We are entering into an era where code is currency, trust is programmed, and global access dissolves traditional economic boundaries. This emerging paradigm is what we call the onchain economy.

Within this landscape, Solana stands out for its continuous innovations in both infrastructure and applications. These advancements are expanding the network's capabilities, attracting a growing user base, and consequently, driving increased economic activity.

As these trends accelerate, the onchain economy is evolving from a niche concept to an increasingly vital part of our global economic system.

The Future Is Onchain

The onchain economy has continued to surge in recent years, catalyzed by 3 key drivers:

Value Creation

Technology Acceleration

Institutional Adoption

These drivers contribute to the ongoing expansion and maturation of the onchain economy, setting the stage for continued innovation and growth.

Value Creation

Bitcoin's genesis block introduced onchain value, while Ethereum's 2015 launch provided the first programmable substrate for a new digital economy. This economy accelerated in 2021, seeing unprecedented highs in asset prices, onchain activity, investments, and new blockchain networks. After cooling in 2022, the onchain economy has entered a new growth phase, driven by maturing applications and scalable infrastructure.

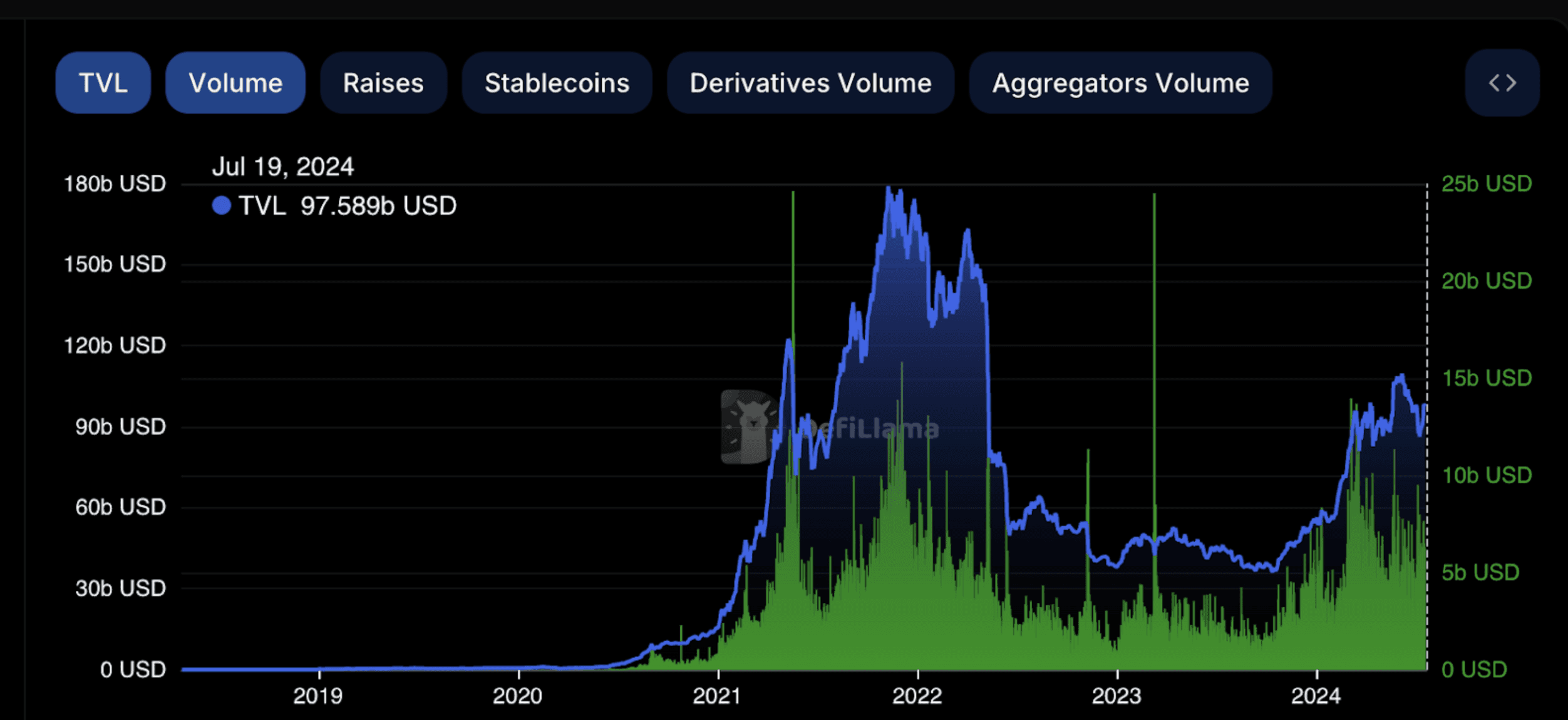

Source: defillama.com

Total Value Locked (TVL) and transaction volume are two primary measures for tracking onchain value. TVL has grown from a modest $620 million in 2019 to a high of $100 billion in 2024, with transaction volume increasing by more than 1000x during the same period.

