TL;DR

Solana currently has the highest number of transactions per second among any blockchain, thanks to unique technology that is unseen elsewhere. Its fast network allows for near-instant trades with almost no gas fees.

While Solana's core engineers have focused a lot on innovation and speed over the last year, stability and robustness of the network are now the main priorities for 2023.

Firedancer is a second Solana client validator built by Jump that will enable the network to continue to operate even if an issue arises in the main validator client.

Solana has a Nakamoto coefficient of 30, making it one of the most decentralized and censorship-resistant Layer 1s.

The Solana ecosystem has one of the most active communities of developers and users across all blockchains, enabling innovative NFT and DeFi products.

When it comes to crypto self-custody, a main concern commonly shared is the secure storage and management of private keys. However, another crucial aspect of self-custody that is not often emphasized, yet is just as important, is the choice of a blockchain for managing crypto assets.

It is essential to carefully evaluate factors such as transaction speed, decentralization, security, liquidity, and available products before selecting a crypto network to hold assets in. Being limited on a less favorable crypto network by not having the freedom to freely transfer funds, hedge positions, or access opportunities is not the experience that users should have.

Among the various blockchains available, one is uniquely positioned as offering the best features for users seeking to hold their cryptos on a decentralized network: Solana.

The Solana Network

Whether it is its technology offering high transaction speeds, its diversified ecosystem of financial products, or its distinctive user-centric experience, Solana has numerous attributes making it a superior choice to custody assets on it, the first one being its lightning fast network.

