Author: Shimon Newman

Edited by: Garrett Harper & Jonathan Gurirab

Stablecoins have emerged as vital technology in global and local economies. This research report, prepared by Squads Labs, analyzes the evolution and impact of stablecoins through two lenses: 1. hedging against monetary debasement and 2. global and state-driven trends.

Background

Definition of stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value “pegged” to a specific asset or basket of assets, typically a fiat currency like the U.S. dollar. Issuers use various mechanisms to maintain the price stability of their stablecoins, the most common being full collateralization by fiat currency reserves or liquid debt instruments like U.S. treasuries [1].

Stablecoins offer the potential for faster, cheaper, and more accessible transactions compared to traditional bank transfers. They also provide a store of value less susceptible to external forces—like regime changes and hyperinflation—or internal forces, like downturns in the crypto market [2]. Another key component is the idea of self-custody, meaning that users can store stablecoins in their digital wallets without needing banks or custodians.

Brief history & market overview

Stablecoins emerged as a response to the high volatility of early cryptocurrencies, with the first notable stablecoin, Tether (USDT), introduced in 2014 [3]. Since then, the stablecoin market has experienced rapid growth, particularly in emerging markets and developing economies (EMDEs), by addressing acute cross-border payment frictions and fiat instability [1].

Key milestones in stablecoin history include [4]:

2014: Launch of the first major stablecoin Tether (USDT)

2018: Introduction of USD Coin (USDC)

2019-2021: Rapid growth in stablecoin adoption, particularly in DeFi applications, emerging markets, and developing economies (EMDEs). The total stablecoin market capitalization reaches ~$5B [5]

2022: Collapse of algorithmic stablecoin TerraUSD, leading to increased regulatory scrutiny

2023: Stablecoin market capitalization reaches approximately $165B, 33x from 2019

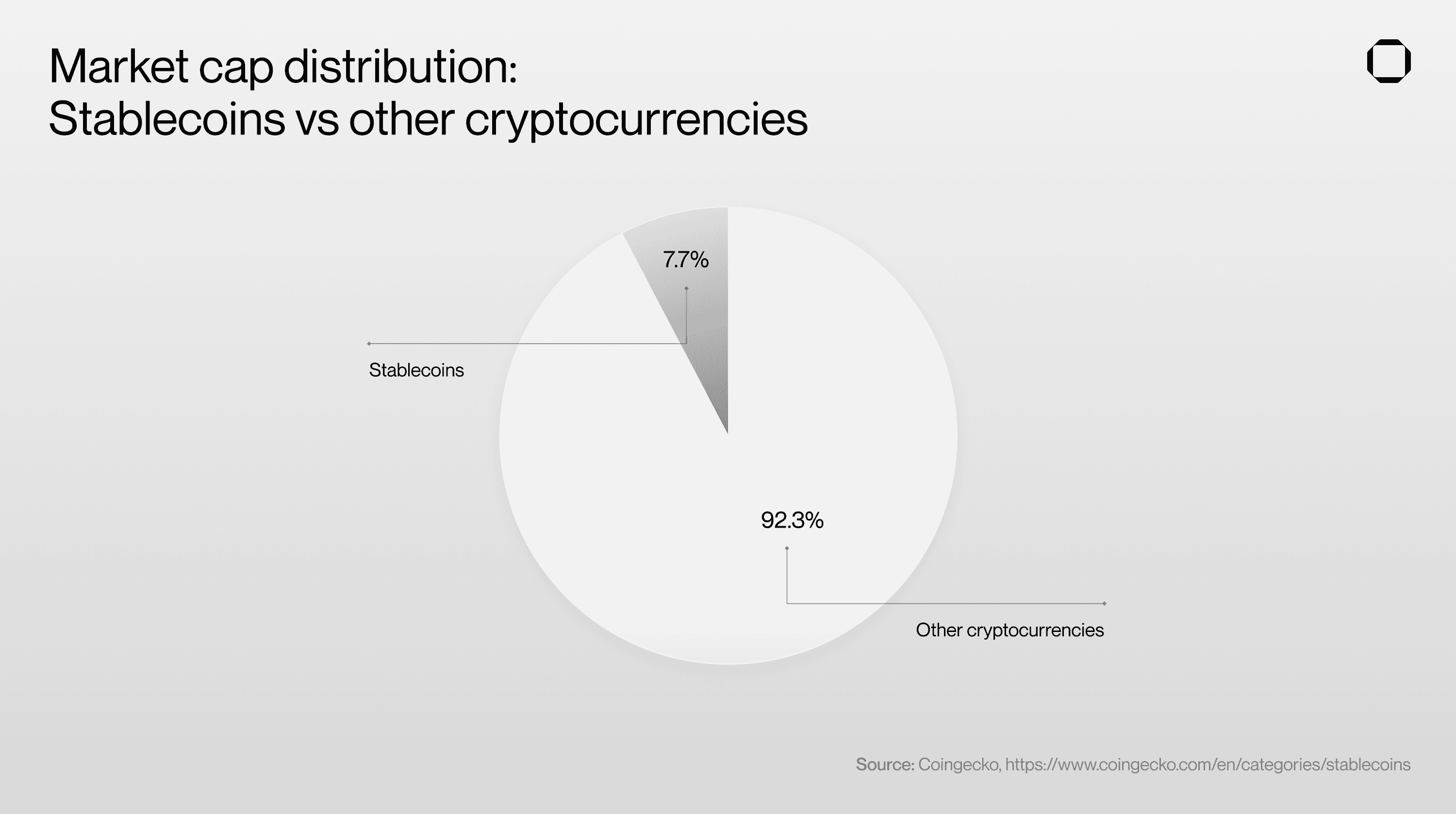

As of October 2024, the total market capitalization of stablecoins has reached approximately $178B [6]

The strong demand for digital stable assets is clear, with stablecoins making up nearly ~8% of the total digital asset market.

There were more than $10.8 trillion of stablecoin transactions in 2023, or $2.3 trillion if excluding "inorganic" activity like bots or automated transactions [1]. This adjusted transaction volume is growing 17% year-over-year, faster than any other payment network [7]. According to research from Coinbase, when “adjusted for ‘inorganic activity,’ stablecoins last year processed about a fifth of Visa’s volume in payments, over a quarter of Mastercard’s, and more than double that of Stripe’s [8], which represents massive growth for stablecoin adoption since their inception” [7].

Fiat-backed stablecoins dominate the market

Many stablecoin designs exist; our research, however, exclusively focuses on fiat-backed stablecoins, typically pegged to the U.S. dollar. Prominent examples include Tether (USDT) and USD Coin (USDC). Fiat-backed stablecoins dominate the market, with USDT alone holding over 75% market share among stablecoins [6]. They are also the only type of stablecoin widely used in EMDEs and accepted as money through emerging regulatory frameworks. For this reason, when we refer to stablecoins, we refer to fiat-backed stablecoins from here on out.

Stablecoins are the future of money

In their brief 10-year history, stablecoins have demonstrated remarkable growth and adoption, particularly in emerging markets and developing economies where they address acute financial needs. Their role is especially significant in countries experiencing local currency depreciation or banking instability, where stablecoins provide a stable store of value and efficient transaction means. As we explore the multifaceted applications of stablecoins, it becomes evident that these digital assets are not merely a temporary phenomenon but a fundamental component of the future financial landscape.