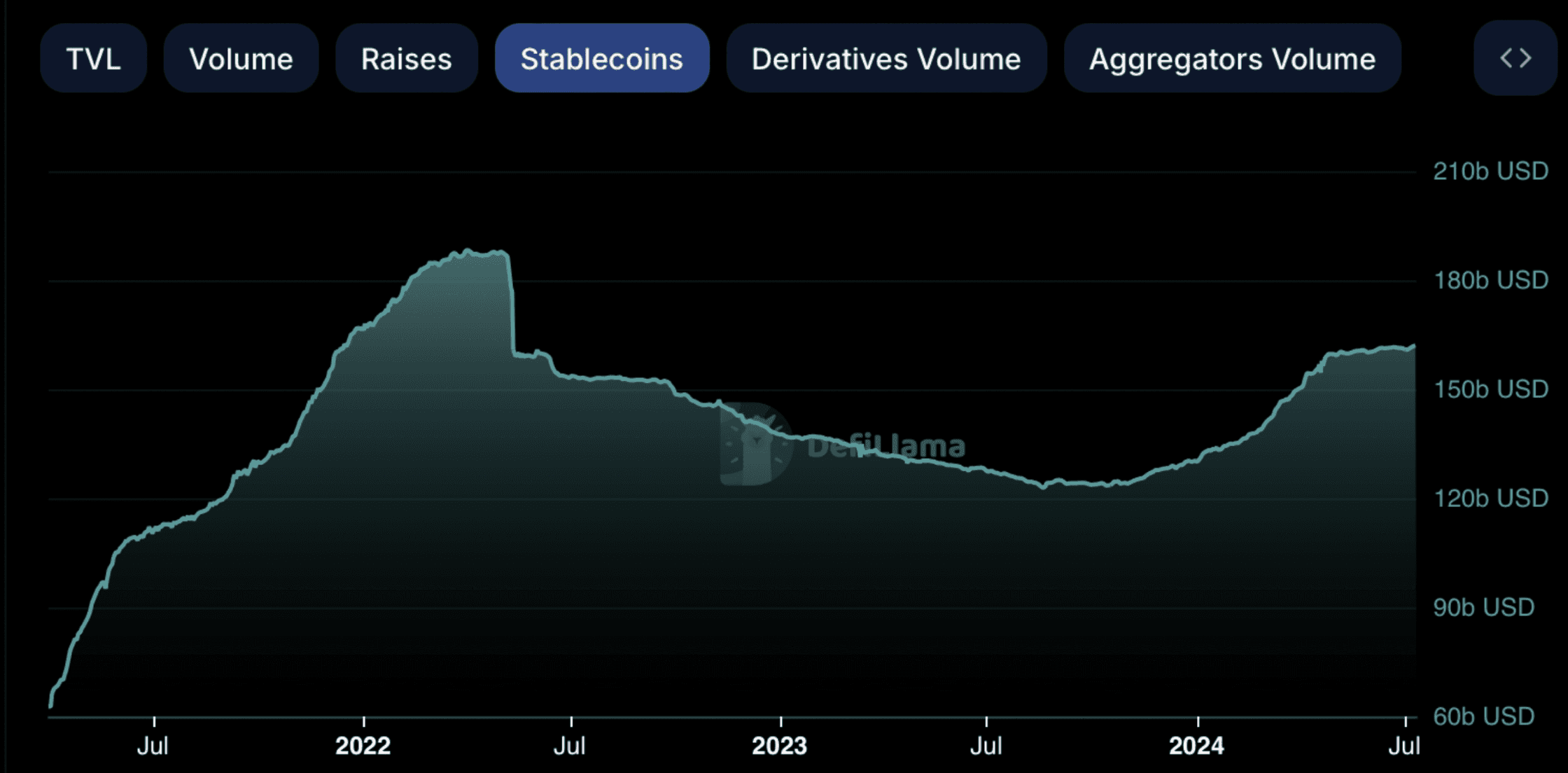

Additionally, the stablecoin market capitalization has shown resilience, nearly recovering to previous highs and exhibiting steady growth. This trend underscores the enduring appeal of stablecoins, which are increasingly being favored to fiat due to their convenience and settlement speeds.