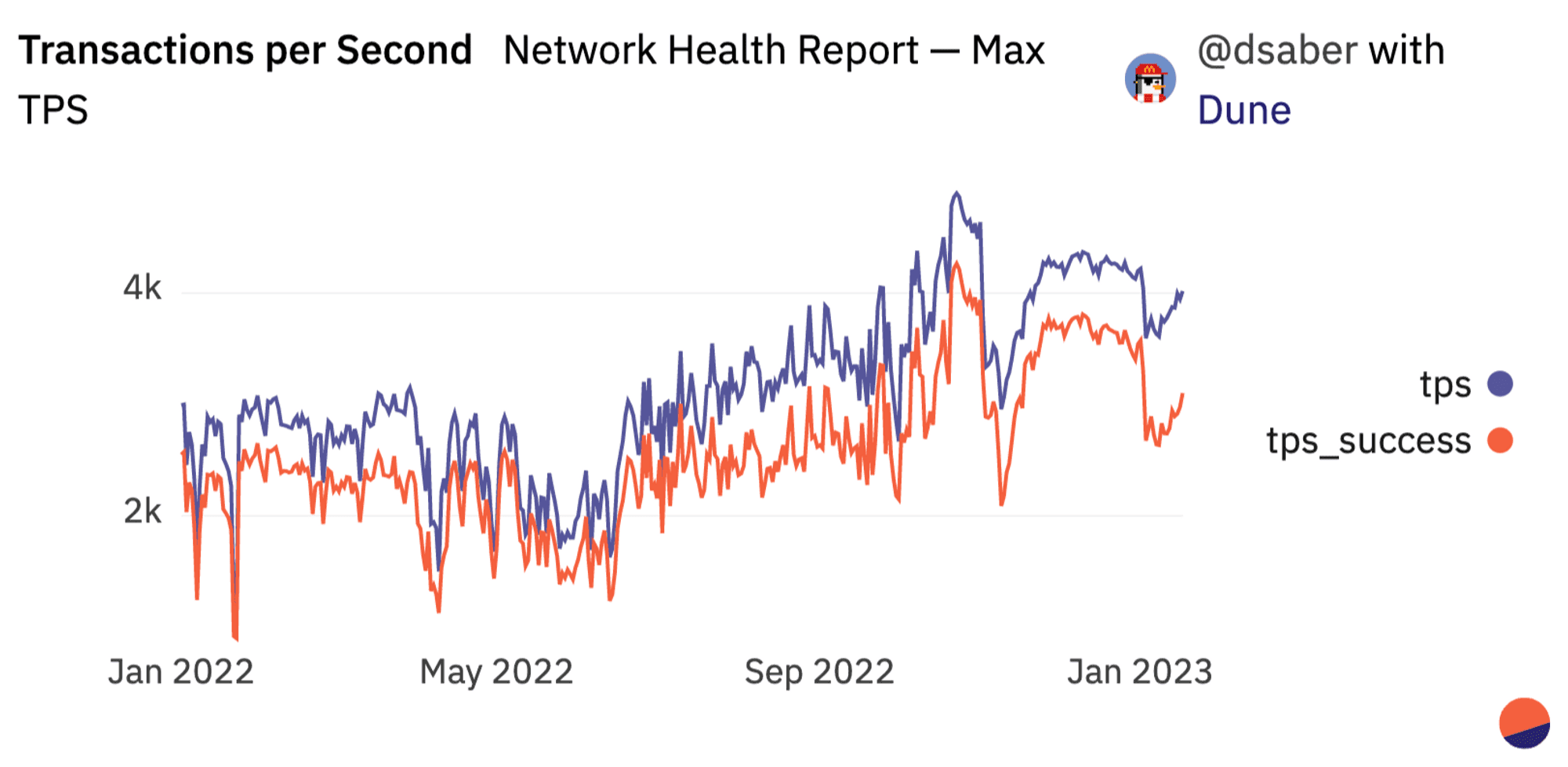

While in 2021 claiming to be the fastest Layer 1 in the world was a common thing to say, Solana has differentiated itself by actively moving towards its aim of being a “blockchain at NASDAQ speed”, with currently around 4,000 consistent transactions per second.

Solana’s TPS have steadily increased in 2023, nearly 4,000 to date. Source.