Section I: Stablecoins as currency hedges

Traditional hedges vs. stablecoins

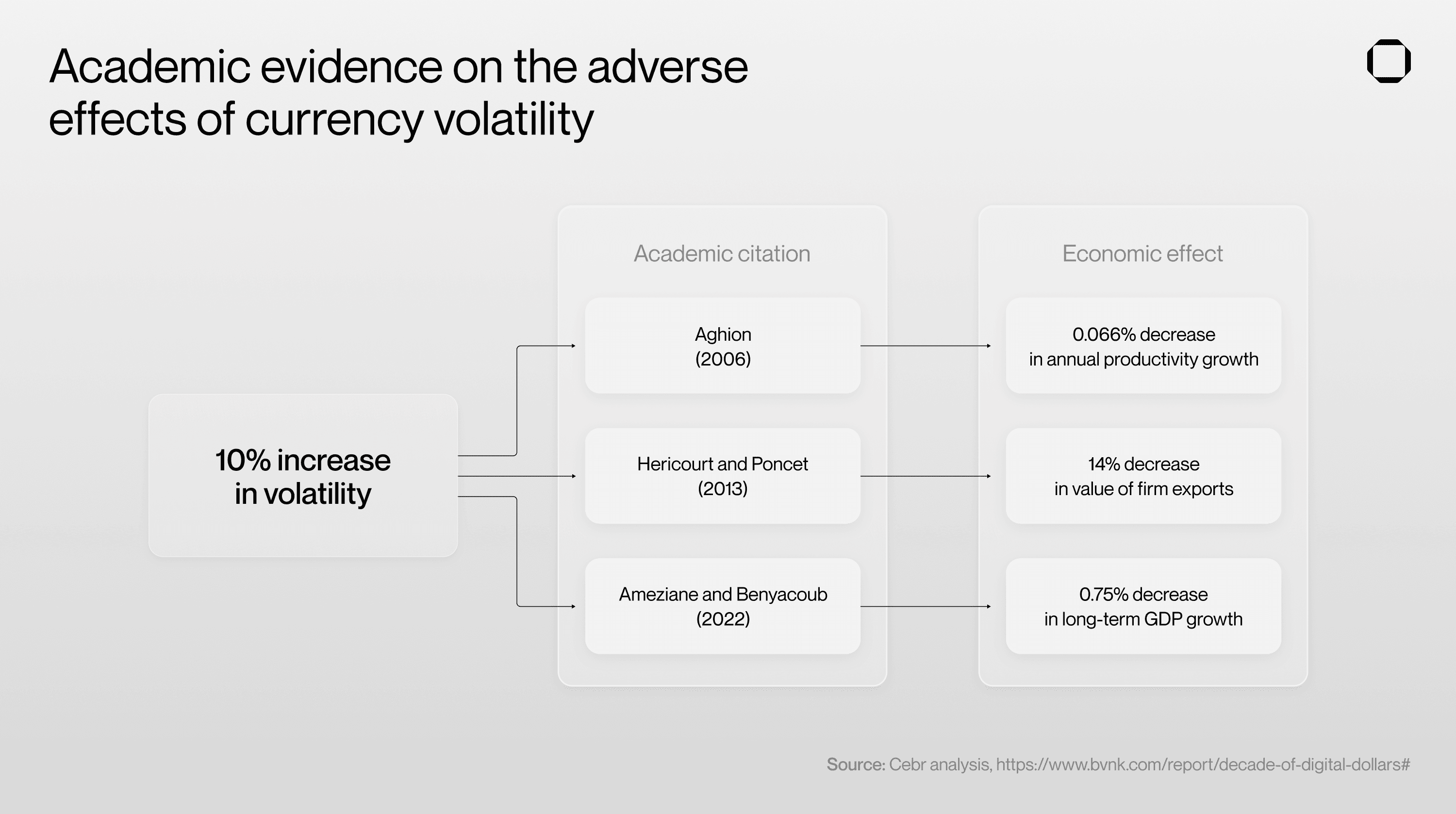

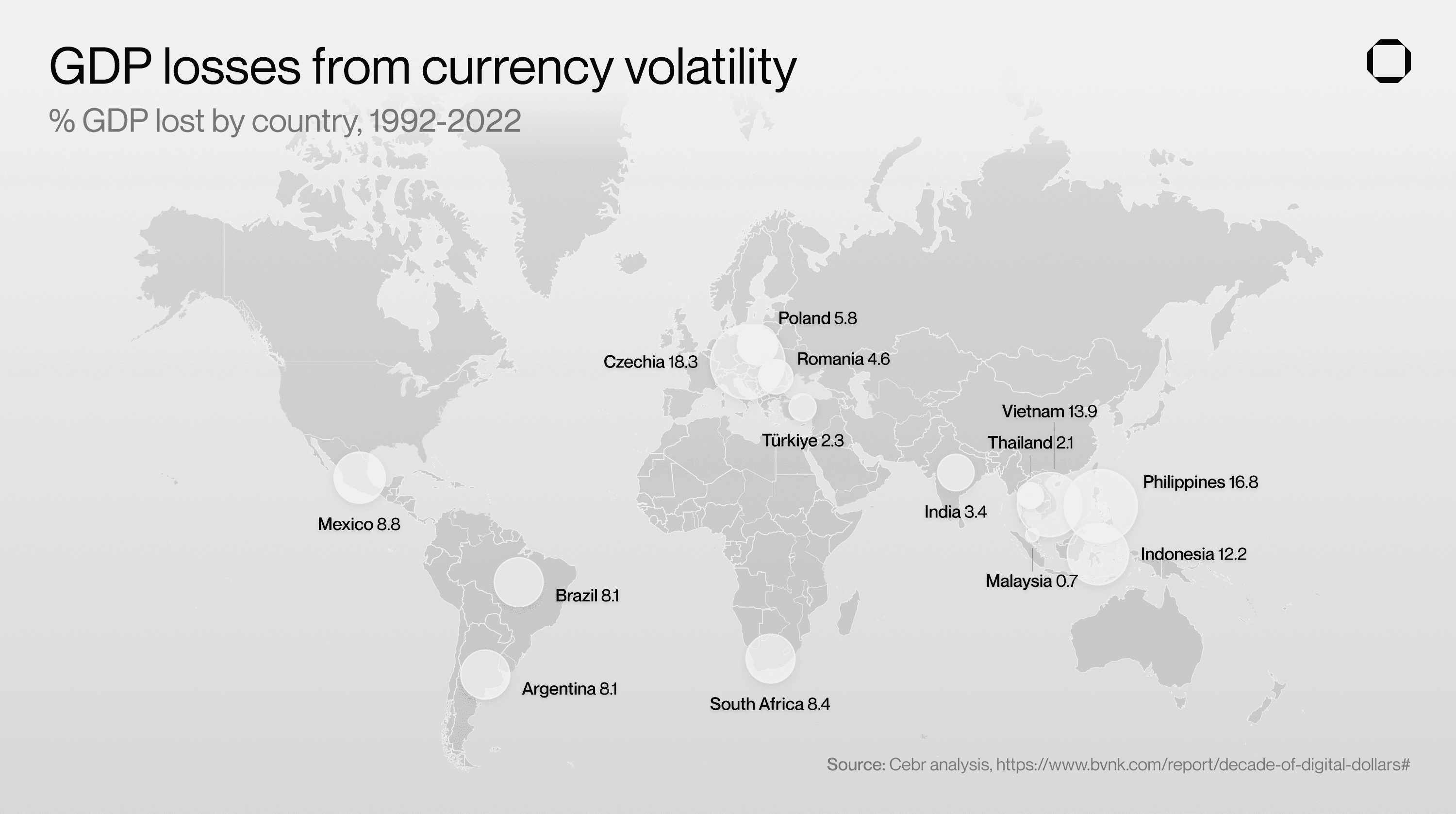

Total cumulative and aggregate GDP losses due to long-term currency volatility in key EMDEs are at least $1.2 trillion, or 9.4% of GDP on average [9]. GDP losses since 1992 are particularly significant in Indonesia ($184B) and Brazil ($172B) [9].

Traditionally, businesses and individuals in these economies have relied on various methods to hedge against currency devaluation, such as holding foreign currencies (particularly U.S. dollars) or precious metals. However, these methods often come with limitations, such as difficulty in storage, transferability, and accessibility.

Instability drives stablecoin adoption in EMDEs

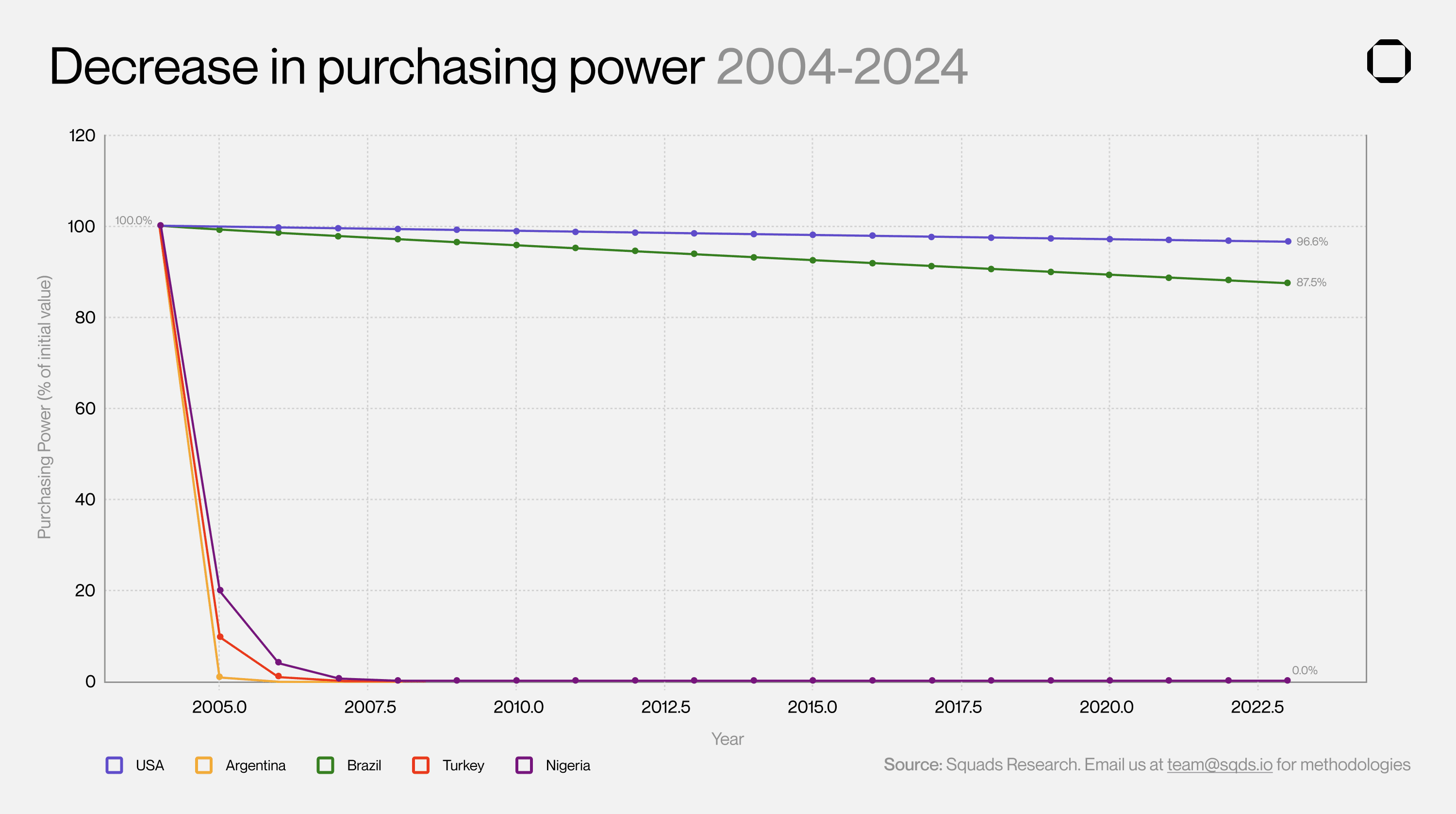

While the U.S. dollar's purchasing power has decreased in the last century, currencies that experience hyperinflation decrease exponentially more.

