Multisig solutions have finally started to be considered not only for treasury management, as they are also becoming a standard for managing program authorities of protocols. But another significant use case of multisig is validator management. Whether for individual validators or stake pool managers, a multi-signature wallet is a great alternative to traditional self-custody solutions like hardware wallets to secure their operations.

This article aims to introduce management of Solana validators and stake pools with multisig and its benefits compared to current solutions. Although it is often more suitable for teams and organizations, we'll also cover how validators managed by a single operator can use Squads in their setup.

Multisig and Individual Validator Management

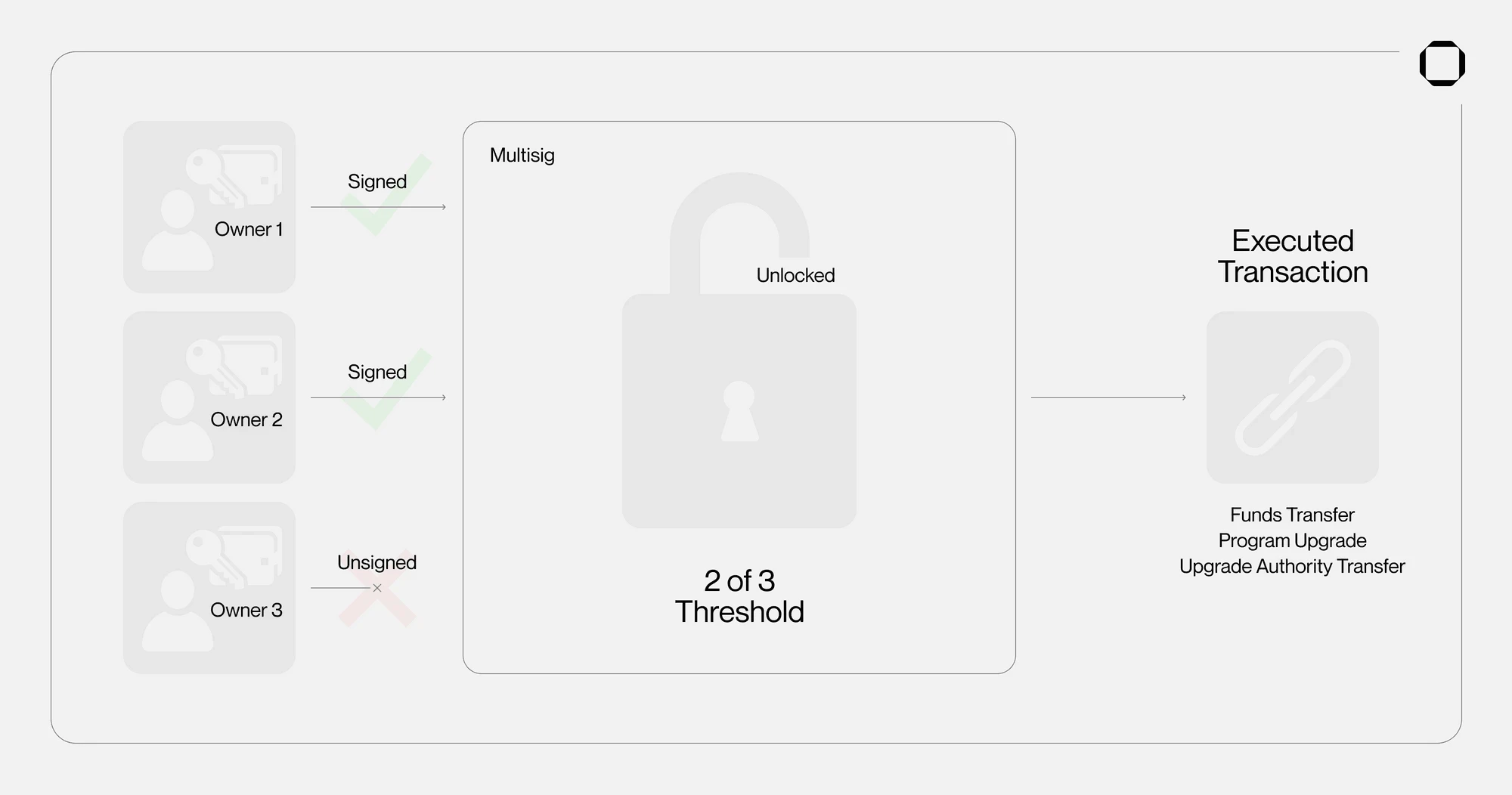

Multisig, short for multi-signature, is a self-custody solution using a mechanism where multiple signatures are required to execute a transaction. Upon creation, several owners (private keys) are added, and a signature threshold is set. The multisig can then be used to store and manage any on-chain asset that a regular key can control, such as treasury assets or authority keys of programs, tokens, or validators. Any action involving the assets held within the multisig requires approval from the owners and must meet the set signature threshold.