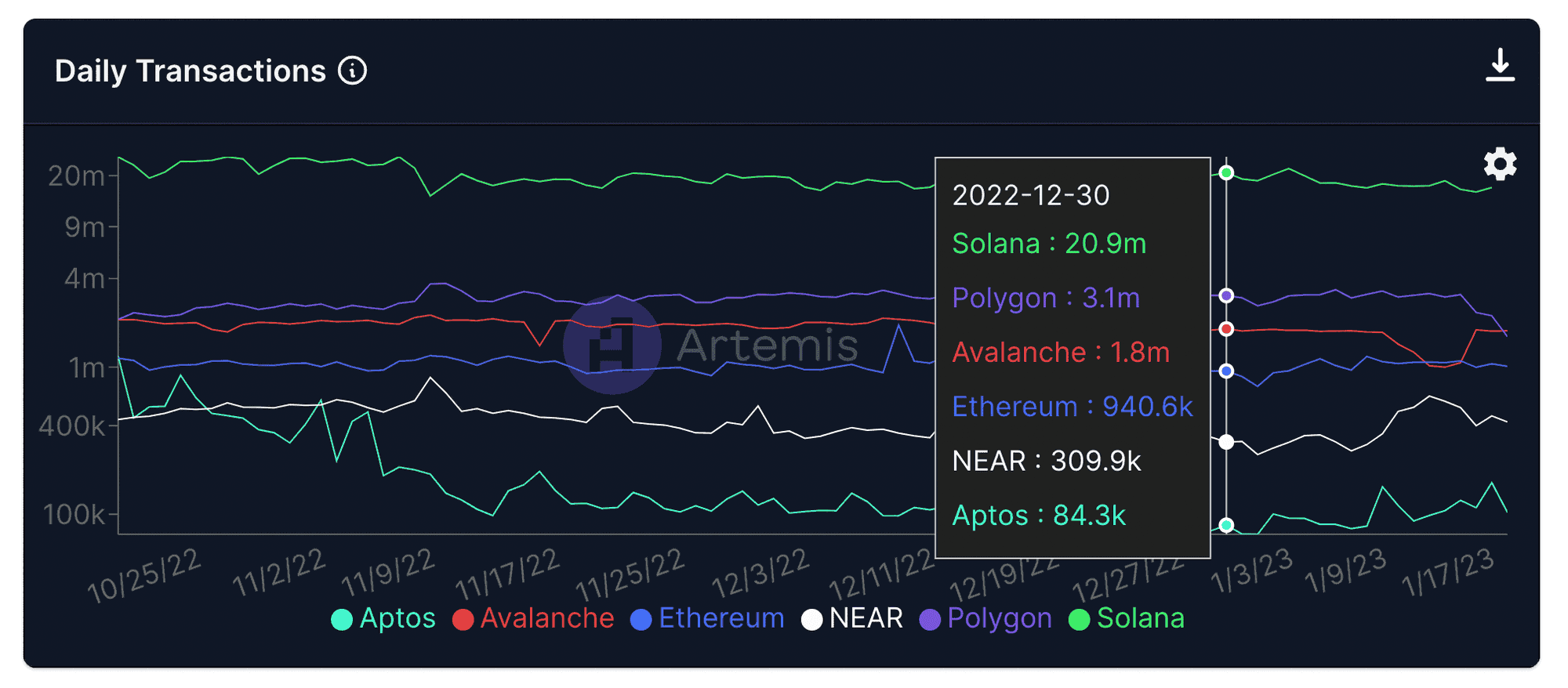

Solana is the only blockchain in 2023 reaching these numbers. Although it is true that a majority of transactions executed concern consensus votes, Solana’s non-vote TPS are still near 300-400 when no other blockchain is currently close to performing this level of speed. The closest network to Solana in terms of throughput is Polygon, with around 35 transactions per second.

Proof of History (PoH), Sealevel, and Tower BFT are some of the Solana’s underlying technologies that enable the network to scale transactions and be the fastest crypto blockchain. These pillars of innovation offer various advantages to users managing their assets on the network:

Near instant transaction times, ~400 milliseconds

Extremely low transaction fees, ~$0.001 for a swap

High scalability, as the network can handle thousands of transactions per second.

For instance, holding crypto assets on a fast blockchain like Solana can minimize the risks of trades being executed at bad prices, as transactions are executed almost instantly in milliseconds. It also allows making trades faster and more efficiently, potentially increasing profits for users.

On the other side, speed reduce the risks of lost opportunities or financial losses that can be caused by transaction delays or failures. All these benefits related to the incredible network’s speed provide a competitive edge over slower blockchains to Solana users, such as traders or institutions.

Antifragile Scalability

In addition to being extremely fast, the Solana blockchain is built in such a way that it improves as the hardware used by its validators upgrade, allowing it to gradually scale up to higher throughput to handle more transactions per second.

This, combined with continuous core technology improvements and updates from contributors and the community, enables the Solana network to grow and always be able to onboard more users as it scales, making it a first choice as a blockchain for custodying assets.

Solana is the only live chain capable of handling +20 million transactions per day with 4,000 TPS. Source.

However, when the hardware is unable to keep pace, Solana must still possess the ability to accommodate thousands of additional users and transactions, otherwise the benefits of having assets on the network would not hold. Fortunately, the network is extremely well-supported by contributors and community developers that are improving it relentlessly.

We have seen in 2022 outages and downtimes on Solana, and while these incidents were unfortunate, direct actions have been taken to address these issues and implement measures to prevent future occurrences.

Additionally, while Solana's blockchain development has been primarily led by Solana Labs/Foundation over the past years, there are now other teams that are contributing to the development of validator clients for Solana, such as Jito Labs and Jump Crypto, pushing the network further.

Firedancer, a second Solana client validator built by Jump Crypto, will enable users to run their validators using one of two different software packages with independent dependencies. Moreover, Firedancer has demonstrated exceptional performance, achieving a processing capacity of 600,000 TPS (!) in a test environment. This further highlights the scalability of Solana and its ability to handle large volumes of transactions in a fast and efficient manner.

Firedancer will be highly beneficial for the Solana network. By having multiple validator clients, if an issue arises in one of them, the network can continue to operate through the other, enhancing the reliability and decentralization of Solana. It will also make Solana the only other smart contract network besides Ethereum to have more than one independent validator client.

And speaking of decentralization, everything is showing that Solana is doing well as a distributed network.