Source: defillama.com/?stables=true&tvl=false

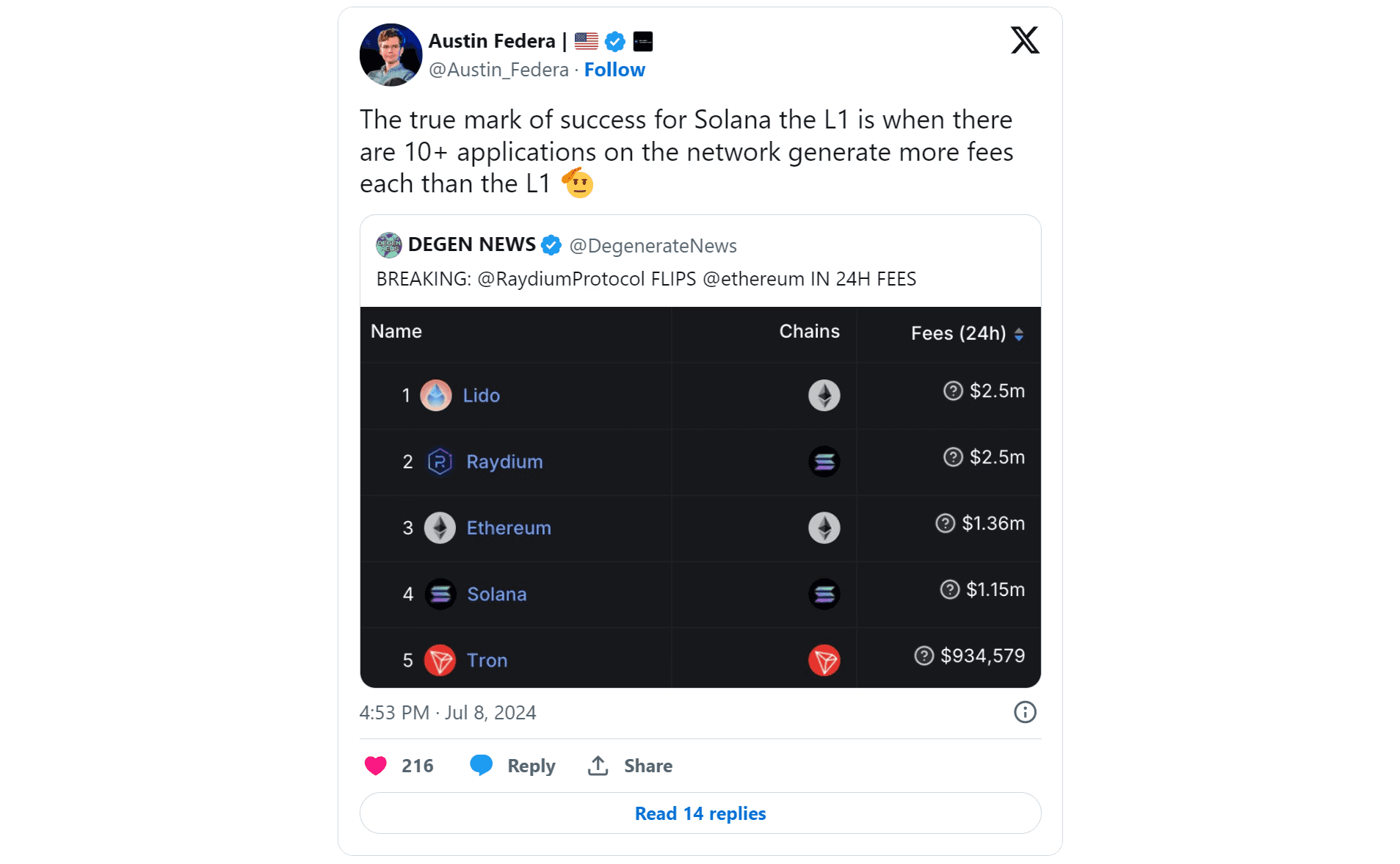

While Ethereum remains the primary platform for major DeFi protocols such as Uniswap, Lido, Aave, and Maker, Solana's DeFi ecosystem has made remarkable strides, often matching or surpassing Ethereum in trading volume.

The rising popularity of memecoins has further bolstered Solana's volume growth. Platforms such as pump.fun, a memecoin launchpad, and Raydium, an AMM DEX, have occasionally surpassed both the Ethereum and Solana networks in 24-hour revenue generation.