For this reason, access to USD in any form is a lifeline for businesses and individuals in areas experiencing hyperinflation or cut off from formal banking. Available data indicates a strong correlation between political or economic turmoil and increased demand for dollars/stablecoins [12]. Stablecoin adoption in EMDEs currently comes purely from citizens' and businesses' organic demand; as of yet, no sovereign nation has accumulated stablecoins in its national treasury.

Unlike traditional hedges like physical U.S. dollar notes, stablecoins are more accessible and efficient for making international payments and engaging in the growing digital economy. Stablecoins are also cheaper for international remittances, a market that will surpass $1T by 2029 [13]. Remittances are a major form of income for EMDEs, and empirical research shows that they are one of the most effective ways to bolster local economies [14]. Coinbase estimates that over $12B annually could be saved in remittance fees using stablecoins instead of traditional wires [14].

Furthermore, remittance access positively correlates with decreases in illicit capital outflows from countries with stricter currency control [15].

There is so much increased EMDE demand for stablecoins that there now exists a “stablecoin premium”: research from The Centre for Economics and Business Research (Cebr) identified that businesses and individuals within EMDEs are willing to pay, on average, 4.7% more than the standard U.S. dollar price for stablecoins, rising to 30% in countries like Argentina [9].

As of 2024, EMDEs will pay ~$4.7B in premiums to access stablecoins, with total premiums rising to $25.4B by 2027 [9]. These findings suggest that providers offering access to stablecoins in EMDEs without such premiums have a significant chance of winning substantial market share.

Case studies of stablecoin usage in high-inflation economies

Several EMDEs have seen significant adoption of stablecoins as a hedge against inflation [9]. All data and visuals in this section come from Cebr.

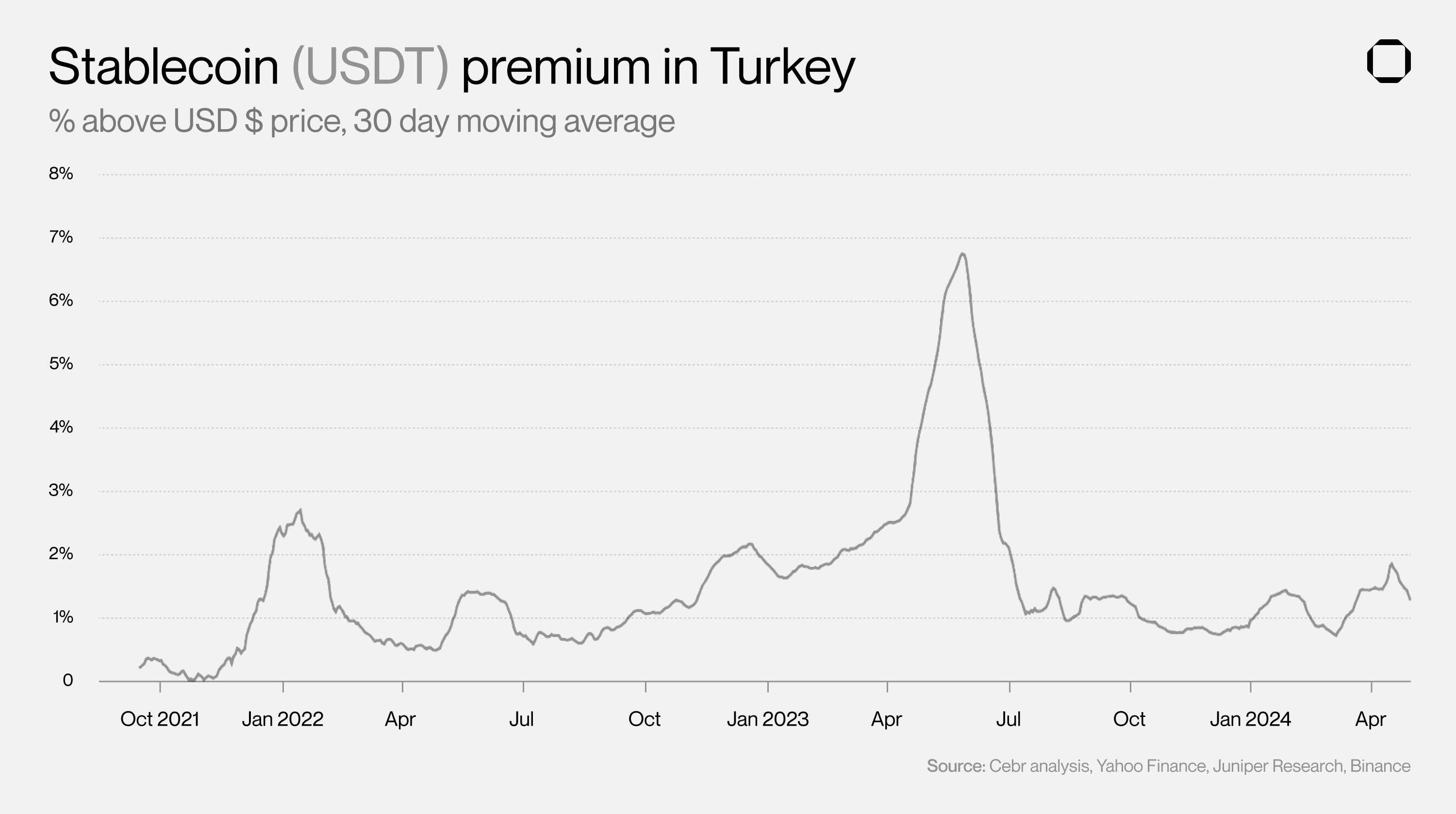

Turkey

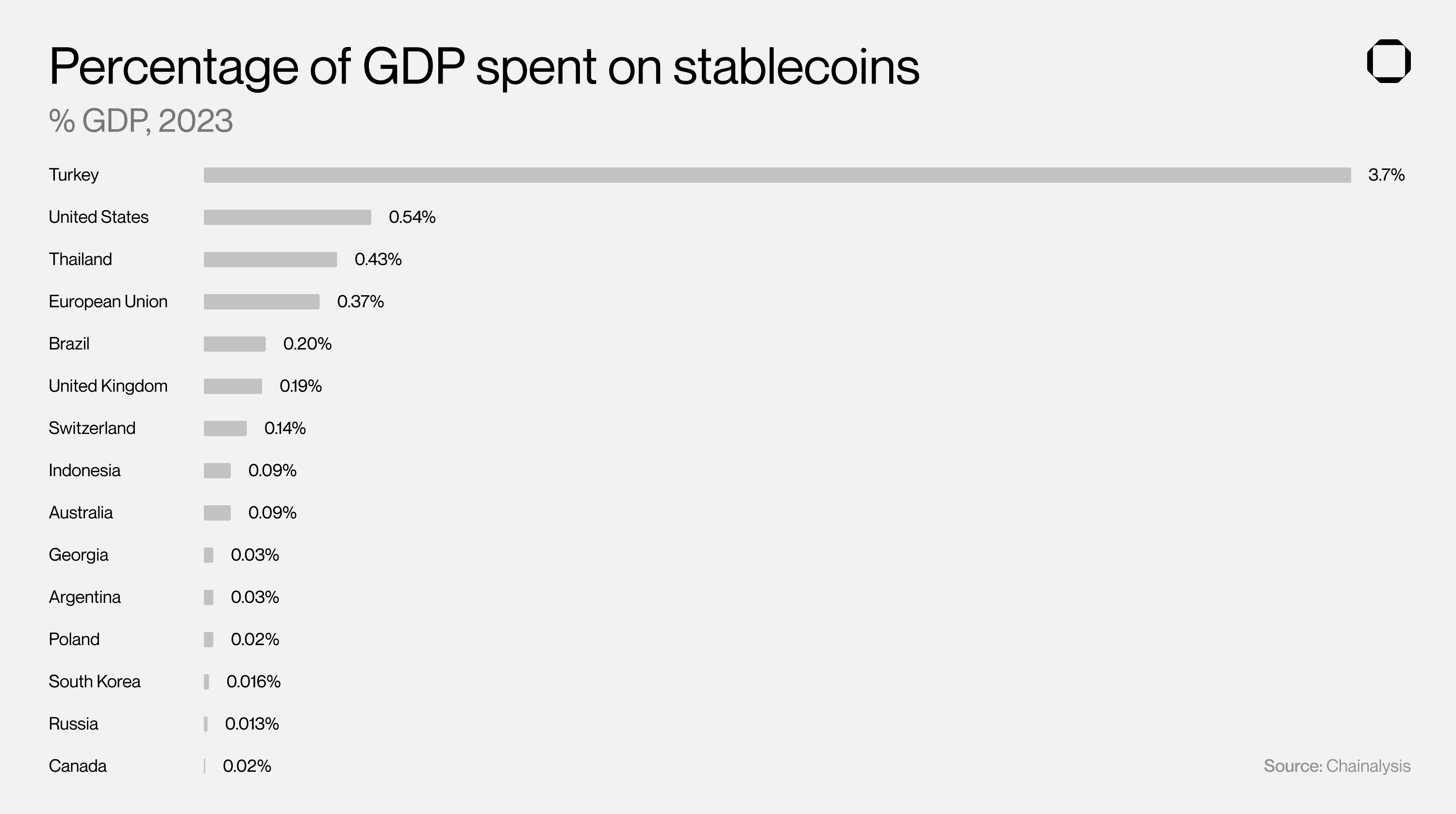

Turkey has one of the highest rates of stablecoin purchases as a share of GDP, at 3.7%, and one of the highest cross-border stablecoin payment volumes, $63.1B in 2024 alone. This high adoption rate reflects the strong demand for stable assets in an economy grappling with currency instability. Turkey's strong adoption and availability of stablecoins and the loosening of FX controls post-election (2023) have reduced local stablecoin premiums. Despite reduced premiums and less restrictive currency controls, regional demand for stablecoins remains strong, which may indicate that stablecoins have become mainstream in Turkey.