How Solana is Decentralized and Secure

Any blockchain network could potentially achieve near-instant transactions execution by sacrificing decentralization. This is another factor where Solana stands out, as it is currently able to process 4,000 TPS, while having one of the highest numbers of validators among other decentralized networks, as well as a strong resistance to censorship.

When making the decision to hold assets on a blockchain, it is important to consider the decentralization and security of the network. No one wants to be unable to withdraw, sell, or even access their assets. If validators are located too closely together, they can pose a risk to the network and its users in the event of an incident. This is why it is important for validators to be numerous and geographically distributed.

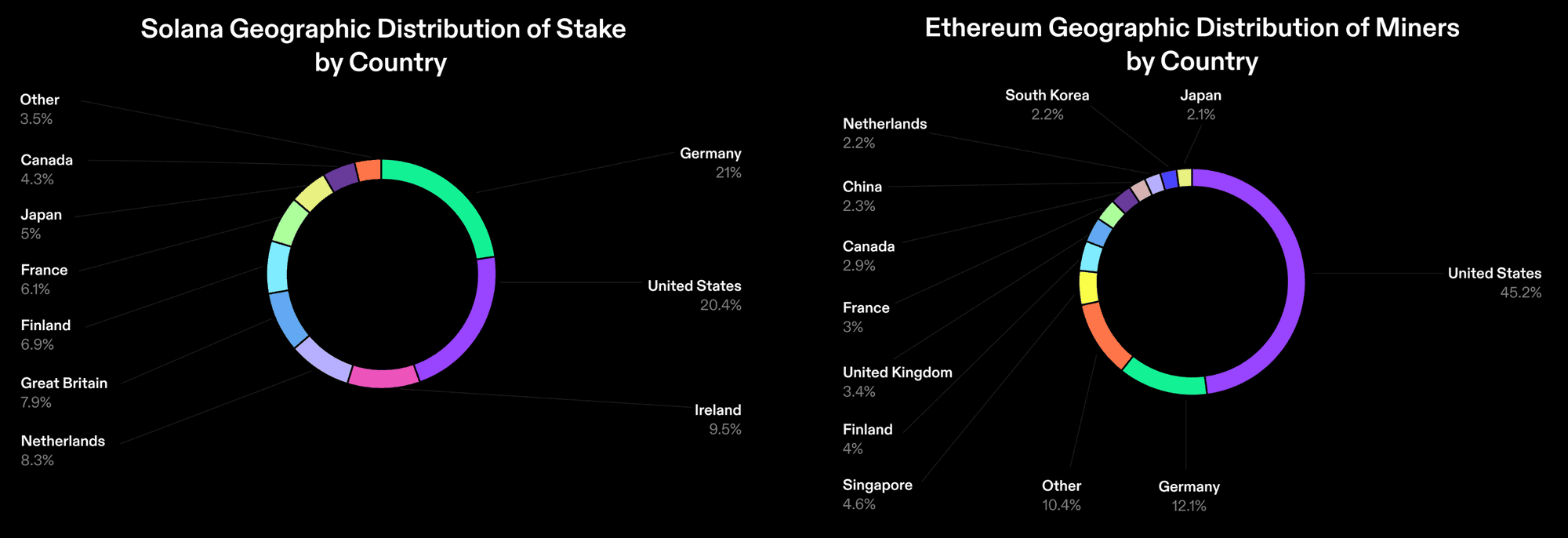

Solana currently has a healthy amount of +2,000 validators, whereas blockchains like Cosmos Hub or Polygon have less than 200 validators. Besides being numerous, Solana's validators are scattered across +10 countries. Although this is not ideal yet, it is actually superior to the geographic distribution of stake by country of networks like Ethereum or Avalanche.

Solana and Ethereum Geographic Distribution of Stake by Country Source 1; 2.

The validators of a blockchain should not be located in the same country, as it could leave the network and its associated projects vulnerable to the regulations of that country. If a blockchain network is not well distributed, this can have negative consequences for users if validators have to shut down or follow restrictive laws, such as loss of access to their products or the ability to use their funds.