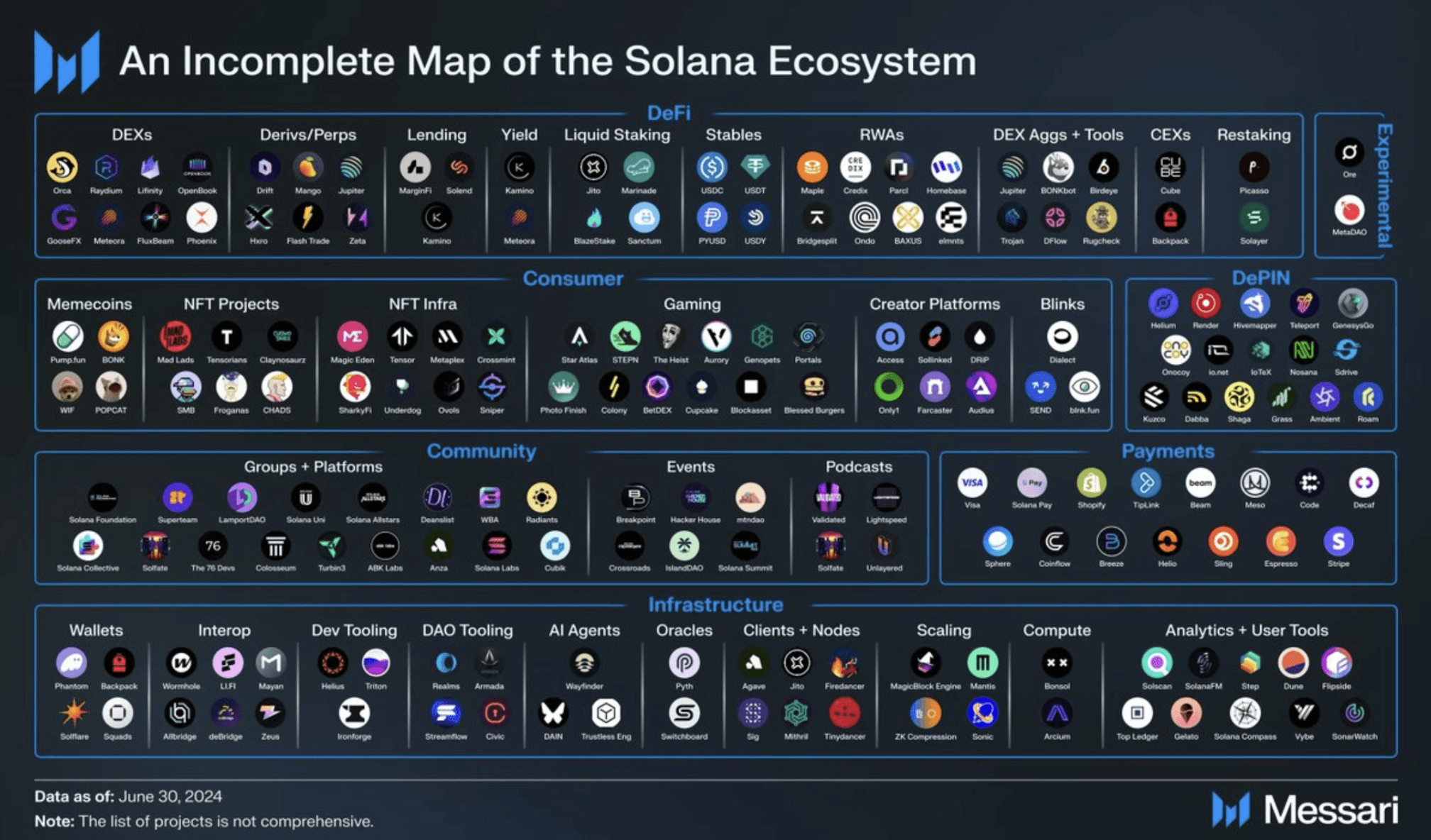

Apart from DeFi, the onchain economy is experiencing growth across multiple sectors, including consumer apps, payments, and decentralized physical infrastructure networks (DePIN).

A few of these projects within the Solana ecosystem include:

Consumer Applications: Solana's ecosystem features popular apps such as Photo Finish, a horse racing game, and Drip, a consumer-focused collectibles app that’s minted over 170 million NFTs so far. BonkBot, a Telegram trading bot, is another consumer app that has gained traction by offering users seamless Solana token trading on mobile devices.

Payment Solutions: Sphere leads the Solana payment sector, providing efficient crypto-to-fiat and fiat-to-crypto on- and off-ramps, and various other payment services. Solana Pay—an open, free-to-use payments framework—is available to millions of businesses as an approved app integration on Shopify, while TipLink enables crypto transfers via email links.

DePIN: Helium stands out by incentivizing users with MOBILE tokens to create and manage hotspots, building a decentralized mobile network. Hivemapper leverages crowdsourced data to develop an evolving global map, rewarding contributors with HONEY tokens. The Render Network is the first decentralized GPU rendering platform, enabling high-performance, scalable, and cost-effective graphics processing.

The Solana ecosystem is also branching out into more experimental ventures:

StakeNet: A decentralized Solana stake pool manager built by Jito.

Actions & Blinks: Turn any website into a Solana frontend/app.

ZK Compression: A new primitive to compress on-chain state while preserving security.

Chapter 2: Solana Mobile’s second device after Saga (which sold 20,000 devices).

FORMA: The first-ever Solana Economic Zone in Buenos Aires, Argentina.

Restaking: Solana’s validators secure additional protocols and services beyond the Solana blockchain.

MetaDAO: The world's first market-governed organization.

The expansion of DeFi, consumer applications, payment solutions and DePIN has significantly increased user adoption while simultaneously driving the growth of Total Economic Value.