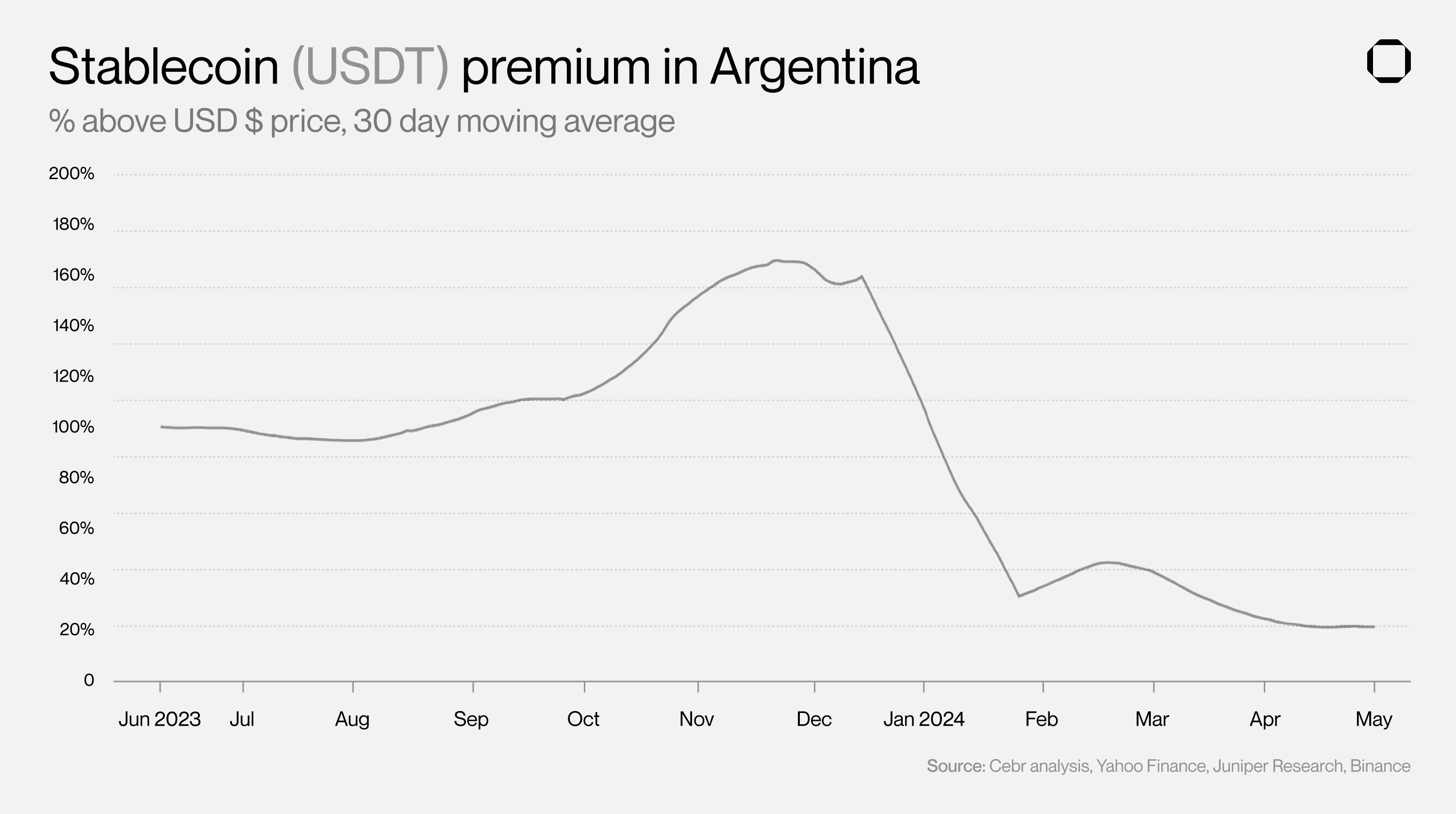

Argentina

Argentina has a long history of economic instability and currency crises. The Argentine peso (ARS) has lost over 90% of its value against the USD since 2019. In December 2023, newly-elected president Javier Milei devalued the ARS by over 50%, which, along with other cost-cutting measures, has led Argentina to experience a fiscal surplus for the first time since 2012 [16] and led to a temporary reduction of the local premium paid for stablecoins.

Milei’s policies have been a boon for the local economy and have also led to a dramatic reduction in ARS inflation month-to-month. However, the current inflation rates of the ARS surpass 250% normalized to global annual inflation rates. Despite Milei’s economic policies, the continuation of relatively high premiums exemplifies the strong demand for stablecoins and the difficulties Argentinians face in accessing USD through conventional channels.

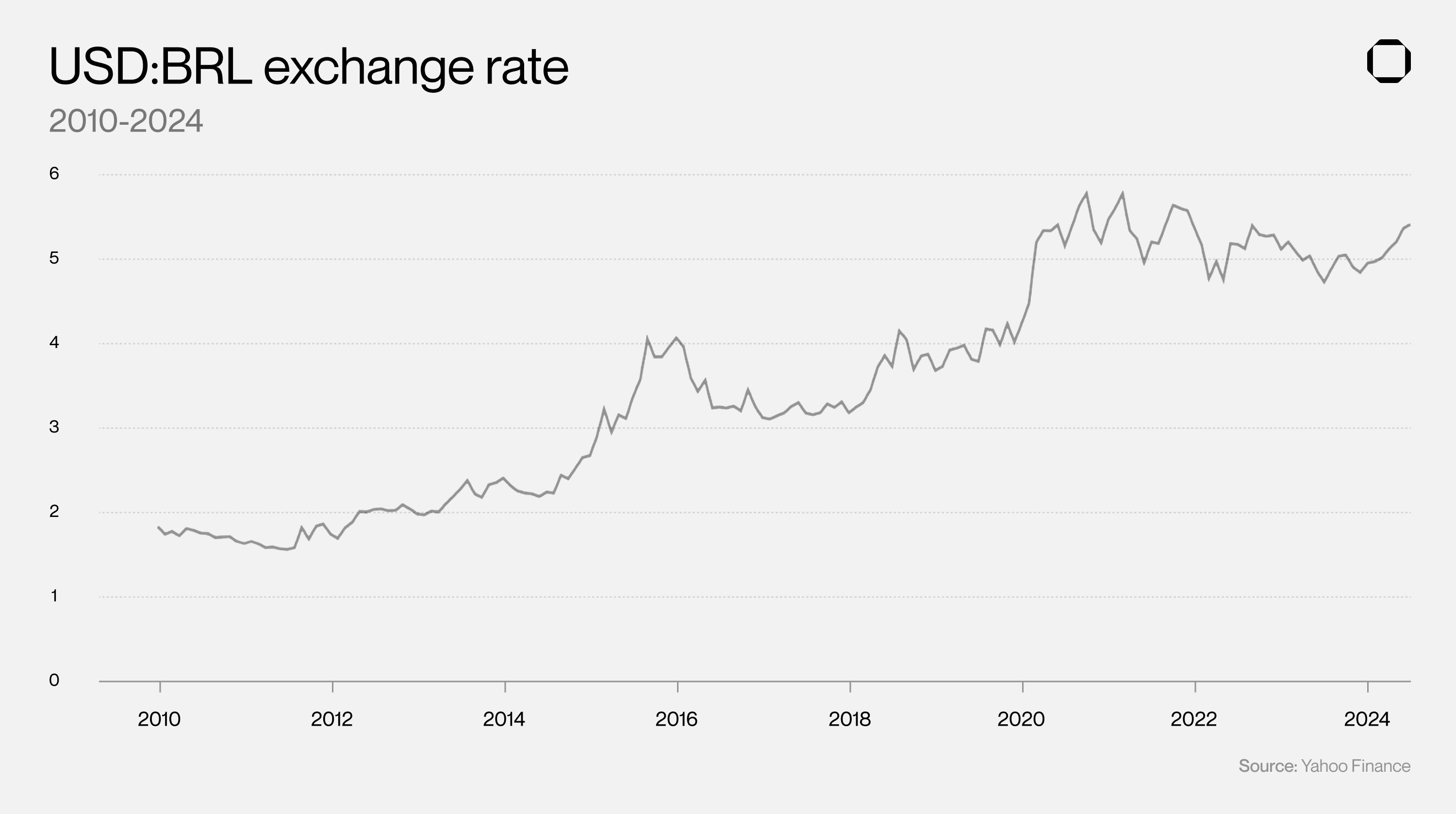

Brazil

While not experiencing the extreme inflation of Argentina or Turkey, Brazil has also seen significant stablecoin adoption. The country has experienced $12B in cross-border stablecoin payment outflows in 2024 and a stablecoin purchase rate of 0.20% of GDP, indicating a growing interest in these digital assets as a hedge against potential currency instability.