Regarding how are distributed the staked tokens between validators, Solana has a Nakamoto coefficient of 30, making it one of the hardest networks to collude alongside Avalanche and Polkadot. Ethereum 2.0, on the other hand, only has a coefficient of 2, due to Lido and Coinbase being the two largest stakers of Ethereum.

Its Diversity of Financial Products and Projects

Beyond its speed and security, the Solana’s performant infrastructure makes possible the creation of unique decentralized financial products, unseen elsewhere, and close to what is possible in traditional finance. This gives another competitive advantage to Solana users, as they are able to access new forms of yield to get the most of their assets.

In addition, Solana also has a well-developed ecosystem with a diverse range of projects and one of the highest active community of developers among crypto, providing more options for individuals and companies managing assets on it.

Solana Technology Enables Unique Yield Opportunities

Apart from having access to a variety of DeFi primitives such as lending, borrowing and leverage, the Solana ecosystem has also seen the emergence of new decentralized financial products, including order book (CLOB), concentrated liquidity, high-performance trading, leveraged yield farming, or even prediction markets.

UXD, a decentralized solana stablecoin, has recently announced a partnership with Credix to collateralize UXD with real-world assets. Source.

Institutions and high net worth users can also access a wide range of investment opportunities on Solana that are similar to traditional finance products. One such example is Credix Finance, a decentralized credit marketplace that connects institutional investors with FinTechs in emerging markets by offering over-collateralized structured debt facilities on Solana. Other platforms such as Friktion, Zeta, PsyOptions, are also offering various on-chain crypto derivatives and structured products.

In terms of unique decentralized financial products, Solana has seen many emerge in the last year alone:

OpenBook, Ellipsis: Market makers can provide liquidity on a decentralized order book and earn fees from trades.

Kamino: Users can earn trading fees from swaps with automated concentrated liquidity management vaults.

Drift, Zeta: Traders can leverage BTC, ETH, SOL on a decentralized perpetual futures exchange, instead of storing their assets on a central entity like FTX.

Tulip, Francium: Yield farmers can increase their exposure with leverage, and long, short, or be delta-neutral on any coin that has liquidity on an AMM pool on Solana.

Props: Users can bet on a decentralized sports exchange powered by liquidity pools.