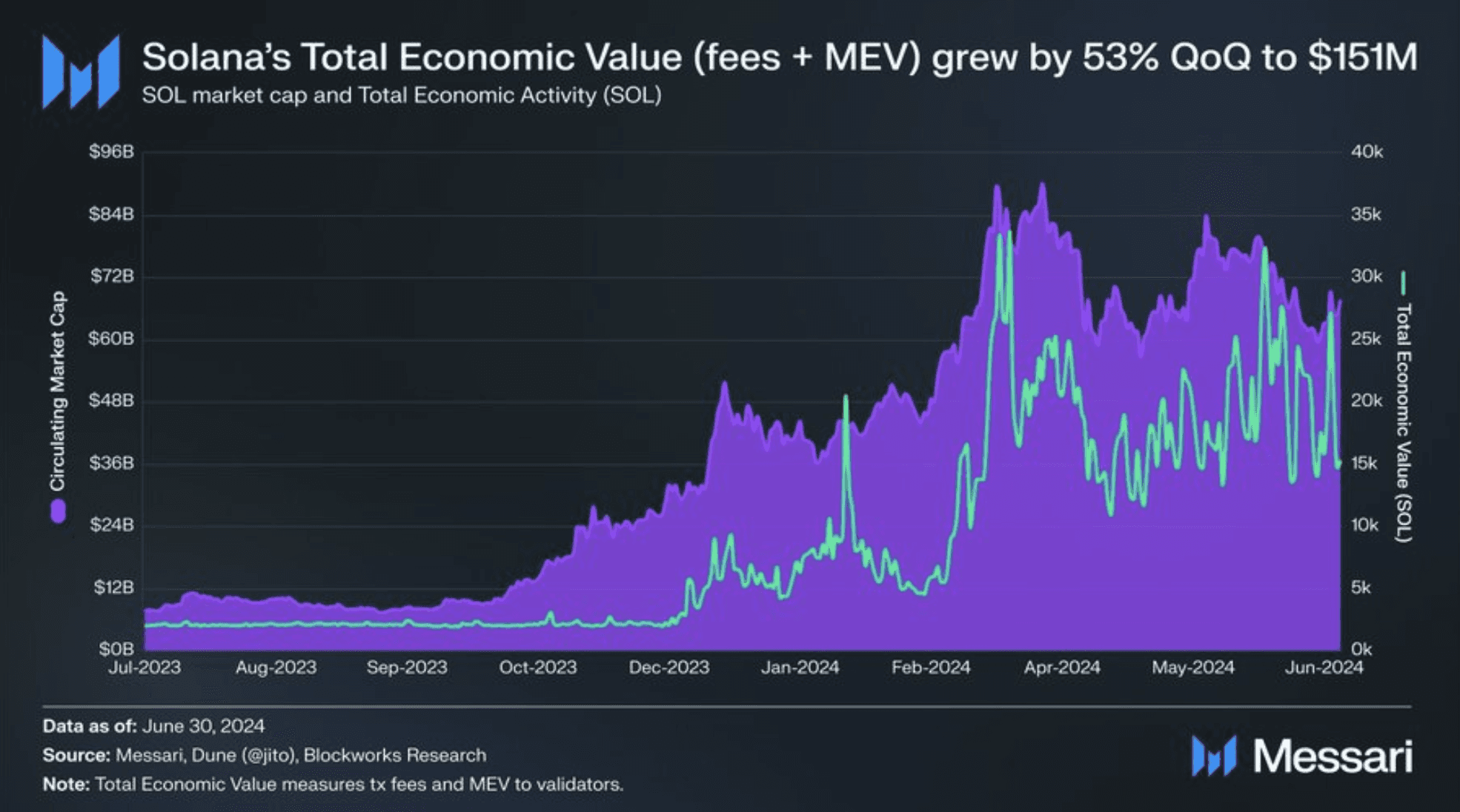

Total Economic Value (TEV) encompasses user transaction fees and maximal extractable value (MEV). In May 2024, Solana surpassed Ethereum in TEV generated in a single day for the first time. This achievement underscores Solana's growth trajectory and increasing competitiveness in the onchain ecosystem.

Technology Acceleration

The growth of the onchain economy extends beyond the quantitative measures of onchain volume, revenue, and application activity. It's the ecosystem's technological acceleration that fuels tomorrow's value-creation engine. Since Ethereum's 2015 launch, the ecosystem has evolved from a barren landscape to a dynamic ecosystem, with numerous teams developing:

Scaling solutions: asynchronous execution, local fee markets, parallel processing, offchain state management, database optimizations, proof aggregation, verifiable offchain computation, and modular components

MEV infrastructure: Flashbots (Ethereum) and Jito (Solana)

Developer tooling: advanced SDKs, multi-language support, and novel VM implementations

Network infrastructure: multiple client implementations, light clients and optimized networking protocols

Asset management solutions: institutional custodians, multichain wallets, embedded wallets, smart wallets, social login wallets and enterprise treasury management software

Interoperability: cross-chain bridging solutions and intent infrastructure

Data services: analytics platforms, indexing (RPCs and explorers), oracles and research

Workflow automation: onchain payroll, on/off ramps, accounting software and management platforms

Security: automated fraud detection, formal verification and industry security standards

The Solana ecosystem is poised for significant technological enhancements, particularly with respect to network infrastructure and client implementations. This list includes, but is not limited to:

Firedancer: a cutting-edge validator client developed in C++ engineered to outperform existing validator clients across all blockchain networks. Firedancer will be released incrementally, with the complete full-stack version slated for release in 2025.

Mithril: a lightweight full node client designed to validate Solana with reduced hardware requirements.

Sig: developed in Zig, Sig is a Solana validator client with a specific focus on RPS (Requests Per Second).

Anza’s SVM API: a new API that streamlines the process of implementing Solana's SVM for developers.

Tinydancer: an experiment to create Solana’s first light client, enabling end-user verification.

