Squads users can now access Maple’s Cash Management product through the SquadsX browser extension wallet and earn yield from U.S. T-Bills on their idle USDC treasury.

As Solana’s leading multisig solution, Squads enables teams and organizations to safely store their on-chain assets such as treasuries collectively with multi-signature security. It currently helps protect over $600 million in value and is used by the biggest Solana-based organizations, including but not limited to Pyth, Helium, Jito, Marginfi, Drift, Helius, Jupiter and more. SquadsX is the recently launched browser extension wallet of the Squads app, enabling users to connect their multisig to Solana dApps as they would with regular wallets.

Maple Finance is an on-chain capital marketplace that connects institutional and accredited investors with high-quality lending products. Recently launched in August 2023, Maple's Cash Management pool is a product targeting companies operating on Solana. It accepts deposits of USDC-spl and passes the 1-month U.S. Treasury Bill rate to lenders, minus fees totaling 0.5% annualized. There are no in or outbound fees and fees of 50bps are annualized and paid on interest earned.

Additionally, the Cash Management Solution offers immediate interest and next-day withdrawals. Interest starts accruing from the moment of deposit, conversely from other offerings in the market. There is no lock-up period and withdrawals are promptly serviced on the following U.S. banking day to ensure lenders can effectively manage their cash flows.