This setup is perfectly suited for teams and organizations that need to distribute control over on-chain assets among multiple stakeholders. Multisig ensures that no single point of failure exists - even if one person or private key gets compromised, the assets remain secure. This is because several keys are added as owners to the multisig. Thus, it becomes more challenging for unauthorized actions to occur as each owner has visibility over every transaction and must approve them.

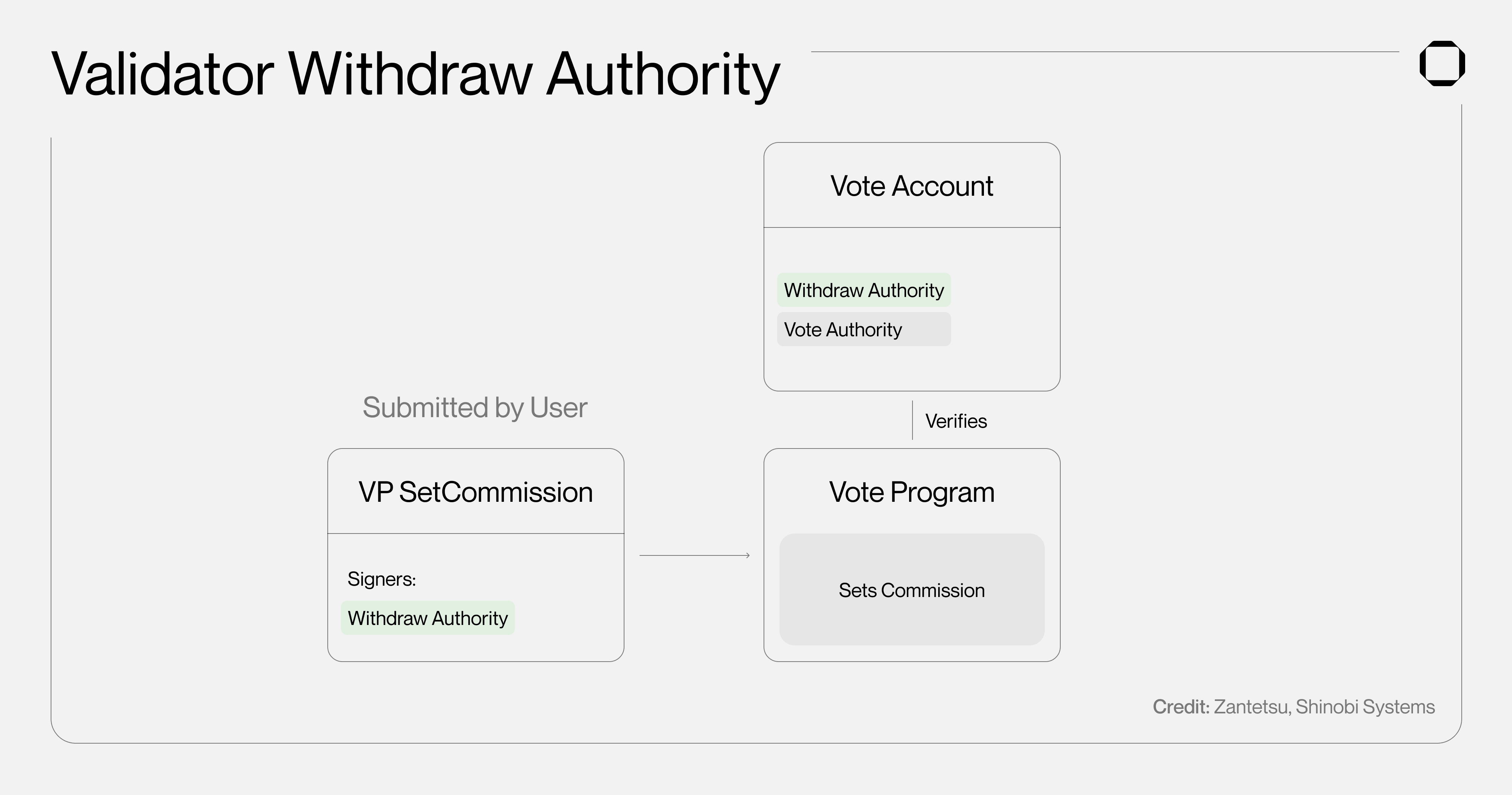

On Solana, individual validators primarily manage two authority keys: the vote authority, and the withdraw authority. Authority keys grant total control over on-chain assets and can update them. Programs, tokens, validators, and more have authority keys to manage specific types of operations. While the validator vote authority is used solely for voting, the withdraw authority serves as a sort of master authority key and requires the highest security measures to prevent undesired situations. It has the power to change the validator identity as well as the authorized voter, adjust the commission rate, or withdraw rewards. The core business of a validator depends on it - if something happens to this key, it could severely damage the validator's operations.