Nigeria

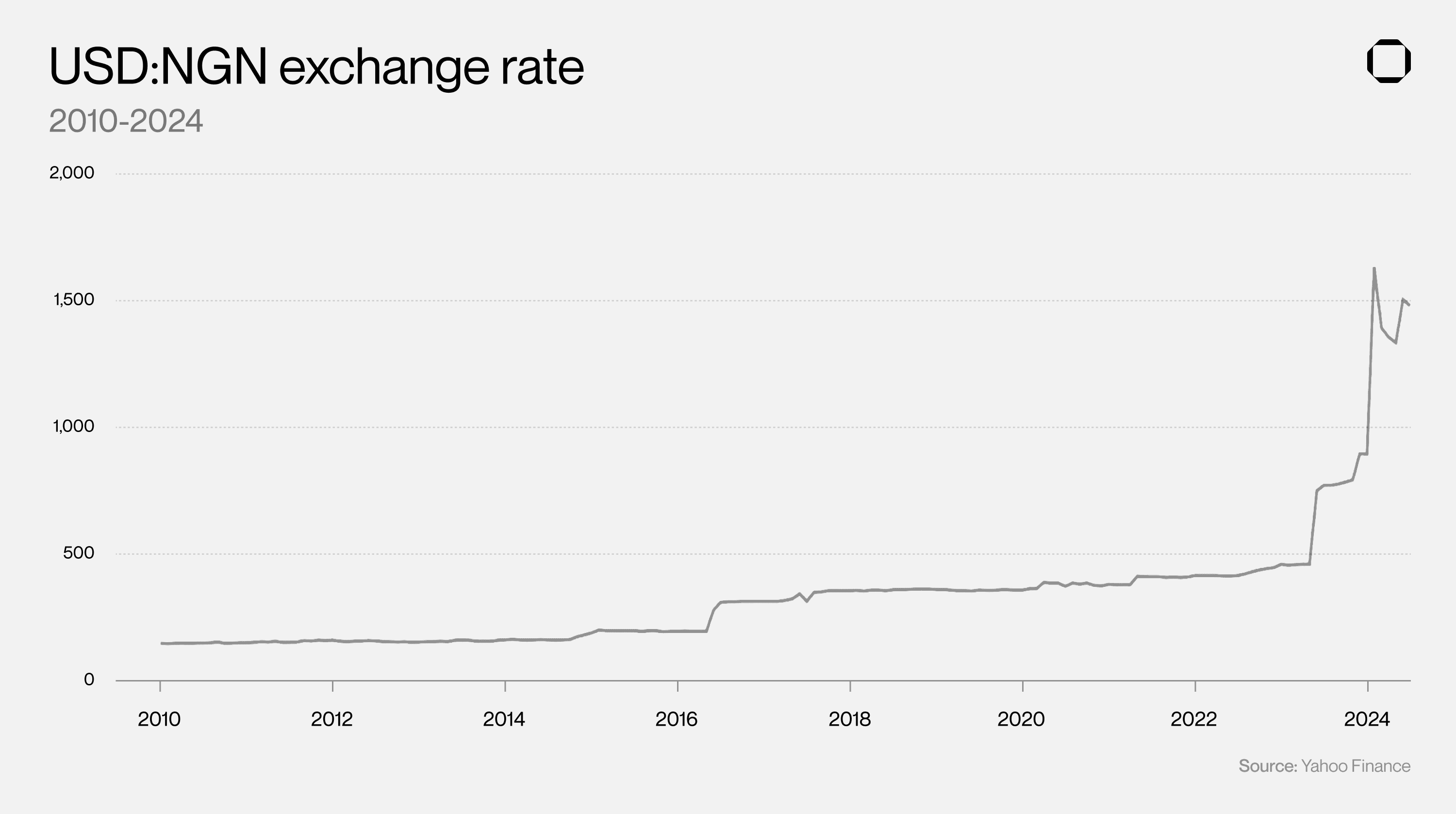

Nigeria has faced multiple currency devaluations and forex restrictions in recent years, with the exchange rate of NAIRA:USD fluctuating between -5 and 125%. Nigeria has the highest volumes of USDT (Tether) on the TRON blockchain, reflecting the demand for stablecoins in unstable economies. TRON's local domination also highlights that different blockchains are inherently accepted or promoted in various regions, leading to regional domination for chains like TRON, Solana, Polygon, etc.

Economic shocks [16] and political instability [17] will likely increase in the coming years, increasing demand for stablecoins as inflationary hedges within EDMEs. The IMF reports that higher political instability, ideological polarization, and political fragmentation are associated with higher inflation and local currency volatility [18]. Furthermore, political instability can reduce a nation’s GDP by 4–7% [19]. A symbiotic relationship is emerging between stablecoins and political and economic instability, and we can expect the proliferation of stablecoins as hedges against inflation to continue for the foreseeable future.

However, independently issued stablecoins require broader market acceptance to serve as mainstream currency. Only a small fraction of users in EMDEs use stablecoins for everyday transactions, except in Turkey, where locals spend 3.7% of GDP to purchase stablecoins annually [9]. The number of daily users of stablecoins in EMDEs will likely grow as new stablecoins emerge, on- and off-ramps increase in quality, and local premiums are reduced.

Section II: Regional trends and state-driven adoption

The second section of this report analyzes regional and state-driven trends in stablecoin adoption.

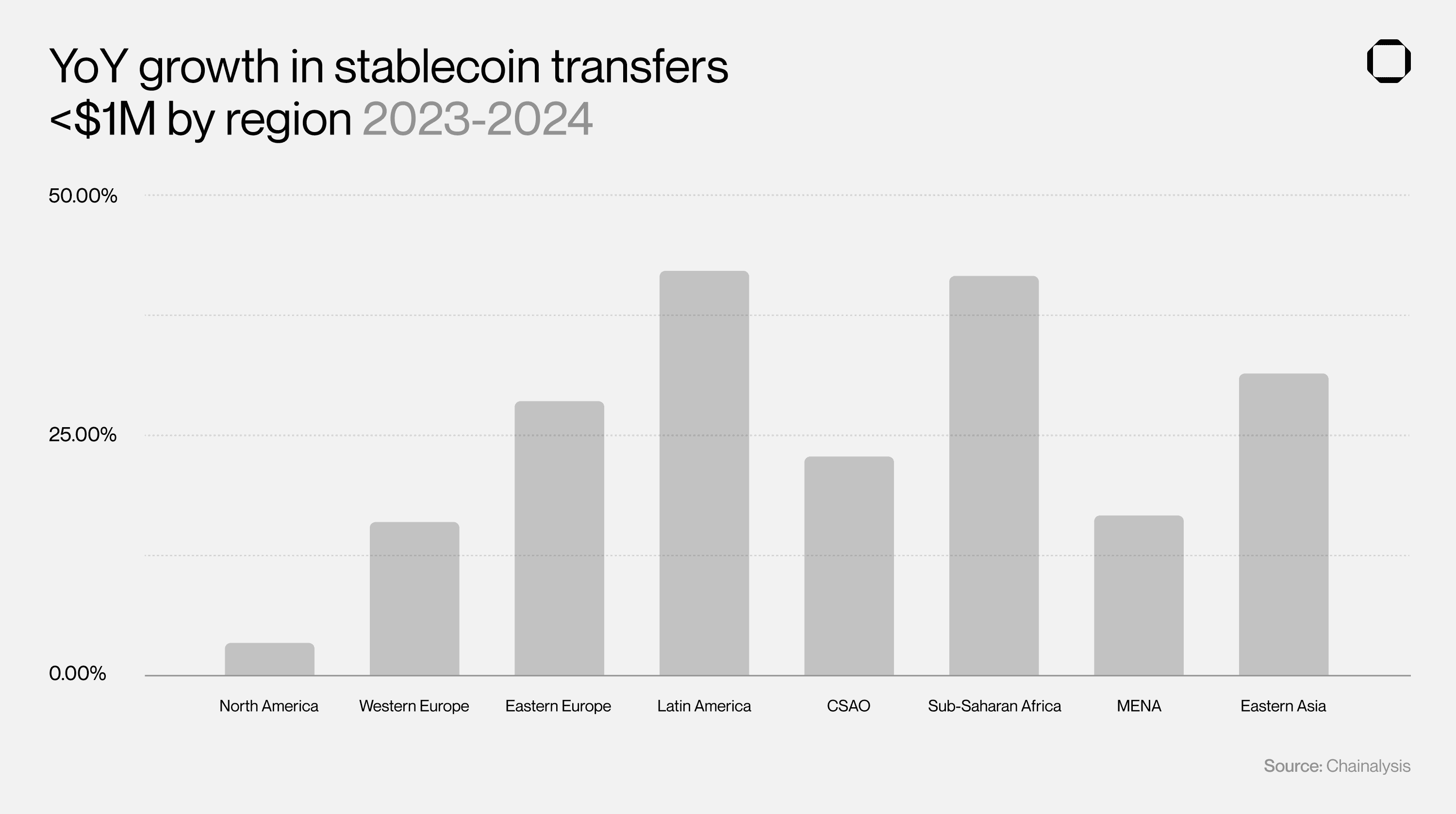

Regional adoption of stablecoins

Data shows that in 2024 stablecoin usage grew exponentially in Latin America, Sub-Saharan Africa, and Eastern Asia relative to volatile assets like BTC [20]. USDT on TRON has grown particularly in EMDEs, where stable currencies are difficult to access. In contrast, USDC is more broadly used in countries with stable currencies and clear stablecoin regulations.

USDT: Adoption in EMDEs and sanctioned regions

USDT is the largest stablecoin by market capitalization, with roughly 50% of its supply on the TRON blockchain [21]. As of 2024, USDT represented more than 99% of the total transfers made by the top 10 smart contracts on TRON [22]. According to a report from CryptoQuant, it is likely that retail users drive TRON USDT adoption:

“[...] the median transaction value of USDT on TRON is consistently lower than on Ethereum, indicating that TRON is widely used by retail users for smaller transactions. This broad user base drives high transaction volumes and liquidity, enhancing TRON’s role as a cost-effective solution for remittances, micropayments, and peer-to-peer transfers.”

More than 52 million addresses on TRON hold less than $1000 USDT, and over five million weekly transactions involve USDT less than $100 [22].