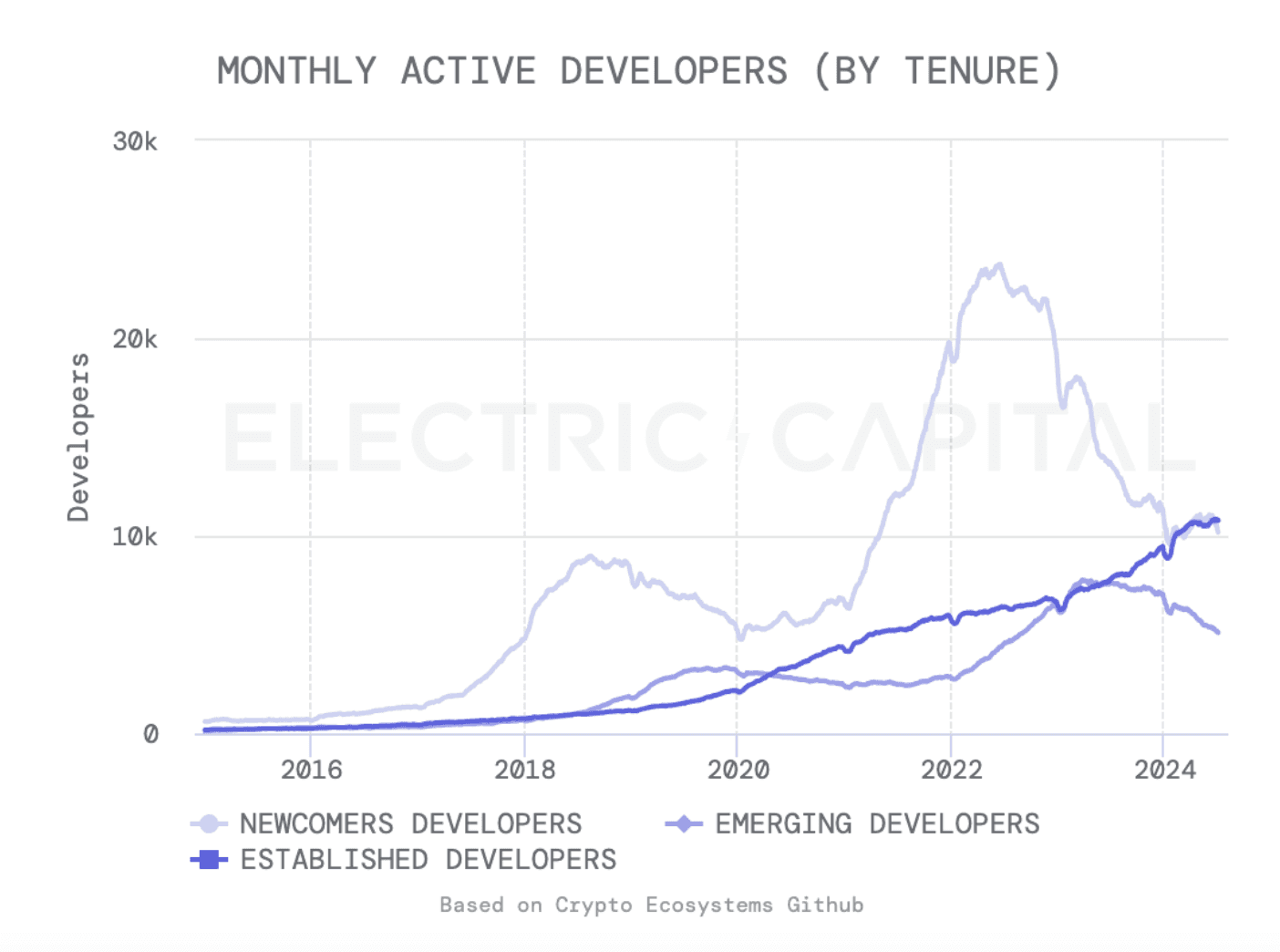

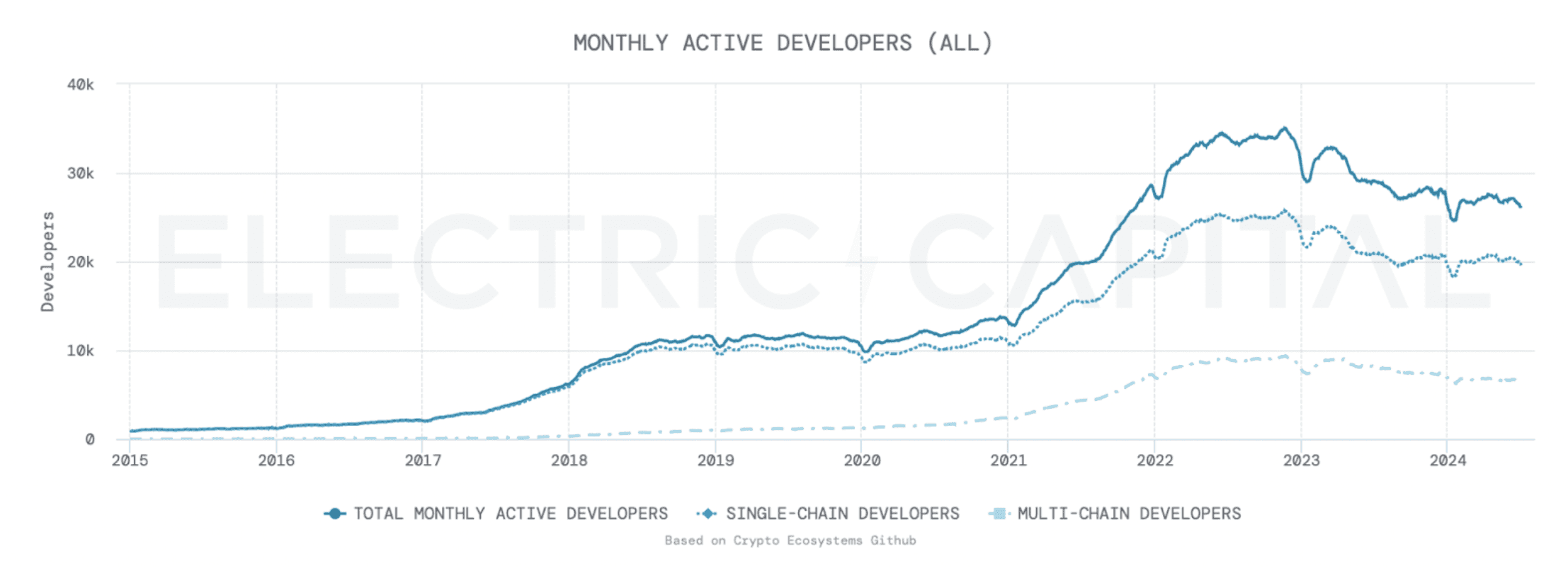

The crypto developer ecosystem continues to expand as interest grows and improved developer tools and infrastructure increase accessibility. While the number of monthly active developers has stabilized after an initial dip, there's been a notable surge in established developers. This cohort, with over two years of crypto experience, has reached an all-time high, growing at a 52% annualized rate over the past five years.