Using a simple hot/cold wallet solution or a CLI wallet to manage authority keys is potentially risky for teams and organizations, primarily because:

One person holds all decision-making power;

These wallet solutions can be easily compromised.

In such scenarios, a multisig is likely the best option. By delegating the withdraw authority key to it, a validator can split the ownership among various owners/private keys, each having a decision-making power to execute transactions involving the validator key. This can include actions like changing the commission rate or rotating the vote account authority keys. Additionally, it eliminates a single point of failure - even if one key of the multisig is compromised, it cannot use or affect the withdraw authority.

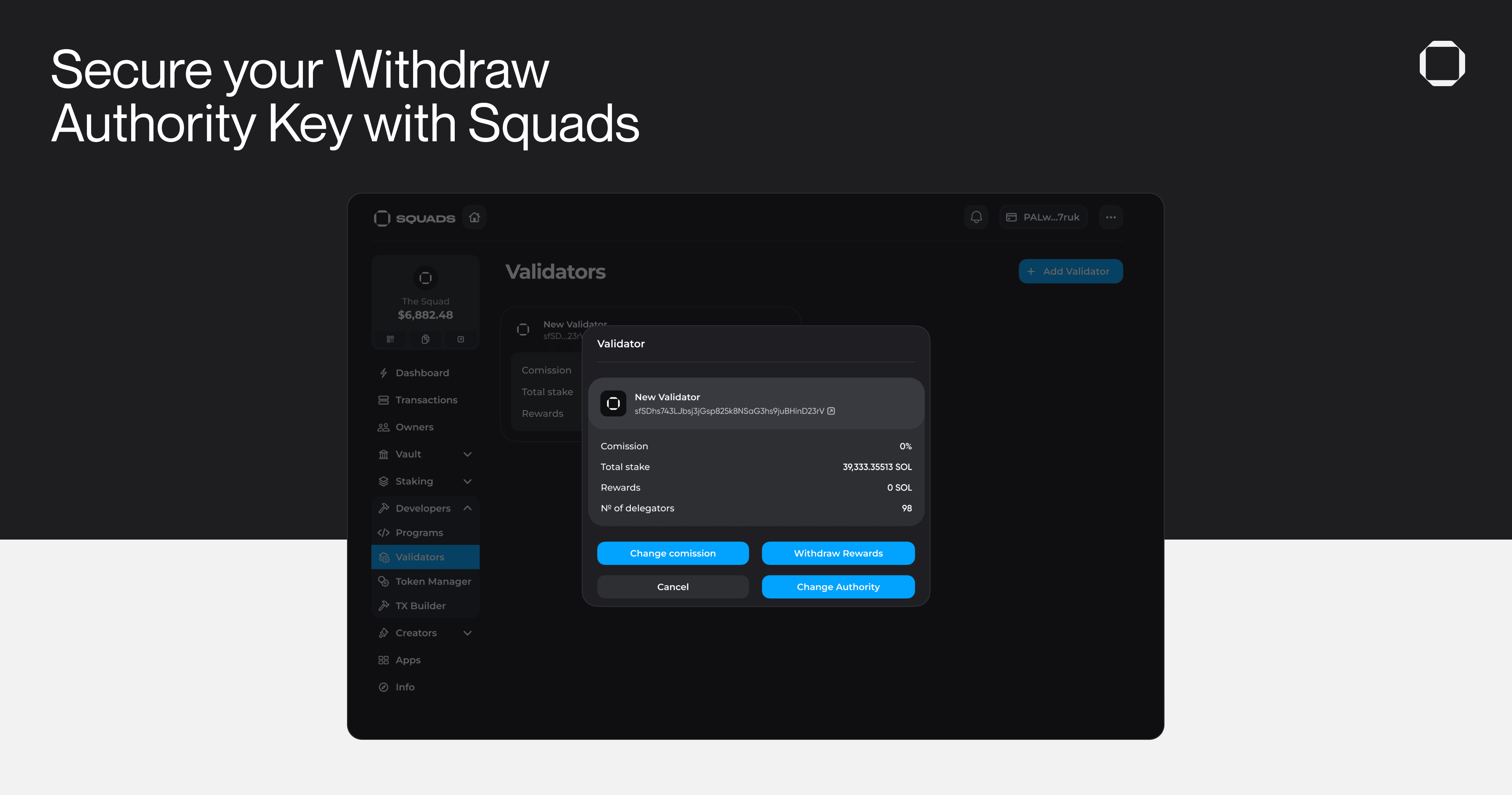

Squads has built a platform that facilitates the creation of a multisig and management of various types of on-chain assets, including validator withdraw authorities. Operators can transfer their validator key using their CLI, and then manage the commission rate and withdraw rewards directly from the interface. Additionally, the Squads multisig program is open-source and immutable (non-upgradeable), which means that no one besides you can access or move your withdraw authority key.

On top of this, this setup streamlines the operation of validators. Since the key is held within the multisig, the validator operators can easily withdraw the rewards to their Squad and manage them collectively (e.g. to cover expenses such as salaries). Simply put, the Squads multi-signature functionality provides the same benefits for managing treasury assets, such as validator revenues, as it does for the withdraw authority. This makes it a secure and efficient management solution for all business aspects of a validator.

Stake Pool Management with Multisig