USDT on TRON has seen significant adoption in regions with limited access to traditional banking services. For example, following Lebanon's severe economic crisis in late 2019, local TRON-based USDT transactions increased substantially [23, 24]. Similarly, the TRON network and its USDT implementation have gained notable usage in countries facing international banking restrictions, such as Iran and Russia [25].

In 2022, major Russian banks were removed from the SWIFT network after the Ukrainian invasion, leading to an estimated 5% reduction in Russian GDP [26]. Since then, several Russian banks have begun to accept stablecoins like USDT [27]. In September 2024, new laws were enacted in Russia permitting the usage of cryptocurrencies and stablecoins. Consequently, several local services now allow Russian businesses to conduct international transactions and imports/exports using USDT as collateral [27]. Russia’s adoption of USDT exemplifies how sanctions accelerate state-driven acceptance of stablecoins.

Unfortunately, USDT on TRON is also widely used by crime syndicates [27] and terrorist organizations like Hezbollah and Hamas [28]. According to TRM Labs, there has been a “significant increase in the use of the Tron (TRX) blockchain among terrorist groups and associated fundraising campaigns, with some using it exclusively. [Most] of those actors used Tether (USDT) addresses to collect donations” [28].

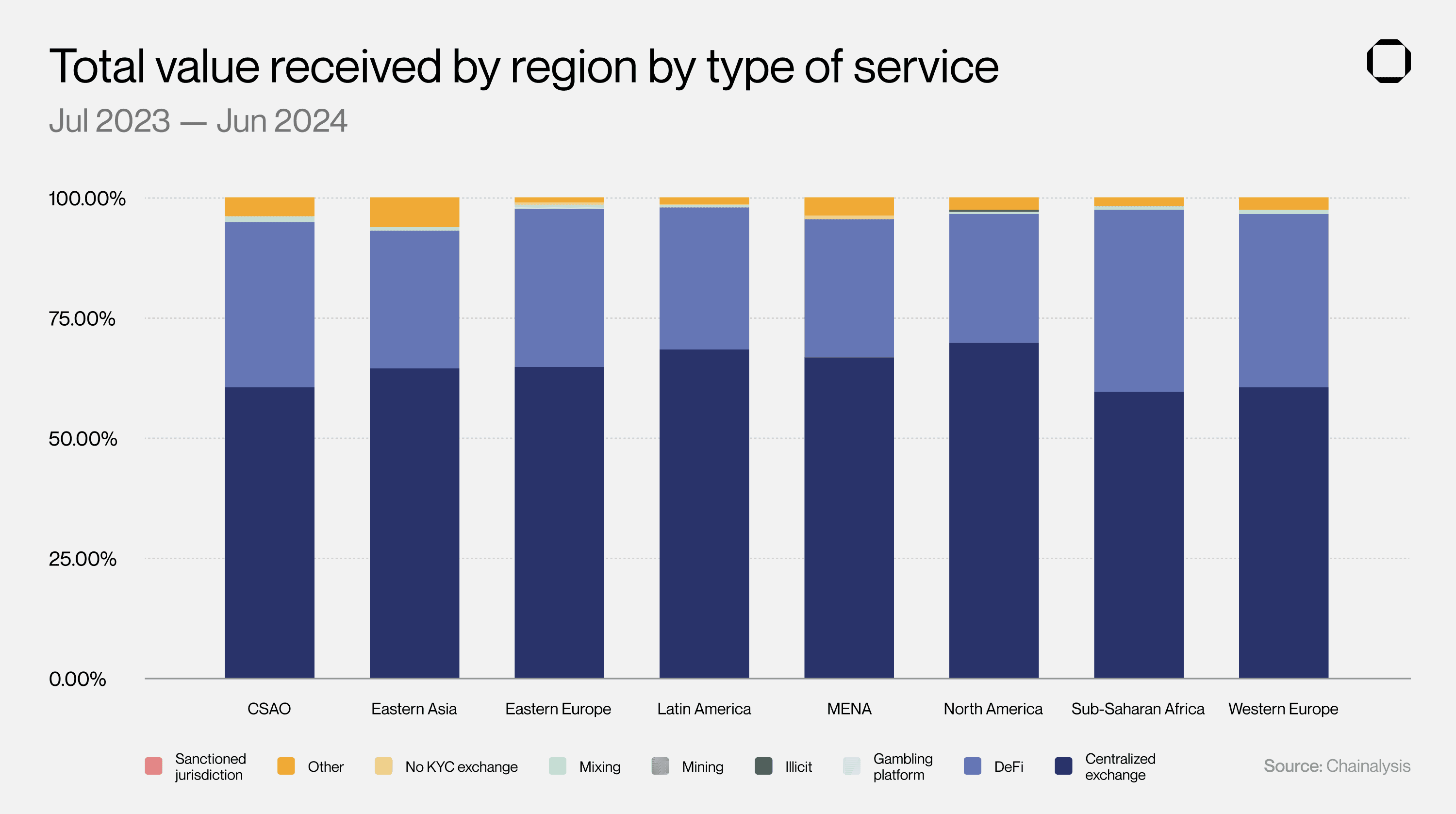

While stablecoins are used for illicit activities, the total amount of stablecoins and cryptocurrencies used for such funding is negligible compared to the total market, as visualized below [20].

Unlike fiat currencies, which can be laundered and obfuscated through regulated channels like banks, the actual payment flows of USDT to terrorist organizations are all available onchain and are negligible compared to the total USDT marketcap. In contrast, the United Nations estimates that somewhere between $773 billion and $1.7 trillion are lost annually through money laundering via regulated banks [29].

Tether has not been able to prevent all illicit usage of USDT; however, the company has collectively frozen $1.86B of illicit USDT since its inception [30]. In 2023, Tether froze hundreds of millions of USDT from wallets listed on the U.S. Office of Foreign Assets Control’s (OFAC) Specially Designated Nationals (SDN) List [31]. Furthermore, in September 2024, TRON, USDT, and TRM Labs established the T3 Financial Crime Unit (T3 FCU), a “first-of-its-kind initiative aimed at facilitating public-private collaboration to combat illicit activity associated with the use of USDT on the TRON blockchain.” [32] Since its inception, the T3 FCU has already frozen over $12M of illicit funds [32]. Tether works proactively with law enforcement agencies to freeze USDT when appropriate, indicating that stablecoins are a technology for reducing illegal payments.

Circle: Developing the fastest-growing regulated stablecoins

While USDT has found product-market fit in countries cut off from the global money supply, Circle, the company behind USDC and EURC, is taking a different approach. It focuses on compliance and regulation within countries where access to stable currencies is less of an issue.

Major governments regulate Circle’s stablecoins, including the United States, the European Union, and Singapore [33]. For this reason, USDC and EURC are the preferred choice for institutions that wish to hold stablecoins. USDC, with a current market cap of $35B, was the fastest-growing major stablecoin in 2024, growing over 45% [34]. Circle’s EURC, backed by EUR, and USDC were among the first stablecoins licensed under the European Union’s Markets in Crypto Assets (MiCA) regulations [35]. In October 2024, EURC hit an all-time high market capitalization of $99M [37], showing increased demand for non-dollar-denominated stablecoins.

Tether’s USDT, and its EUR-backed counterpart EURt, are non-MiCA compliant; USDT will be delisted on major exchanges like Coinbase Europe by December 2024, which will significantly impact USDT’s growth [38]. Tether is reportedly working on a MiCA-compliant solution for its offerings [39].

In 2023, USDC experienced a significant depeg from the U.S. dollar after Signature and Silicon Valley Bank (SVB), two banks holding roughly 8% of the USDC treasury, were declared bankrupt [40]. Circle froze the redemption of USDC for dollars through its native platform. Fortunately, both Signature and SVB were Federal Deposit Insurance Corporation (FDIC) members.

To avoid economic fallout, the FDIC guaranteed all deposits at both bankrupt banks for their depositors—including deposits above the FDIC standard of $250,000 per customer [40]. Because Circle chose to hold its assets within regulated U.S. banks, USDC did not suffer a prolonged depeg and was soon redeemable 1:1 for dollars through Circle. Rather than a sign of USDC weakness, this government “bailout” is a sign of Circle’s regulatory strength and shows the increased interplay between sovereign nations and independent stablecoin issuers.

Treasury-backed stablecoins are a net good for the U.S. economy

U.S. dollar domination

While there are other regional stablecoins pegged to currencies other than the dollar, like BRZ (Brazilian) and ARZ (Argentinian) stablecoins from Transfero, EURC from Circle, or the Tanzanian Shilling stablecoin (TZS) from ClickPesa [41], their combined market share is less than 1% of the total market cap of stablecoins [42], indicating that the U.S. dollar dominates stablecoin market share.