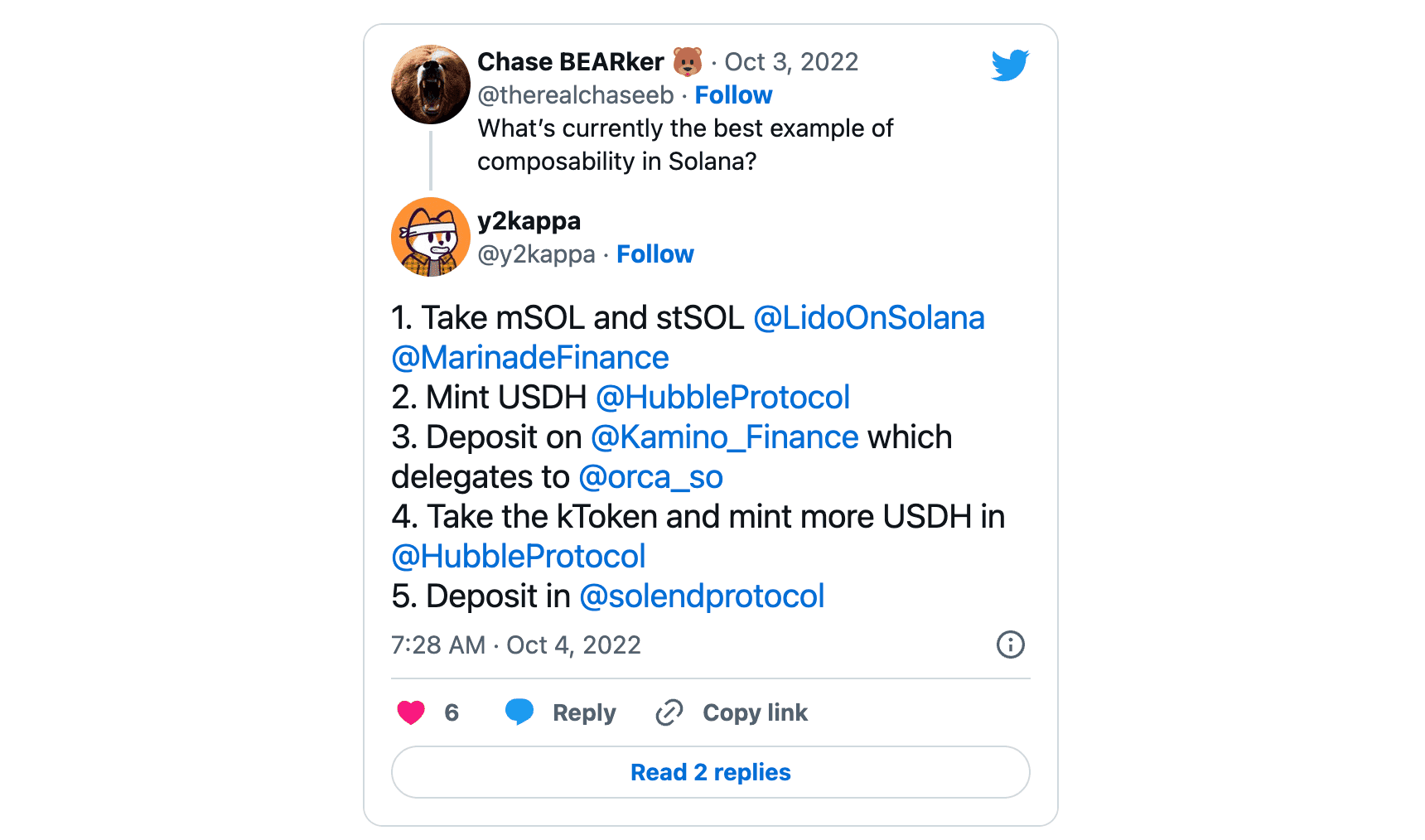

Composability is another strong feature of Solana, as it gives projects and users the possibility to compose on top of other products through Solana’s low fees and high-speed transactions. Protocols like Kamino, Atrix, Tulip, Meteora would not be able to offer their products to users from other blockchains, as those networks have non-performant underlying technologies that bring slow transactions or unsustainable transaction fees.

This is what Solana makes possible, while spending less than $1 in transaction fees. Source.

As well as having unique DeFi products, Solana’s composability creates unique opportunities and new strategies for users that want to maximize their yield.

Solana is also one of the largest blockchains where there are the most USDC natively minted, offering great liquidity for users who prefer not to hold long positions. Additionally, this eliminates the risks associated with bridged assets other chains can have, such as Polygon or Arbitrum, which can be vulnerable to hacking and result in the loss of value for bridged USDC.

Users that custody their assets on Solana can thus diversify their portfolio strategies, generate new revenue streams, access new markets and investments opportunities unavailable elsewhere. All of this by reducing the need for intermediaries they have in traditional finance, increasing efficiency and reducing costs.

A Growing Ecosystem with A Vibrant Community

Solana holds a unique technology for institution-grade financial applications, whether it is derivatives, structured products, high-performance trading, that aren’t possible on any other current live blockchain. But it is not just about the products themselves, the teams behind them are well experienced as well to develop them.

Solana founders often have a background in traditional finance and trading, which gives them a strong foundation to create innovative decentralized financial products and infrastructure well suited for the blockchain.

José Macedo, Partner at Delphi Digital, talking about the talents building on Solana. Source.