Solana stake pools, another type of staking ecosystem stakeholder, can also greatly benefit from a multisig setup. These pools are a collection of one or more validator nodes that enable delegators to stake to multiple validators at once, often promoting better decentralization and mitigating the risks associated with unexpected validator node downtime. Stake pool managers on Solana, such as Jito, Marinade, Cogent, Laine, SolBlaze, or Lido, provide a liquid stake pool token in exchange for staking to their respective stake pools (e.g. for every SOL staked to the Jito stake pool, delegators receive jitoSOL). This makes staking positions of delegators liquid and allows them to use it across Solana DeFi on protocols like Kamino, Marginfi, Meteora, and more.

Like individual validators, stake pool managers also have authority keys to control:

Staker: The Staker key has the authority to delegate or undelegate the stakes of the stake pool. In essence, the Staker is responsible for allocating the pool's resources to different validators. This is an operational role that needs to be active regularly.

Manager: The Manager key has the authority to modify the stake pool's parameters, such as the fee structure. This key is intended for administrative use, so it isn't frequently used. However, it is crucial for overall control and configuration of the stake pool.

Given that the Staker key is regularly used for routine operations and its compromise doesn't immediately jeopardize the stake pool's health, it is often managed with a simpler setup like a CLI wallet. On the other hand, the Manager key, which has the authority to make significant changes to the stake pool's parameters, demands more rigorous security measures - a multisig is more appropriate to fulfill these security requirements.

With Squads, stake pool operators can spin up a multisig and delegate their stake pool manager key to it via custom instructions. Similar to the withdraw authority for individual validators, this setup provides all the benefits of collective management and prevention against unauthorized actions or compromised keys.