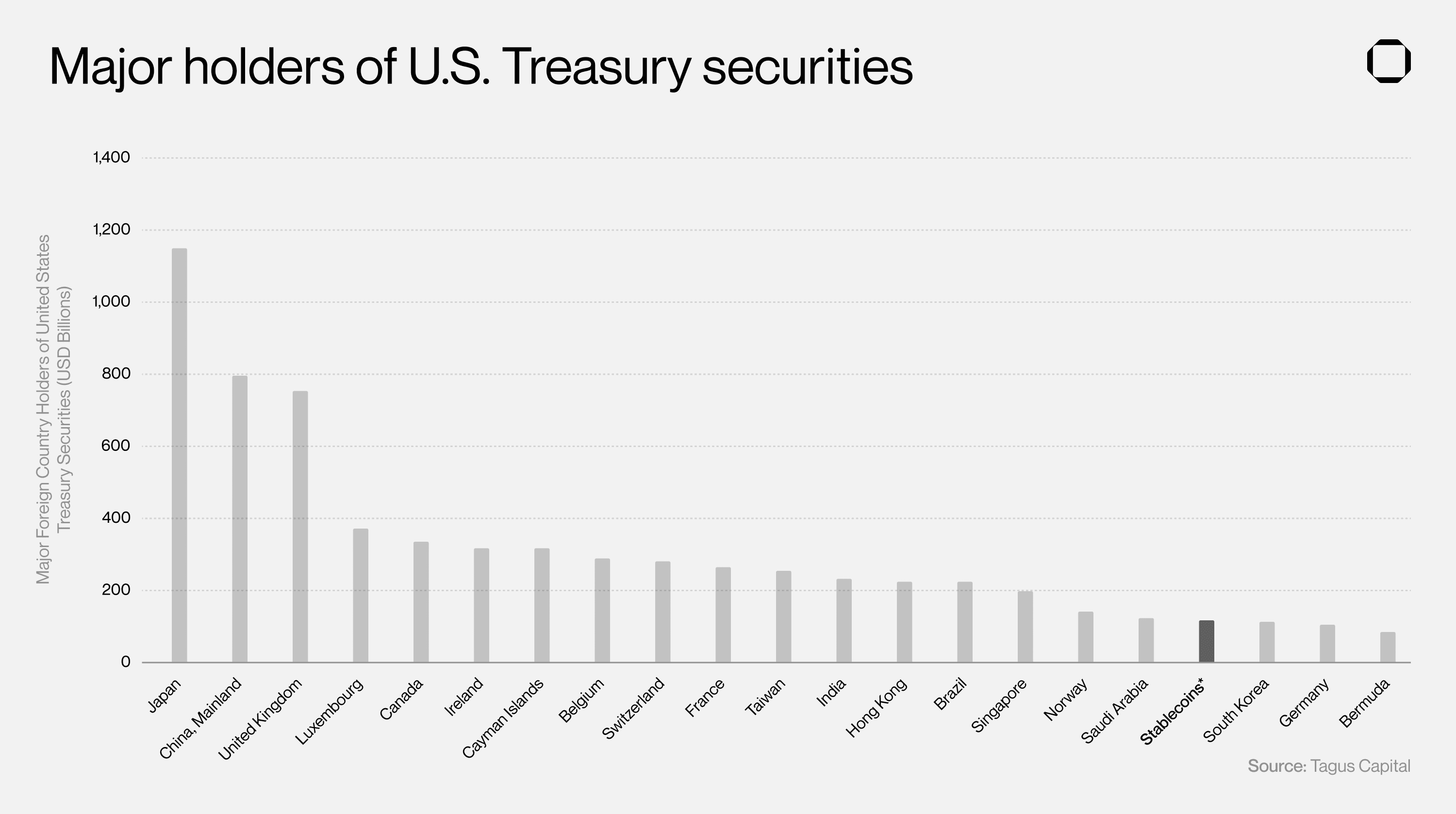

Independent stablecoin issuers are collectively the 18th largest holders of U.S. debt [43].

Tether alone holds over $80B in U.S. treasuries, providing the U.S. with significant capital to pay off its growing debt [44]. Last year, Circle responded to potential U.S. debt default by cutting off all treasuries backing USDC [45] but is now revamping its purchases. While total stablecoin ownership of U.S. debt represents only 1% of total treasuries circulating[44], the growth of Tether and Circle will theoretically result in an increasing amount of debt owned by these stablecoin issuers via treasury holdings.

The Treasury Borrowing Advisory Committee of the U.S. also takes this stance. In October 2024, the U.S. Treasury released a report stating that “growth in stablecoins has resulted in a modest increase in demand for short-dated Treasuries,” with over $120B of stablecoin collateral invested in such Treasuries [46].