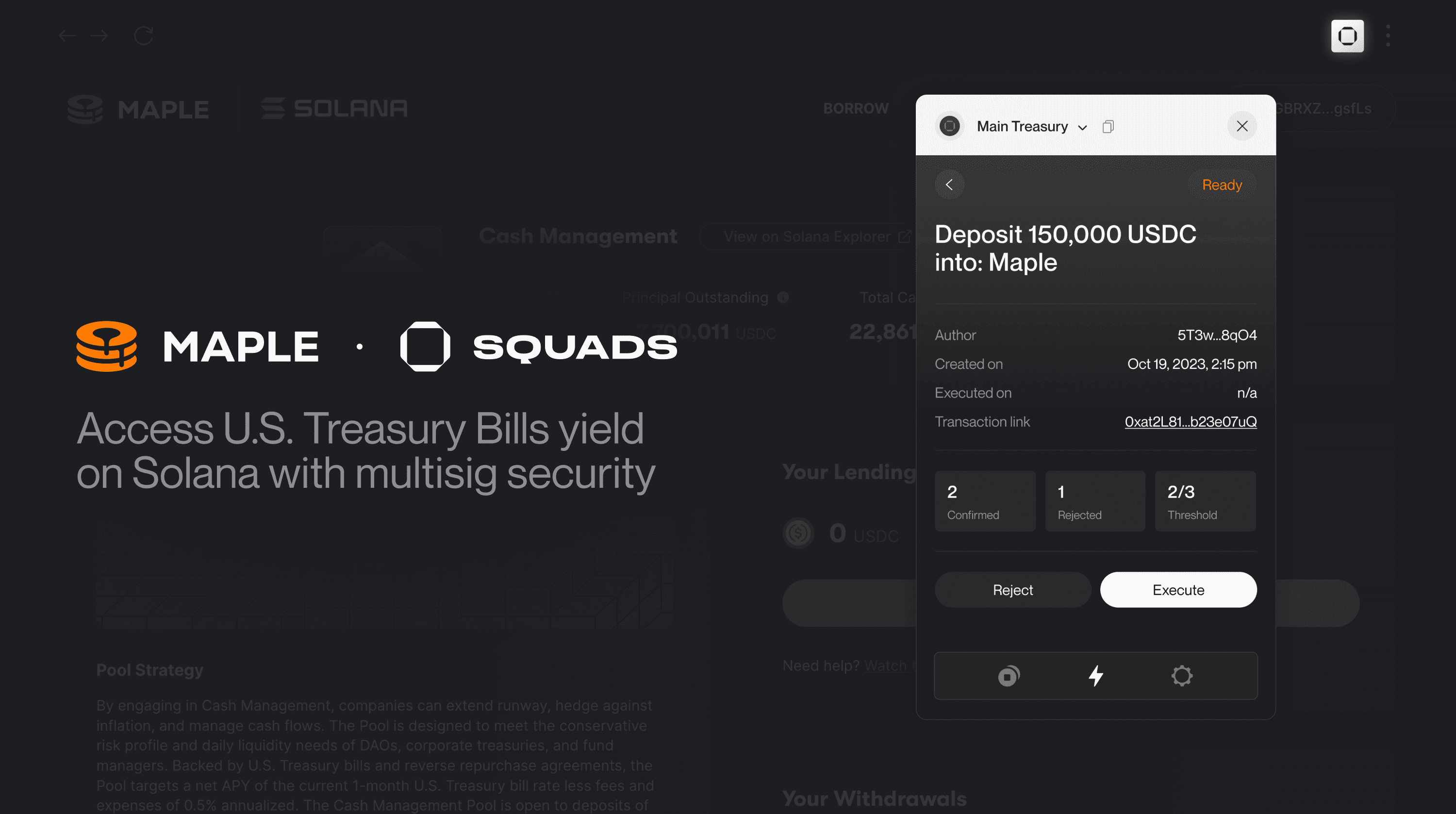

To access U.S. Treasury Bills yield via Maple with SquadsX, simply:

Connect a Squads multisig using SquadsX to Maple's web-app to lend USDC;

Next, click on 'Lend Funds' to initiate a transaction that requires multisig approval;

Once approved and executed by the multisig members, the funds will be deposited into Maple's pool.

Maple's Cash Management Pool is available to accredited investors. Lenders can begin the onboarding process in just 3 steps, taking less than 15 minutes to complete the application here.

Maple's Cash Management solution is the only product that provides a yield backed by U.S. Treasury Bills on Solana. It has attracted $7.7 million in capital since launch and enables Solana-based teams and organizations to earn high yield on their idle treasury while staying on-chain.

The smart contract infrastructure of Maple has processed billions in volume and provides constant, verifiable, on-chain information not subject to manual input or manipulation. Combined with SquadsX, it offers the most secure environment for accessing U.S. T-bills yield on Solana. Teams can leverage the operational efficiency of their multisig setup to deposit into Maple's solution collectively with their team members.

Maple's Pool is also managed in partnership with Room40 Capital, a renowned institutional crypto hedge fund, which has set up a stand-alone SPV to be the sole borrower from the pool. This team is backed by decades of operational and trading experience in the U.S. Treasury market. Additionally, the Room40 Capital team trades, custodies, and clears from an account with the regulated broker StoneX.

Lastly, the core infrastructure powering the Squads app and SquadsX has been audited multiple times by OtterSec, Trail of Bits and Neodyme. It is currently completing two formal verifications by Certora and OtterSec. More information on the security measures taken can be found here.

Start earning yield backed by U.S. Treasury Bills for your company's treasury with SquadsX today. For new users, head over to app.squads.so and create a Squads multisig to get started.

About Maple

Maple Finance provides the infrastructure for credit experts to run on-chain lending businesses and connects institutional lenders and borrowers. Built with both traditional financial institutions and decentralized finance leaders, Maple is transforming debt-capital markets by combining industry-standard compliance and due diligence with the transparent and frictionless lending enabled by smart contracts and blockchain technology. To learn more about Maple, please visit https://www.maple.finance/.

About Squads Labs

Squads Labs is a core contributor to Squads Protocol, the leading multisig infrastructure on Solana. In addition to helping maintain the protocol, Squads Labs makes the Squads platform, an institutional-grade multisig platform for Solana-based teams. The Squads platform helps web3-native teams manage and secure digital assets on-chain. To learn more about Squads Labs, please visit https://www.sqds.io/.