Setup for Single Operators

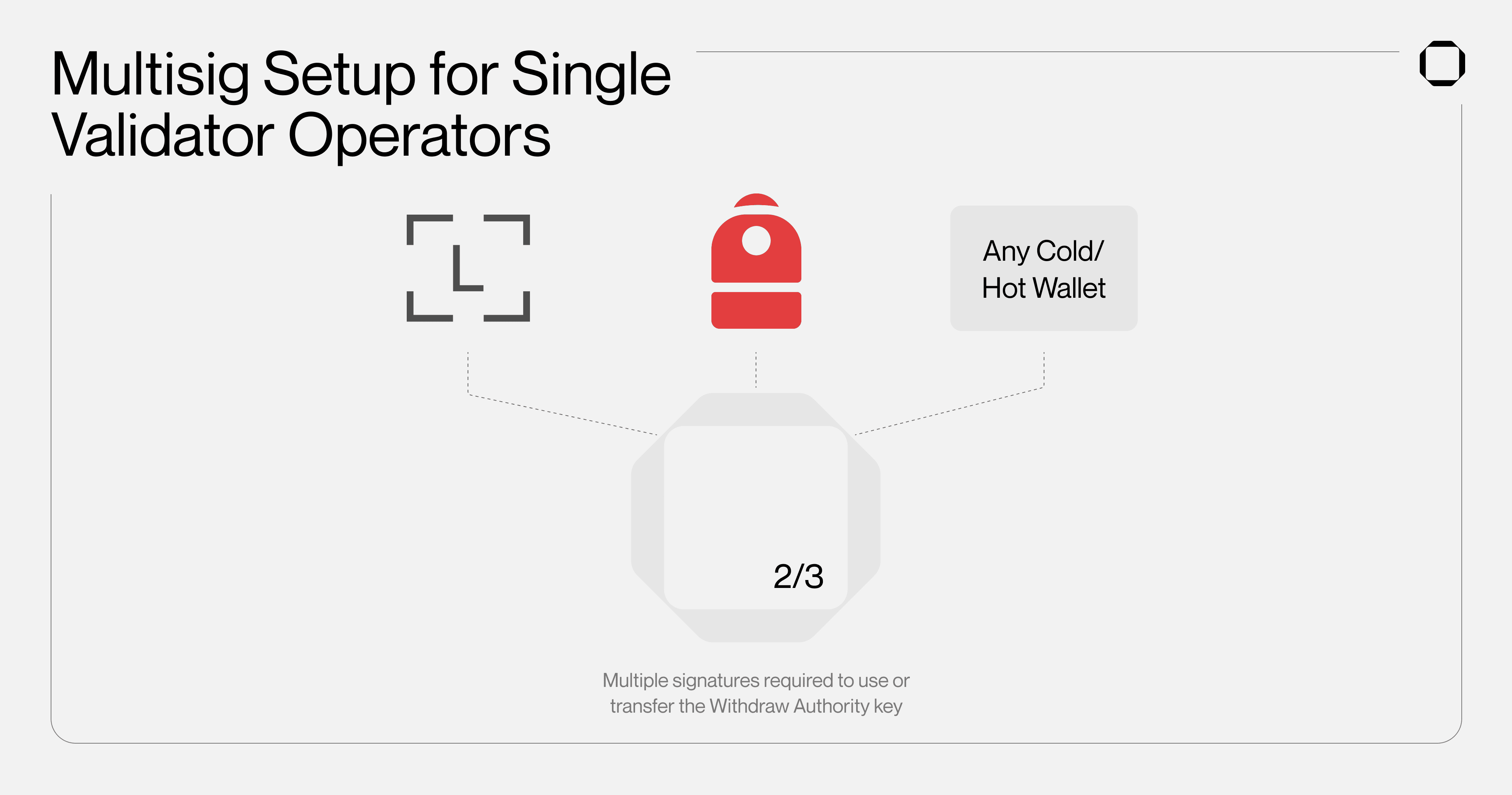

Even if you are a single person managing a validator, you can enhance the security of your withdraw authority key by creating a multisig setup involving several wallets from different solutions. These could include both cold wallets (like Ledger and OneKey) and hot wallets (such as Backpack and Phantom). In an event where one wallet solution gets compromised, your validator key would remain unaffected. This is due to:

The multisig holding the withdraw authority key;

The requirement of approvals from multiple keys to transfer the withdraw authority, change the commission, or withdraw rewards - a compromised private key cannot initiate these changes independently;

The ability to remove the compromised key with the other two hot/cold wallets and replace it with a new and fresh private key.

This approach is certainly more complex, requiring the use of two keys every time the withdraw authority is used or transferred. Nevertheless, it offers the highest level of security for managing a validator’s key.

Secure Validator Management for a Robust Network

Just as secure program management is crucial for an antifragile Solana DeFi ecosystem, secure validator management is essential for the Solana network. If some validators were to have their keys compromised, impacting their operations, it could shatter users' trust and discourage them from staking. This scenario would be detrimental to both Solana and its validators.

With most validator teams and organizations operating remotely, it makes it practically impossible to implement secure measures on their operations without splitting the control of their valuable assets, such as the withdraw authority key, among multiple stakeholders. Relying on one person/key leaves room for many unknowns and facilitates malicious attacks. Opting for a multisig solution like Squads is the best way to mitigate the risks associated with traditional self-custody solutions like hardware wallets and move towards a more decentralized approach.

If you're part of a team or an organization running a Solana validator and seeking enhanced security measures for your operations, feel free to reach out to us here.

Acknowledgments: Thanks to Michael (Laine / Stakewiz.com) for feedback on earlier drafts of this post.

About Squads

Squads is a crypto company operations platform that simplifies management of developer, creator, and treasury assets for teams building on Solana and SVM. Open source, formally verified, immutable, Squads enables teams to secure their on-chain assets in a multisig and jointly manage them.

Learn more

Squads: https://squads.so/blog/what-is-squads

What are multisig wallets: https://squads.so/blog/what-are-multisig-wallets

Squads Protocol: https://squads.so/blog/solana-svm-smart-contract-wallet-infrastructure

Code: https://github.com/Squads-Protocol/squads-mpl