Central bank development of stablecoins

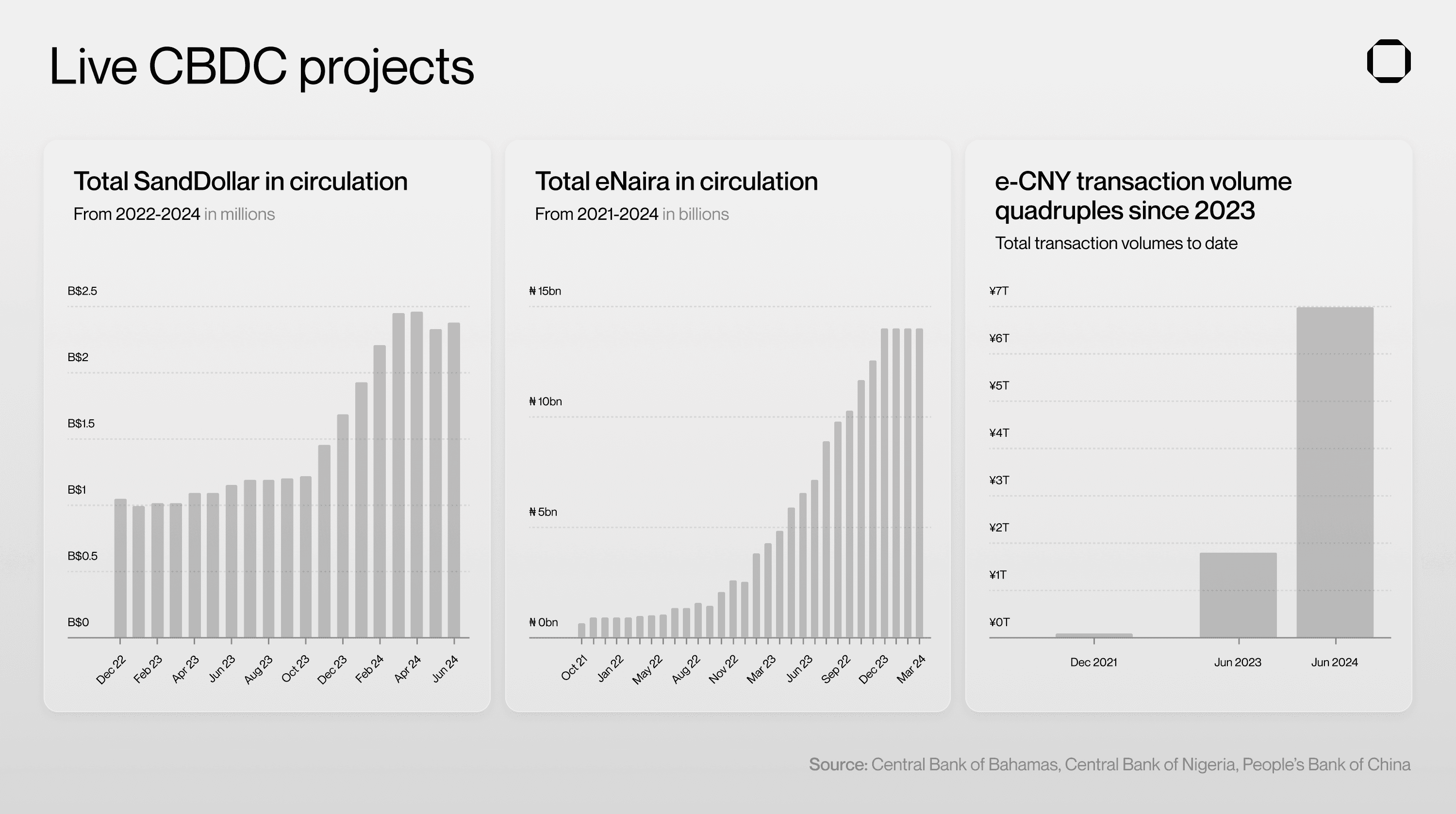

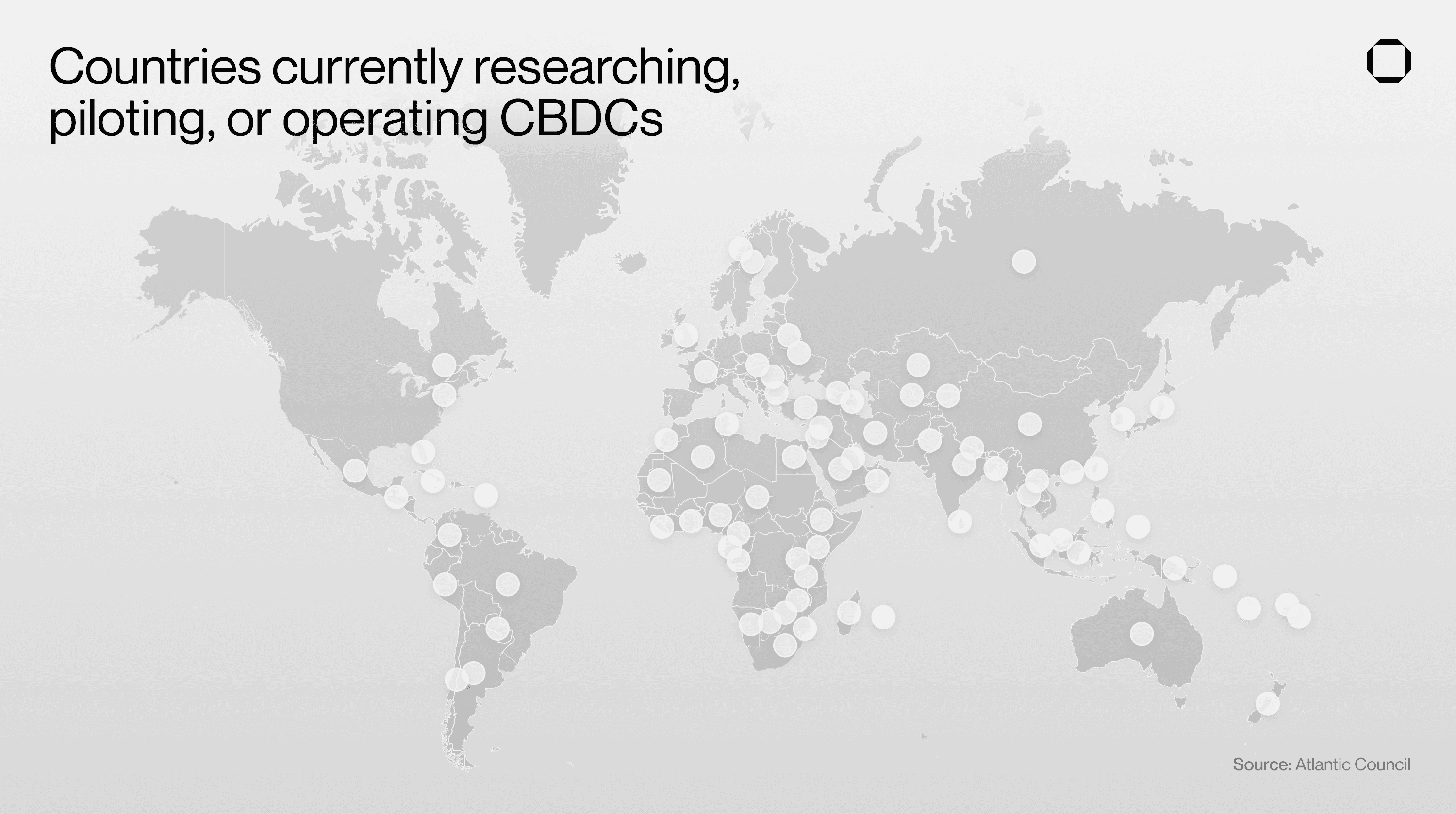

In addition to independent stablecoin issuers, many governments are exploring and developing Central Bank Digital Currencies (CBDCs). These CBDCs are stablecoins designed with different levels of intended interoperability with public and private blockchain networks.

Governmental adoption of stablecoins

Governments and institutions are exploring and implementing stablecoins, often citing compliance, speed, and anti-money laundering considerations.

According to the Atlantic Council, every G20 country is exploring a CBDC, with 19 of them in the advanced stages of exploration; the Digital Yuan (e-CNY) is the largest CBDC pilot in the world, with over $986B in volume [47].

CBDC pilots are accelerating; for instance, the U.S. is now participating in a cross-border wholesale CBDC project, Project Agorá, with six other major central banks to test the efficiencies of a digital dollar [47]. Some other examples include the Central Bank of the United Arab Emirates, which just gave preliminary approval to the development of a stablecoin pegged to the Dirham (AED) [48], the European Union, which is officially researching a Digital Euro [49], and the United Kingdom, which has released a regime and sandbox program for stablecoin development [50].

A common thread in CBDC design is the clear guidelines laid out for international interoperability not only for digital currencies from central banks but also for independent stablecoin issuers who wish to remain compliant and benefit from this new paradigm of digital fiat.

The Bank for International Settlements (BIS) has laid out clear guidelines for how independent issuers can design stablecoins to be compliant and compatible with the era of CBDCs [50], as has the United Kingdom. Such regulatory clarity indicates a future where CBDCs and independent stablecoins work seamlessly together, benefiting from built-in compliance and enhanced settlement speed, thus simplifying the process of international money movement.

Stablecoins will effectively be the future of state-issued currencies and, thus, the future of money.

Conclusion

There is a direct correlation between political and economic instability and stablecoin adoption. Such instability may increase demand for stablecoins, often backed by U.S. securities. This creates a virtuous cycle where the U.S. Treasury sells bonds to stablecoin issuers to meet the needs of their users. As such, the longevity of the U.S. dollar as the world reserve currency benefits from global stablecoin adoption, especially as geopolitical instability continues to rise.

Governments can no longer ignore the benefits of stablecoin technologies. Every major government in the world is exploring or developing its own CBDC. These CBDCs will likely be connected to public and private blockchains, payment networks, and independent stablecoins in the coming years. As regulatory clarity around stablecoins increases, the small fraction of stablecoins used for illicit payments will likely decrease further. Stablecoins are a technology for reducing corruption, not growing it. The utility and programmability of stablecoins suggest a future interconnected financial system where money can move seamlessly across any border.

If you enjoyed this research, please follow us at x.com/SquadsProtocol for future reports. Our next research report will analyze stablecoin's impact on cross-border transactions and payment interoperability.

References

[1] CPMI (2023). Considerations for the use of stablecoin arrangements in cross-border payments – October 2023.

[2] Tether (2023). Tether Official Website – October 2023.

[3] Mirela Ciobanu (2024). The road ahead: Towards seamless payment interoperability.

[4] Deltec Bank (2023). The History of Stablecoins – October 2023.

[5] Statista (2023). Stablecoin Market Capitalization – October 2023.

[6] CoinMarketCap, October 2024.

[7] David Duong (2024). Stablecoins and the New Payments Landscape.

[8] Stripe (2023). 2023 Annual Update – October 2023.

[9] Cebr (2024). The decade of digital dollars: Unlocking economic efficiency with stablecoins – July 2024.

[10] World Bank (2023). Global Inflation – October 2023.

[11] CEMLA (2023). Stablecoins in Latin America and the Caribbean – October 2023.

[12] Financial Stability Board (2023). Global Regulatory Framework for Crypto-Asset Activities – October 2023.

[13] Yahoo Finance (2023). Global Remittance Industry Report 2024 – October 2023.

[14] Coinbase (2023). Crypto Could Help Save Billions of Dollars in Remittance Fees – October 2023.

[15] World Bank (2023). What Types of Capital Flows Help Improve International Risk Sharing – October 2023.

[16] Plummer, R. (2024). Have Milei's First Six Months Improved the Argentine Economy? – October 2024.

[17] World Economic Forum (2024). IMF, BIS Warn Economic Shocks and Other Economy Stories – October 2024.

[17] Atlantic Council (2023). Our World Transformed: Geopolitical Shocks and Risks – October 2023.

[18] Coface (2023). Social & Political Risk: What to Expect in 2024 – October 2023.

[19] Dirks, Maximilian; Schmidt, Torsten (2023): The relationship between political instability and economic growth in advanced economies: Empirical evidence from a panel VAR and a dynamic panel FE-IV analysis, Ruhr Economic Papers, No. 1000, ISBN 978-3-96973-166-6, RWI - Leibniz-Institut für Wirtschaftsforschung, Essen.

[20] Chainalysis (2024). The 2024 Geography of Crypto Report – October 2024.

[21] DeFiLlama (2023). Tether Stablecoin Data – October 2023.

[22] CryptoQuant (2023). The TRON Stablecoin Edge: Activity and Retail Payments with USDT – October 2023.

[23] DLNews (2023). Lebanon’s Crypto Underground: ‘We’ve Been Assaulted by Gunmen’ – October 2023.

[24] World Bank (2021). Lebanon Economic Monitor: Lebanon Sinking to the Top 3 – May 2021.

[25] Finbold (2023). Tron Overtakes BTC as Hamas and Hezbollah's Blockchain of Choice – October 2023.

[26] Foreign Policy (2022). SWIFT Sanctions, Ukraine, Russia, NATO, Putin, War, Global Finance – March 2022.

[27] Wall Street Journal (2023). Chinese Gangs Use Cryptocurrencies to Launder Billions – October 2023.

[28] TRM Labs (2023). Terrorist Financing: Six Crypto-Related Trends to Watch in 2023 – October 2023.

[29] Europol (2023). Money Laundering – October 2023.

[30] Tether (2023). Leading the Way in Financial Freedom: Law Enforcement and Being Safer Together – October 2023.

[31] CryptoSlate (2023). Tether Has Frozen $435 Million USDT for U.S. DOJ, FBI, and Secret Service – October 2023.

[32] TRM Labs (2023). TRON, Tether, and TRM Labs Establish First-Ever Private Sector Financial Crime Unit to Combat Crypto Crime – October 2023.

[33] Circle (2023). Redefining USDC Access in Asia Pacific: Circle Mint in Singapore – October 2023.

[34] Crypto Briefing (2023). Tether European Tech Solution – October 2023.

[35] Circle (2024). Q3 2024 Shareholder Letter – October 2024.

[36] CoinMarketCap (2023). Circle’s EURC Stablecoin Hits New Record Supply Amid L2 Growth – October 2023.

[37] James Hunt (2024). EURC stablecoin supply hits all-time high as market cap approaches $100 million – October 2024.

[38] Bloomberg (2024). Coinbase to Delist Non-Compliant Stablecoins in EU in December – October 2024.

[39] Crypto Briefing (2023). Tether European Tech Solution – October 2023.

[40] Protos (2023). How the US gov’t bailed out USDC stablecoin – October 2023.

[41] Pendulum Chain (2023). Regional Stablecoins: Catalyzing Financial Inclusion and Growth Outside of the USA – October 2023.

[42] CoinGecko (2023). Stablecoins by Market Capitalization – October 2023.

[43] Decrypt (2024). Stablecoin Issuers Now 18th Largest Holder of U.S. Treasuries, Says Bernstein – October 2023.

[44] Fidelity (2024). Fidelity Fixed Income. Tether Now Holds $81B In Treasury Bills, Aims For Further Growth – August 2024.

[45] CoinDesk (2023). Circle Restarts U.S. Treasury Purchases in BlackRock-Managed USDC Reserve Fund – October 2023.

[46] U.S. Department of the Treasury (2024). Combined Charges for Archives Q4 2024 – October 2024.

[47] Atlantic Council (2023). Central Bank Digital Currency (CBDC) Tracker – October 2023.

[48] Cryptonomist (2024). The Central Bank of the United Arab Emirates Gives Preliminary Approval to the Stablecoin on AED – October 2024.

[49] European Central Bank (2023). Digital Euro – October 2023.

[50] Bank of England (2023). Regulatory Regime for Systemic Payment Systems Using Stablecoins and Related Service Providers – October 2023.