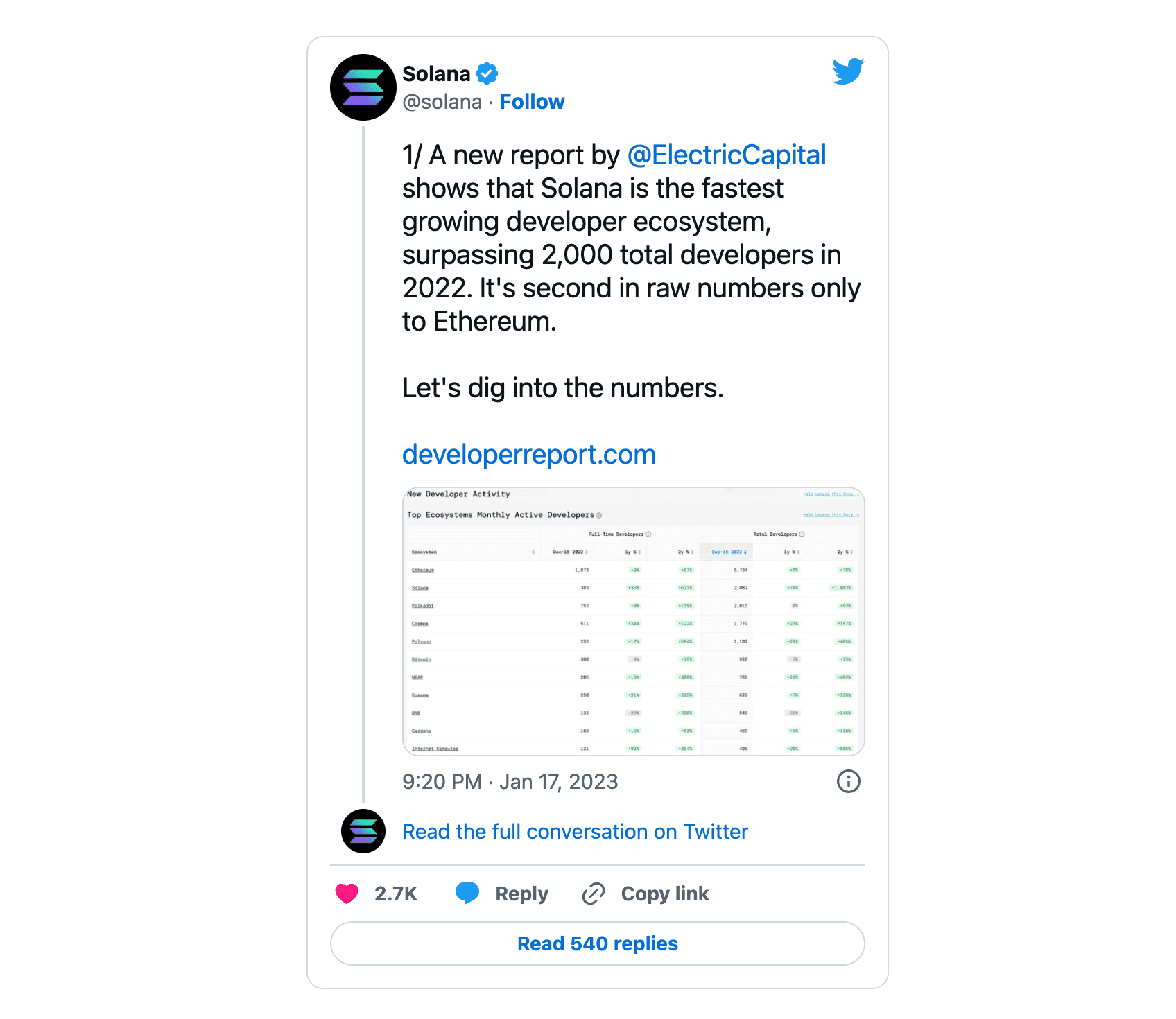

And even in this bear market that the whole crypto industry is facing, there is still a significant community of developers building on the Solana ecosystem, showing an optimistic future for its users.

Across all the blockchains, Solana has the highest number of active developers, with more than 2,000 total developers at the end of 2022, in second position after Ethereum. The total number of developers on Solana has grown more than 10x since 2018, more than any other blockchain to date.

The ecosystem is also moving towards a more open-source culture, as more and more major Solana DeFi projects are making their code publicly available. By moving towards greater transparency with more protocols sharing their code, users are able to trust the code rather than the individuals behind it, which enhances security. It enables anyone to deploy more safely their funds on a Solana protocol, as they can independently verify it through its code.

