user experience are requirements for that to happen.

Get Started With Squads Today

If you are a team building on Solana and need a place to secure and manage your developer and treasury assets, create a Squads App account on app.squads.so.

And enterprises looking for a more robust and comprehensive digital asset management platform, make sure to reach out to garrett@sqds.io to get onboarded.