Source: developerreport.com

This trend is crucial, as developers are key drivers of onchain value creation. They develop the products and services that attract and benefit users, and as the user base expands, it draws in more developers, establishing a self-reinforcing cycle that propels the growth of the onchain economy forward.

Source: developerreport.com

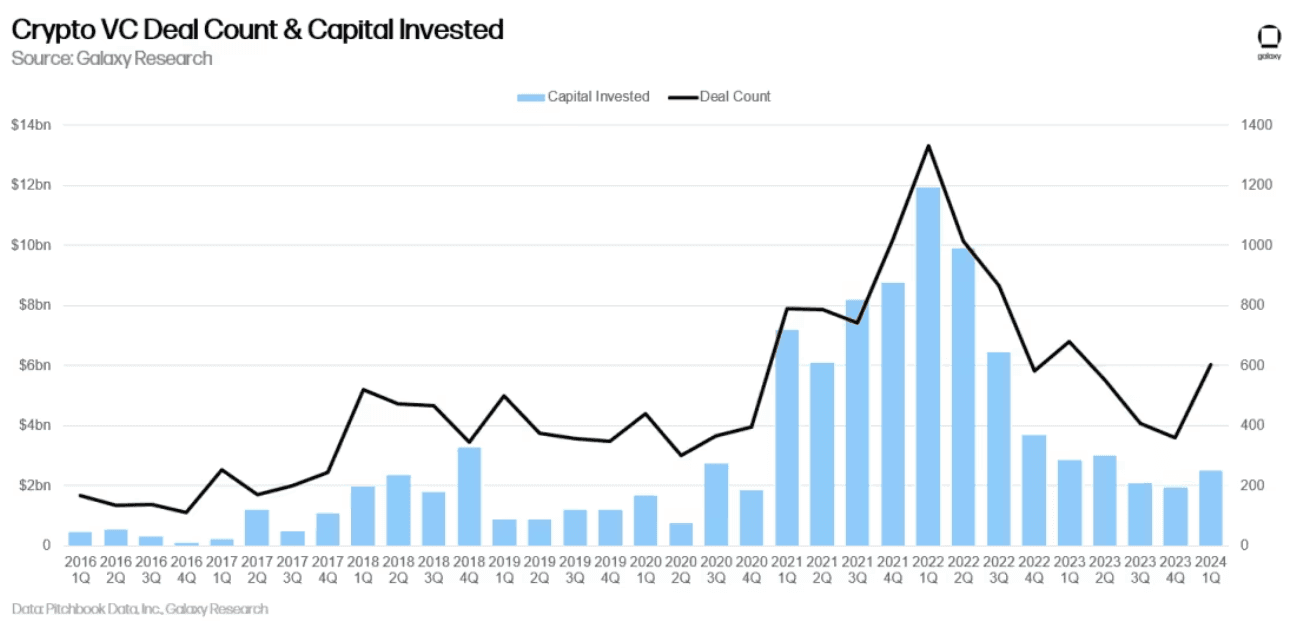

The developer ecosystem and technological innovation have been accelerated by an influx of capital over the last two years, with a recent uptick in the first quarter of 2024, attracting $2.49 billion across 603 deals, marking a 29% increase from the previous quarter.

Source: galaxy.com/insights/research/crypto-and-blockchain-venture-capital-q1-2024

Institutional Adoption

Leading institutions across various sectors are actively exploring ways to incorporate blockchain and cryptocurrency solutions into their operational frameworks:

J.P. Morgan leverages Avalanche to build a proof-of-concept for the asset and wealth management industry.

BlackRock runs the USD Institutional Digital Liquidity Fund, known as BUIDL, as a tokenized fund on the Ethereum blockchain.

UBS launched a controlled pilot of a tokenized money market fund that leverages the Ethereum network.

Societe Generale issued its first digital green bond as a security token on the Ethereum blockchain.

Shopify has implemented Solana Pay, enabling merchants to charge and receive USDC for their goods and services.

Stripe is offering USDC payment acceptance on Solana for its merchants, with transactions instantly settling onchain and automatically converting into fiat.

Visa is experimenting with USDC on both Ethereum and Solana to optimize the speed and cost of USD transactions and settlements.

Mastercard announced the introduction of Mastercard Crypto Credential, a set of common standards and infrastructure that will help verify interactions among consumers and businesses using Solana, Polygon, Aptos and other networks.

The launch of Bitcoin spot ETFs (January 2024) in the United States was another major milestone for institutional adoption. Since their launch, these ETFs have seen substantial daily net inflows, highlighting the demand for these investment products. This rapid accumulation demonstrates the growing institutional interest in cryptocurrencies and signals a broader acceptance of Bitcoin as a legitimate asset class among traditional investors. Applications for Ethereum and Solana spot ETFs are gaining momentum, reflecting a growing institutional interest in diversified crypto assets beyond Bitcoin.