But what good is a technologically advanced and diversified ecosystem blockchain if it lacks a user-friendly experience? A positive user experience is crucial for usage of the blockchain and its products, as users may have to interact frequently with their assets on the network. The third strongest benefit of custodying asset on Solana is precisely its unmatched user-experience.

Unparalleled User Experience

Lastly, through its cutting-edge technology, Solana is capable of providing one of the most user-friendly products in the crypto space. By offering easy-to-use crypto products, Solana users can easily manage their assets, avoiding missed opportunities or financial losses.

With features such as localized fee markets, users do not have to wait on fees to drop to send through their transaction. As Solana handles thousands of transaction per second, congestion are less supposed to happen, and users won’t have to skip a buy or sell order.

Furthermore, the availability of user-friendly wallets and mobile apps such as Phantom, Glow, Ultimate, Solflare and Backpack, makes it easy for users to manage their assets without needing to be crypto experts about Solana’s technology. For example, Solflare has just implemented automatic priority fees on their wallet, allowing users' transactions to be processed faster during times of high network usage without any additional action required from the user.

Depositing and withdrawing funds on Solana is also straightforward. Users have various options to purchase USDC, such as using their credit card through Stripe or MoonPay directly on their wallet, or by using major exchanges like Coinbase, Kraken, and Binance to deposit or withdraw USDC directly with the Solana SPL network. Additionally, Wormhole provides a decentralized way for transferring funds between Solana and other major chains, such as Polygon, Ethereum, and Binance Smart Chain, without the need for users to do a KYC.

Solana’s great technology makes users forget they are, in fact, using a blockchain. With Web2 products, users are not accustomed to paying high fees or experiencing delays for transactions. Unlike other chains, Solana provides a smooth and seamless experience, with a vast range of products and services that are not disadvantaged by slowness or expensive fees.

Users can focus on the aspects that are important to them, such as managing assets, accessing new financial opportunities, buying and selling cryptos in an easy way, similar to the experience of traditional exchanges and web2 products.

The users on Solana can access the same experience, with the added benefit of a decentralized network that does not rely on a central authority, is censorship resistant to regulations, and does not require identity verification to be used.

Conclusion

Solana has reached a level of scalability unmatched on any other blockchains, giving users access to unique products and opportunities, bridging the gap between DeFi and traditional finance. Every choice comes with its own set of trade-offs, but it's important to consider the full range of options available when custodying crypto assets.

It is no surprise that major financial institutions such as Jump Crypto are heavily investing in Solana by building infrastructure to improve it even further. They recognize the current benefits of Solana and its potential for further scalability. And with more than 2000 validators and a Nakamoto coefficient of 30, it would be difficult for any country to shut down the network, providing a level of security and protection for users' assets, compared to networks with a few hundred validators.

Despite the current market conditions causing some investors to adopt a cautious approach, the advantages of utilizing a blockchain network like Solana for custodying assets is difficult to ignore. Solana's cutting-edge technology allows for high-speed trading, akin to what is typically seen on centralized exchanges or in traditional finance, which is quite noteworthy for a decentralized network.

Users who opt to store their crypto on a different blockchain may be missing out on the potential advantages and benefits of holding their assets on Solana, whether it is investment opportunities, user experience, or security.

Note: On February 25, an issue occured after the 1.14 network upgrade, impacting the network's speed and usability. This outage has not been taken lightly, and Anatoly Yakovenko, Solana's founder, publicly shared his plans to prevent this unstability to happen again in the future. As mentioned earlier, the new Solana client validator built by Firedancer will also make it unlikely for this kind of event to arise again, thus reinforcing the network's robustness.

About Squads

Squads is a crypto company operations platform that simplifies management of developer and treasury assets for teams building on Solana and SVM. Open source, formally verified, immutable, audited by Neodyme and OtterSec, Squads enables teams to secure their treasuries, programs, validators, tokens in a multisig and jointly manage them.

Learn more

Squads platform: https://v3.squads.so/

Read the documentation: https://docs.squads.so/squads-v3-docs/

Review the code: https://github.com/Squads-Protocol/squads-mpl

Join the community: https://discord.com/invite/tYpY9UfRFx