The growing institutional interest in the onchain economy has also led to significant developments in the stablecoin sector. Recently, PayPal has introduced PYUSD, a dollar-pegged stablecoin available on both the Ethereum and Solana networks. Meanwhile, Circle, the company behind the widely adopted USDC stablecoin with a $33 billion market cap, is preparing to relocate its domicile to the United States, potentially in preparation for an initial public offering (IPO).

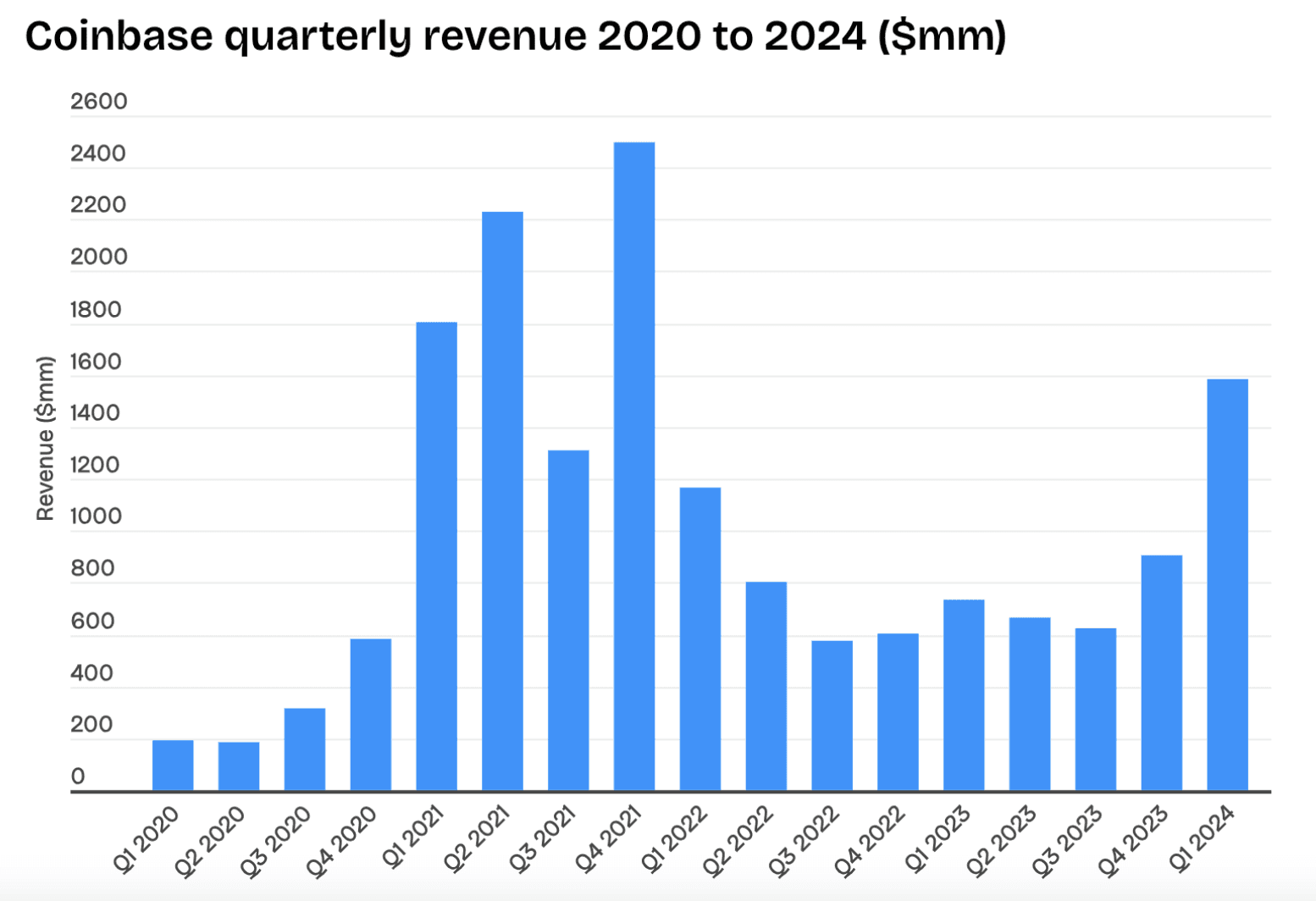

Further evidence of crypto's expansion can be observed in the user base of centralized exchanges. Binance, the largest of these exchanges, boasts over 170 million global users—significantly surpassing other popular exchanges such as Coinbase, which reports approximately 105 million global users. Coinbase experienced stagnating revenue growth throughout most of 2022 and 2023. However, Q1 2024 growth signaled a recovery, suggesting that retail is regaining confidence and interest in digital assets.

Source: businessofapps.com/data/coinbase-statistics

Squads: Accelerating The Onchain Economy

An ever-increasing amount of economic activity will move onchain. To accelerate this future, we're building Squads—an enterprise platform that enables businesses to securely manage and scale their onchain operations. With Squads, businesses can deploy a smart account, configure it to satisfy their security and organizational requirements, and use it to manage a wide range of onchain assets such as treasury, program upgrade authorities, admin keys, tokens and validator keys.

If you are a team building on Solana and need a place to secure and manage your developer and treasury assets, create a Squad on app.squads.so and reach out to garrett@sqds.io to learn more.